| « Back to article | Print this article |

Budget 2013: Tax credit of Rs 2,000 for persons with income up to Rs 5 lakh

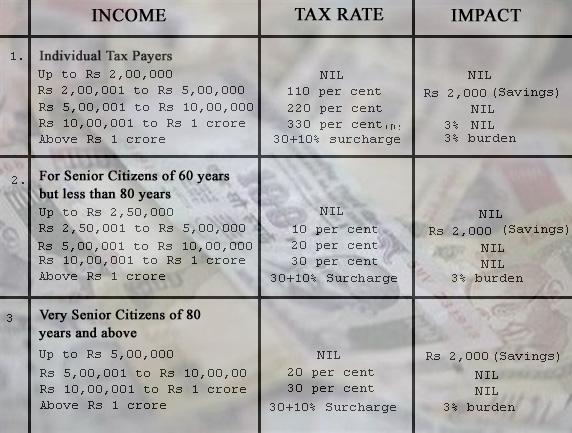

Giving small relief to taxpayers, Finance Minister P Chidambaram on Thursday announced a tax credit of Rs 2,000 for persons with income up to Rs 500,000.

The proposal, he said, will benefit 1.8 crore taxpayers entailing a revenue sacrifice of Rs 3,600 crore (Rs 36 billion).

The other slabs and rates have been kept unchanged in view of constrained economy, he said.

"In a constrained economy, there is little room to raise tax rates or large amounts of additional tax revenues. Equally there is little room to give away tax revenues or the tax base. It is time for prudence, restraint, and patience," Chidambaram said.

However, he said: "I am inclined to give some relief to tax payers in the first bracket between Rs 200,000-500,000.... I propose to provide tax credit of Rs 2,000 to every person who has a total income of up to Rs 500,000. 1.8 crore taxpayers are expected to benefit, to the value Rs 3,600 crore".

As per the existing slabs, tax on income from 200,000 to 500,000 is at 10 per cent, up to Rs 10 lakh at 20 per cent and above 10 lakh at 30 per cent.

In the Budget proposals for the next fiscal, Chidambaram proposed a surcharge of 10 per cent on persons with income of over Rs 1 crore. The proposal will cover 42,800 individuals and tax entities.

"Even an moderate increase in the level of threshold exemption will mean that hundreds of thousands of taxpayers will go out of the tax net and tax base will be severely eroded," he said.

KPMG (India) Tax Partner Parizad Sirwalla said: "The overall slabs and tax rates remain same in view of the objective of widening tax base and increasing tax compliance."