| « Back to article | Print this article |

FIIs to continue selling Indian stocks till mid-2011

Foreign institutional investors will continue selling Indian equities to invest in the more profitable north-east Asian markets till mid-2011, Australian investment bank Macquarie said.

"India will continue to be seen as a funding source for investments into the South Korean and Taiwanese markets," Michael Kurtz, the bank's head of strategy for Asia, said on Monday.

Click NEXT to read on . . .

FIIs to continue selling Indian stocks till mid-2011

According to Rakesh Arora, Macquarie's head of research for India, the net outflow of FIIs within the first six weeks of this year stood at $2 billion as against the record $29 billion of net inflows last year.

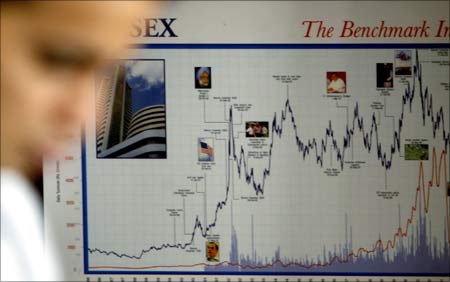

The BSE Sensex, which on Monday gained 473 points to end at 18,202 level, so far has had a volatile 2011, and India counts as one of the worst performing global markets, second only to the politically strife-torn Egypt.

Click NEXT to read on . . .

FIIs to continue selling Indian stocks till mid-2011

High inflation and political uncertainties in scam-hit India are among the factors forcing FIIs to rework their India strategy, Arora said. Scams, he said, was the more disturbing factor among the two.

Kurtz said improvement in the economic scenario in the developed world, coupled with low valuations, had made some export-oriented stocks in South Korea and Taiwan in the information technology and consumer durables sectors very dear to the global investors.

Click NEXT to read on . . .

FIIs to continue selling Indian stocks till mid-2011

"In relative terms, India stands to be a loser here," he said, adding that an improvement in the domestic scenario can result in investors re-looking their India strategy in the second half of the year.

The government showing signs of relenting on forming a Joint Parliamentary Committee probe into the 2G spectrum allocation scam can result in a fruitful Budget session and assuage investor concerns, Arora said.

Click NEXT to read on . . .

FIIs to continue selling Indian stocks till mid-2011

If headline inflation comes down to the Reserve Bank of India's stated 7 per cent guidance by March, it will be another factor to comfort the nervous investors, he said.

When asked to predict the Sensex movement in the coming weeks, Arora said that multiple factors would decide the performance of the 30-share index.

Click NEXT to read on . . .

FIIs to continue selling Indian stocks till mid-2011

The fact that domestic mutual funds get more active in the months of February and March due to higher subscriptions will absorb the damage on the Indian markets inflicted by the retreating FIIs, he maintained.

"The India growth story is intact and our markets will be back to the growth phase in the next 6-9 months' time," Arora added.