Photographs: B Mathur/Reuters

Finance Minister Pranab Mukherjee has a tough job at hand to bring down inflation, curtail the rising fiscal deficit and at the same time ensure that the economic growth is on track while withdrawing the stimulus measures.

Double-digit inflation rates have stayed on for two years. Food inflation is at all-time highs. Will the Budget offer any succour to the common man? Does the Budget have a solid plan for India's one billion-plus population?

Click NEXT to find out what you can expect from the Budget 2011...

What to expect from the Budget

Image: Relief for taxpayers.In the Direct Taxes Code Bill, introduced by the finance minister last year, the government seeks to widen tax slabs to levy 10 per cent rate on income between Rs 2 lakh (Rs 200,000) and 5 lakh (Rs 500,000), 20 per cent on Rs 5-10 lakh (Rs 500,000-Rs 1 million) and 30 per cent above Rs 10 lakh.

Currently, income between Rs 1.6-5 lakh (Rs 160,000-500,000) attracts 10 per cent tax; Rs 5-8 lakh (Rs 500,000-800,000)20 per cent and beyond Rs 8 lakh 30 per cent.

The government is likely to retain these rates and wait for DTC Act to come into force from April 1, 2012. Since it is also in talks with states to bring Goods and Services Tax from the same date, the government might also not change indirect tax rates.

However, it may tinker with threshold limit. The lower income group may get more relief.

. . .

What to expect from the Budget

Image: Vegetable prices rise.. . .

What to expect from the Budget

Image: GDP growth to rise.Led by a smart recovery in farm output, the economic growth for the current financial year at 8.6 per cent, as against 8 per cent a year ago.

Agriculture and allied activities are likely to grow at 5.4 per cent in 2010-11, compared to just 0.4 per cent in 2009-10, according to Advance Estimates released by the Central Statistical Organisation.

Finance Minister Pranab Mukherjee had exuded confidence that the economy would grow by 8.5 per cent despite rising inflation.

The Budget will unveil several measures to boost infrastructure projects and further strengthen the economic growth.

. . .

What to expect from the Budget

Image: Infosys.The software industry has been hit by the double taxation issue on software packages.

This Budget is likely to bring cheer to the software industry by rationalising the tax structure.

The imposition of service tax and countervailing duty for software packages sold with licenses is a deterrent for software companies.

In 2010, the Budget introduced conditional exemptions from countervailing duty or excise duty on the import/manufacture of packaged software if the importer/manufacturer is registered for service tax.

The Indian IT industry has sought extension of tax benefits under STPI and simplification of the tax structure to encourage investments in the sector, among others as part of its budget wish-list.

The $76 billion software industry has requested the government to extend the Software Technology Parks of India (STPI) scheme till the Direct Tax Code (DTC), which is under consideration, is implemented.

. . .

What to expect from the Budget

Image: India to see more new banks.India is considering allowing new private sector banks, including by industrial houses, and a roadmap for the same could be announced in the annual Union Budget to be presented later this month.

While the formal and final guidelines would be announced by the Reserve Bank of India on who should be allowed to set up new banks and what should be the terms and conditions for them, a roadmap on the subject could be announced in the Budget speech on February 28 by Finance Minister Pranab Mukherjee, sources added.

In his Budget speech last year, Mukherjee had said that there was a need for extending the geographic coverage of banks and improving access to banking services.

. . .

What to expect from the Budget

Image: More services under service tax net.What to expect from the Budget

Image: Customs duty to be cut.Considering the present inflationary pressures in a difficult macroeconomic environment, it is likely that the rate of basic customs duty, could be brought down.

Surely, the present duty structure on oil will undergo changes, given the present high prices and the significant quantities of oil imports. In any event, median customs duties must be brought down, if we are to reach ASEAN levels in the near future, according to S Madhavan, Leader, Indirect Tax Practice, PricewaterhouseCoopers.

. . .

What to expect from the Budget

Image: Budget to look at generating more funds.In addition to the basic customs duty, there is also an expectation around the special additional duty (SAD) of 4 per cent, which is supposed to countervail the sales tax/VAT.

It is now recognized that the present position with regard to availment of credits in relation to the SAD are inadequate, in that these are not presently admissible to service providers, unlike manufacturers, according to S Madhavan, Leader, Indirect Tax Practice, PricewaterhouseCoopers.

Further, the position relating to refunds of SAD to traders/resellers are extremely cumbersome and result in significant blockage of funds.

In light of this, and as a possible measure to mitigate the inflationary pressures on imported goods, it is likely that the SAD could be completely abolished.

. . .

What to expect from the Budget

Image: Education is likely to get a big boost.Higher education is likely to get a big boost in the Budget. Pranab Mukherjee has been asked to double the budgetary allocation for the higher education to over Rs 30,000 crore (Rs 300 billion) in 2011-12.

Sarva Shiksha Abhiyan, which has turned into a vehicle for implementing the Right to Education, has already got a boost in funding, as the Centre's share of funds has increased to 65 per cent from 50 per cent.

So, this year again, the allocation may see a slight increase from the Rs 31,000-crore (Rs 310 billion) allocation in 2010-11.

It likely to get a 20 per cent increase each over their 2010-11 Budget allocations.

. . .

What to expect from the Budget

Image: Dollar notes.Photographs: Reuters.

The government is likely to remove the loopholes in international taxation to add more money to the exchequer.

Black money has become a major headache for the government. With millions of dollars stashed away in foreign banks, Indian government is under pressure to stop the flow of money to tax havens. The Budget will bring about tax and administrative changes.

. . .

What to expect from the Budget

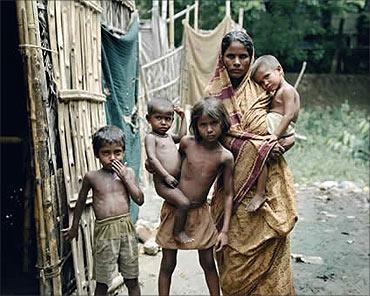

Image: Farmers.Photographs: Reuters.

While contribution of agriculture to the gross domestic product (GDP) is 14.6 per cent, about 65 per cent of the population was dependent on it. Hence, it may get more Budgetary push for increasing productivity.

The funding may go to areas of research, as for a long time there has been little improvement in terms of new strains of crops, an official in the finance ministry said.

The agriculture sector is also anticipating tax benefits on import of agricultural tools and other mechanisation equipment.

. . .

What to expect from the Budget

Image: Power sector may get a fillip.The power sector may get a fillip as withholding tax on overseas investment may be waived to bring in more investment.

The finance minister is also likely to focus on rural electrification. Affordable energy solutions will be the thrust.

Private players will be invited to play a role in the electrification projects in rural areas.

. . .

What to expect from the Budget

Image: Health insurance for poor.The labour ministry may get a higher allocation for various programmes like the much-publicised health insurance for the poor.

Though social sector spending will continue to be the government's top priority with a major chunk of allocation expected to be made towards existing schemes like the Mahatma Gandhi Rural Employment Guarantee Scheme (MGREGS), many social sector ministries have got broad hints from the finance ministry that no new schemes would be entertained and the government's emphasis in the Budget is likely to be on the existing schemes in agriculture, education and infrastructure.

. . .

What to expect from the Budget

Image: Gold prices to rise.Traders are expecting a hike in import duty increase on gold. In the 2010 Budget, the duty on imports of gold was hiked to Rs 300 per 10 gm from Rs 200.

India has seen gold prices zoom by 23.7 per cent from Rs 16,772 per 10 grams since March 2010.

article