| « Back to article | Print this article |

Why RBI will cut rate

The central bank has clearly signalled the conditions under which monetary easing would take place early this quarter. And, current conditions meets the RBI's paramters.

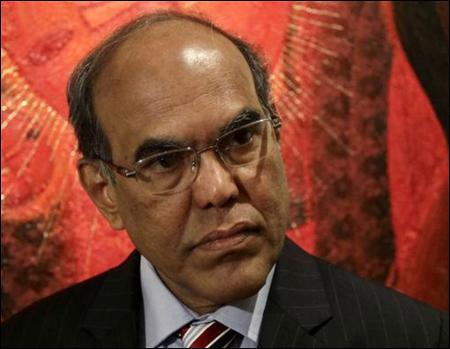

On January 29, the Reserve Bank of India (RBI) is expected to review monetary policy, and it has been widely expected that interest rates will be cut. This expectation is thanks to various statements from the central bank and its governor, Duvvuri Subbarao.

The mid-quarter review of monetary policy in mid-December 2012 was pretty explicit about it, in fact. It said that inflation was steadily moderating.

It added that "in view of inflation pressures ebbing, monetary policy has to increasingly shift focus and respond to the threats to growth from this point onwards".

The review document added: "Recent inflation patterns and projections provide a basis for reinforcing October guidance about policy easing in fourth quarter."

When this was followed by news, earlier this month, that the wholesale price index rose only 7.2 per cent in December 2012 - the lowest rate since December 2009, three years earlier - expectations that a cut would be made were further reinforced.

The markets responded as they would, immediately rising to price in the likelihood of a cut later in January.

Click NEXT to read more...

Why RBI will cut rate

The question is whether, if not for these signals, a rate cut would indeed have been ideal at this time. Liquidity was tight through much of December, with a daily average borrowing of a little over Rs 1 lakh crore (Rs 1 trillion).

That eased going into January and, in any case, there are other instruments available to the RBI to deal with liquidity problems.

There is, of course, the point that diesel price increases will feed into consumer price inflation over the short run - but, on the other hand, the fiscal implications of a reduction in subsidies should alter inflation expectations more than sufficiently to balance that effect.

The RBI will, no doubt, say that consumer price inflation is still out of its comfort zone.

Indeed, Governor Subbarao said as much in a speech at the Indian Institute of Management, Lucknow, last week, stating that the prices of consumer products and manufactured items were still increasing - "inflation has come down, but is still high".

He added that there was not much room for either monetary or fiscal stimulus.

The finance ministry, on the other hand, may find this argument relatively weak, given the decline in core inflation and in the wholesale price index, and the way in which the consumer price index is skewed by fuel and food, neither of which can be controlled by monetary policy.

Click NEXT to read more...

Why RBI will cut rate

A far more persuasive case could be made in terms of the real return to savings. Bank deposit rates are already low; given the consumer price index rising at over 10 per cent, the real return on bank deposits has turned negative.

Unsurprisingly, deposit growth has been slow, lagging credit growth in the quarter between October and December 2012.

It looks increasingly unlikely that the RBI's target of 15 per cent bank deposit growth this financial year will be achieved.

Indians are, instead, putting their money in gold - adding to current account deficit problems. The need to provide savers with a reasonable return might well cause the RBI to think twice about cutting interest rates.

However, there is an important question of credibility the RBI must deal with. The central bank has clearly signalled the conditions under which monetary easing would take place early this quarter.

Wholesale price inflation has indeed fallen. Given that, for it to go back on its word would cause a dent to its credibility that no central bank can afford.