| « Back to article | Print this article |

'Going back to 6.5% growth is leading to anxiety'

'We can manage growth without any big bang reforms, but what is mandatory is good governance. This is really hurting India's growth,' says merchant banker Vikas Khemani.

Finance Minister Pranab Mukherjee could make the Union Budget 2012-13 an important one, says Vikas Khemani, President & Head-Institutional Equities, Edelweiss Securities, an Indian financial services major.

Khemani shares with Rediff.com's Prasanna D Zore his expectations from the Budget, why the Indian stock markets are going through a bull run in the New Year, his apprehensions over the rising non-performing assets in the banking sector, the impact of the Greece crisis on India and sectors that could shine in coming days.

How do you see the Euro Zone crisis panning out?

Greece has been granted a second bailout and its private creditors are gearing up for more than 50 per cent haircut.

Still, as per the IMF, its debt (per cent GDP) will be as high as 120 per cent by 2020 (the same as Italy today!), suggesting that it continues to remain vulnerable.

The evolution of the Greek tragedy reflects the fundamental flaws of monetary union (without fiscal union). Indeed, Greece's case offers valuable lessons for EU (European Union) leaders -- too much fiscal austerity actually leads to worsening of debt dynamics.

This is particularly relevant for Portugal which, just like Greece, has elevated debt levels and is undergoing sharp fiscal adjustments amidst contracting GDP.

We are of the view that Portugal will likely tread the path of Greece -- fiscal slippages leading to a second bailout with possible haircuts to private creditors. This will surely disturb the calm prevailing over liquidity-inebriated Europe.

What kind of bearing will this have on the Indian markets in the short term?

The Greece bailout is good, but what remains to be seen is how will other affected countries -- Portugal, Italy, and Spain perform. All these countries are undergoing sharp fiscal adjustments.

Presently the (stock) markets are on steroids, because of liquidity being provided by the ECB (European Central Bank). But if the tap gets turned off, it could lead to uncertainty.

Please click Next to read what Vikas says about the Indian markets...

'The positivity in the stockmarket will depend upon how much follow-through happens in the Budget'

What are the challenges before the Indian capital markets now?

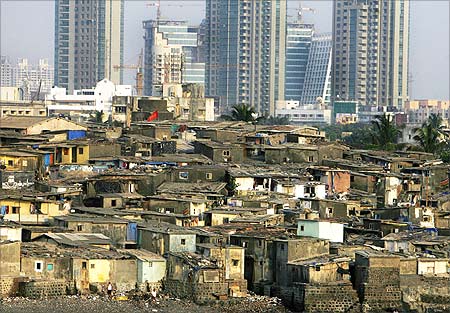

Capital markets are the barometer of economic growth and prosperity. Our growth and confidence in growth has taken a significant beating.

The biggest challenge at this point in time is poor governance. I am not using the word reform intentionally.

We can manage growth without any big bang reforms, but what is mandatory is good governance.

This is really hurting India's growth. Any government has to manage a fine balance between growth and inflation.

For a country of our size and need, we need significant investments in building physical infrastructure, soft infrastructure and intangible capital. We have seen that process slowing down significantly.

In the last one year, most investment plans have gone for a toss because of lack of governance and policy direction.

The last five years has ignited the aspirations of the Indian population and going back to 6.5 to 7 per cent growth after experiencing close to 10 per cent growth is leading to lot of anxiety, which is what we are going through right now.

That has a bearing on the capital markets which have seen a pessimistic phase for quite some time now.

We are seeing some amount of positivity recently backed by strong international liquidity. However, its sustainability will depend upon how much the government follow-through happens in the forthcoming Budget in terms of fiscal consolidation, inflation management and policy management.

What kind of indicators would suggest that the markets have moved out of the pessimistic phase that you talked about?

There are two things here: One is the market sentiment and the second is the economic environment. In the long-term while both are aligned to each other, there could be distortions in the short-term.

What we are seeing right now in terms of the significant market upmove without any significant change in the economic fundamentals of the country.

This anomaly has to change either by fundamentals changing or market correcting (from the current levels). But so far we have not seen any significant measure (by the government) to bring about a major economic change to be very frank (and the markets) are driven by international liquidity coming into India.

I will be very glad to see the government doing something to improve the economic fundamentals.

Gross capital formation, IIP, credit growth and order book of EPC (engineering, procurement and construction) companies, are very good proxies for tracking investment growth.

Please click Next to read what Vikas feels about the direction of the Indian markets...

Needed: Prudent fiscal management; reduction in subsidies and government borrowing

What is your wish list for Union Budget 2012-13?

I look forward to prudent fiscal management, reduction in the government's subsidy burden on all counts, reduction in the government borrowing programme.

At the same time, I do not know how much of this is possible given the government's socialist agenda.

Apart from that, outside of the Budget, there are lot of policy- related measures that the government can take to get going on the power and infrastructure sectors. Then, I think the economy will be back in the reckoning.

Will positive results from the Uttar Pradesh election embolden the government to take strong action on the reforms front?

It will definitely strengthen the government. If the government gets stronger, its ability to push through reforms also improves.By reforms, I do not mean any big bang reforms, but basic things like subsidy reduction, reducing the fiscal deficit and increasing fuel prices.

Having said that, this government has had all the time in the last three years to get things going. Post elections (the 2009 general election when UPA-2 returned to power) they could have done a lot of things, but nothing much happened.

As a citizen of India and as a market participant, I just hope that the government takes some strong, economically rational measures that serve the long-term interests of the country.

Please click Next to read what Vikas says about where the Indian economy is headed...

'Boost confidence via fiscal management, infrastructure investment; the market will be buoyant'

Do you see the current market rally petering out as we approach the Budget?

This government can really make this Budget an important one. It all depends on what kind of policies they announce.

If they boost confidence and sentiment through the Budget around sound fiscal management and infrastructure investment, the market can remain buoyant.

What kind of policies could become game changers?

At this point in time, as a market participant, one is not expecting anything big from the Budget.

I would rather like the government clear some hurdles to growth and investments like land acquisition, availability of coal for power production and improvement in the fiscal condition.

I think the last measure would help the banking sector get into shape again.

On my part, I expect the government to tone down its subsidy outgo, which in turn reduces the fiscal deficit resulting in interest rates coming down.

If the government's high borrowings programme continues, interest rates would continue to remain high.

Please click Next to read what Vikas says about Indian banking...

'Banking can look good if interest rates come down'

Can one presume that interest rates are likely to maintain a downward bias now?

One can very clearly establish that interest rates have peaked out. When something like this happens the bias will always be down.

What will be important will be to see the speed with which interest rates will come down.

For instance, in the last year we had the highest and sharpest-ever increase in interest rates in a year.

Everybody is now focussing at the speed and intervals at which rates will come down.

One of the reasons why the RBI (Reserve Bank of India) had to increase rates at such sharp and regular intervals was because the fiscal position was completely getting out of hand and the RBI had no control on that.

To counter (that), the RBI had to resort to a sharp increase in monetary policy. Now if the government addresses the fiscal side of the equation it will give a lot of leeway to the RBI to ease monetary policy much faster than otherwise it could have done.

Given this situation, what kind of sectors should one keenly watch out for?

Infrastructure is definitely one segment that has a lot of asset plays with values, which the market is not recognising because earning power of those assets, and lots of uncertainties around those assets exist because of policy uncertainties.

Banking is another sector which can look good if interest rates come down and asset quality issues get addressed quickly.

Capital goods is another sector related to the investment cycle so all the capital expenditure-focussed companies of the world will do phenomenally well.

The State Bank of India came out with its results on February 13 and it reported growth in profits along with growth in non-performing assets.

Are you worried about the asset quality of Indian banks given their exposure to the realty and power sector which are under pressure now to fulfil their obligations when the loans on their books come up for payment?

Undoubtedly, asset quality remains a worry point of the banking sector. We all think that asset quality is associated only with the power and real estate sector. It extends to many core sectors including small and medium enterprises (SMEs).

SMEs have sort of had a tough time last year and their NPAs (non performing assets) too have taken off and we very often undermine those values and they are fairly large.

In fact, SME is the segment that hurts the most when the economy goes down.

I think NPAs as an issue will continue to pose a worry at least for the next two to three quarters.