| « Back to article | Print this article |

How I-T dept is catching tax evaders

Old ways of raiding the premises for collecting information is out. Now, I-T dept analyses significant amount of data for discrepancies using highly secure machines that do not have internet connection. They also have informers, who get part of the bounty.

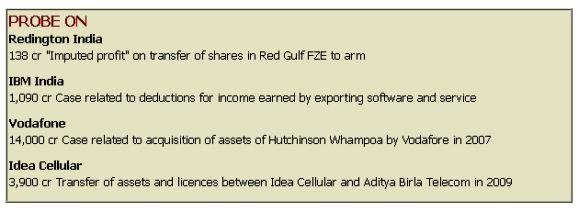

Vodafone, Cadbury, Nokia, IBM, Shell, LG, Capgemini, Hewlett-Packard and Samsung have recently received tax notices from the government.

While nobody expects them to cough up the money without a fight, tax lawyers admit that, unlike in the past, these are meticulously researched and legally sound, and, therefore, cannot be contemptuously thrown into the trash can.

Some companies that have received the notices say that it has vitiated the investment climate in the country, reminiscent of the raid raj unleashed by Vishwanath Pratap Singh as Rajiv Gandhi's finance minister (December 1984 to January 1987).

But the current drive is less about raids and more about painstaking investigation. The finance ministry wants to up its tax collection without ruining the already bleak investor sentiment.

Click NEXT to read more...

How I-T dept is catching tax evaders

Hence, the focus is on due diligence rather than on search and seizure. A raid gives immediate results with only a fraction of the effort required for due diligence but engenders bad publicity.

Finance Minister Palaniappan Chidambaram has given broad instructions to revenue officials to use millions of pieces of information available with various departments under his ministry to identify cases where tax may have been evaded and then try to recover the money.

Why now? Chidambaram's primary concern is to control the fiscal deficit. If it goes haywire, India's credit rating will fall to junk.

There's a limit to which he can cut expenditure and raise tax rates - always inadvisable when general elections are round the corner. Hence the recent tax demands.

The newfound energy is also due, in part, to KV Chaudhary taking over as Member (investigation) of the Central Board of Direct Taxes (CBDT) in September 2012.

Chaudhary is considered a tough officer who had spearheaded high-profile raids in his previous posting as Director General of Investigation, CBDT.

Click NEXT to read more...

How I-T dept is catching tax evaders

In fact, during the National Democratic Alliance regime, he was transferred from Bangalore after leading a search operation against Tamil Nadu Chief Minister J Jayalalithaa.

"He is an exemplary officer of great integrity," says a CBDT functionary.

Advances in information technology have armed the tax authorities with sufficient tools to analyse tax cases.

The 250 sleuths sitting in the swanky office of the Centralised Processing Centre for TDS (tax deducted at source) in Ghaziabad, a few kilometres outside New Delhi, pore over third-party information from sources like annual information returns and TDS filings to study tax behaviour and form 360-degree profiles of suspects.

The tax detectives, including staff of technology partner Infosys, make real-time reconciliation of TDS filings and refund claims and instantly identify erroneous claims.

"There is a conscious effort to be more systematic and scientific now," says a finance ministry official. "We are a lot more organised and ensure a case reaches conclusion. And under this finance minister there is a focus on follow-up action; cases are not abandoned midway."

Click NEXT to read more...

How I-T dept is catching tax evaders

The computers of the investigators are password-protected and do not have an Internet connection. The investigators are wired on intranet and access the Net on other laptops.

But companies too have become smart: they like to store information in pen drives, which are easy to ferry out at the first sign of trouble.

Before proceeding on a raid, the taxmen study the blueprint of the building and make a checklist of who to nab and what to seal.

"We have to put ourselves in the shoes of tax evaders. They would want to destroy the evidence but we have to anticipate their next step," says an investigator. "The profession is such that we are suspicious of everything. You become a man of few words."

Another remembers people getting beaten up during investigations earlier; no longer - it is done with civility.

The old ways haven't been junked, though. To get information on taxpayers, individuals as well as corporations, the revenue department still relies heavily on human intelligence - from labourers to white-collar staff.

Click NEXT to read more...

How I-T dept is catching tax evaders

Many are one-time informers such as disgruntled employees or rivals, while others are on government payroll. There is a system of reward.

Those who give actionable information can stand to receive up to 20 per cent of the recovered amount, depending on the accuracy of the information. Their identities are, of course, protected.

Coordination among various agencies is crucial, for the accumulated information can clinch cases.

For instance, it was the Excise Department going public with tax claims against Cadbury that made the Income-tax Department look into the affairs of the confectioner.

Similarly, data given by Maharashtra's Value Added Tax Department helped Income-tax authorities expose fake bills of over Rs 7,200 crore (Rs 72 billion) in just 189 returns in Mumbai.

"The basic fundamentals don't change. If there is a mismatch in the electricity bill produced by a manufacturing company and the profits or income declared by it, it won't be wrong to assume there could be evasion of taxes," says an income-tax officer.

Most of the tax evasion cases can be traced to transfer pricing, where the price paid by an Indian unit to its parent company ought to be at "arm's length".

Click NEXT to read more...

How I-T dept is catching tax evaders

The allegation is that the Indian arm often underreports transactions, like stake sale, in order to avoid capital-gain taxes, or it underprices sales so that profits (which are taxable) are booked not in India but abroad, preferably in some tax haven.

The Vodafone acquisition of Hutchison Essar in 2007, though not purely a transfer pricing issue, is considered epochal by finance ministry officials, and they say it has increased awareness among tax authorities how foreign companies carry out their business.

(The Supreme Court had in January last year set aside a Bombay High Court judgement asking Vodafone to pay income-tax of Rs 11,000 crore or Rs 110 billion on the deal and had asked the tax department to return the Rs 2,500 crore or Rs 25 billion deposited by Vodafone.)

While the tax officials will not reveal their modus operandi, normally the preliminary information is corroborated by electronic and manual surveillance of suspected evaders.

Click NEXT to read more...

How I-T dept is catching tax evaders

The number of people deployed to scrutinise the tax credentials of a company ranges from four or five for relatively smaller cases to 60 or 70 for complicated, major ones.

Of course, staff shortage is a big problem for CBDT - most investigators complain the workload is heavy and they frequently have to spend days away from home.

At present, each assessing officer handles 11,000 taxpayers, up from 7,250 in 2001-02. The working strength of CBDT is currently around 40,756 - almost a third less than the 57,793 sanctioned in 2001.

The Central Board of Excise and Customs is also facing a shortage of 14,000 personnel in a sanctioned strength of 68,000.

Both the boards are planning to fill the vacancies after securing the Cabinet's nod. But even before that can happen, the North Block sleuths have grown fangs.

Click NEXT to read how I-T dept detected evasions by Nokia, Cadbury and Shell...

Nokia: You've got mail

Nokia

Tax demand: Rs 3,000 cr

In 2012, the Income-tax Department received information that Nokia was downloading software from its parent in Finland to manufacture mobile devices.

The Income Tax Act says royalty paid on downloaded software attracts TDS at the rate of 10 per cent. However, tax authorities claim, these transactions were shown in Nokia's audit report as "procurement of raw materials" to avoid taxes.

In January this year, Nokia's factory at Sriperumbudur in Chennai was raided. Cyber experts from Central Forensic Science Laboratories, Hyderabad, scanned Nokia's computer systems to trace the downloading of the software from Finland.

In its interim report, the Income-tax Department has calculated tax evaded at Rs 3,000 crore or Rs 30 billion (10 per cent of Rs 30,000 crore or Rs 300 billion worth of mobile devices manufactured in the past six years using downloaded software).

It has suggested a demand of Rs 13,000 crore (Rs 130 billion), including Rs 10,000 crore (Rs 100 billion) for violating transfer-pricing regulations.

After the raid, Nokia issued a statement: "In tax investigations like this, local standards would prohibit government officials from entering the factory premises and Nokia IT systems without valid authorisation and questioning individual employees for intolerably long periods of time, even after they have fully cooperated with the authorities."

Nokia said it was in compliance with the laws and the bilateral treaty between India and Finland.

Click NEXT for Cadbury case...

Cadbury: Small print on wrappers

Cadbury

Tax demand: Rs 252 crore

The government had announced a 10-year tax holiday for companies setting up units in Himachal Pradesh till March 31, 2010.

Cadbury set up a factory in Baddi in 2005 and earned a 10-year tax holiday till 2015. In 2009, it decided to set up another unit next to the existing one.

But, in 2011, the Directorate General of Central Excise Intelligence got information about "some manipulation by Cadbury" at the Baddi plant "from an authentic source".

A finance ministry officer says though Cadbury claimed that production commenced in March 2010, it actually started only in May 2010.

The tax authorities claim that details on confectionery wrappers proved production had commenced after the March 31 deadline.

The orders for the wrappers with details of Unit II were placed only in April 2010 and the wrappers delivered to the company only after May, they claim.

On February 28, 2012, a notice was sent to Cadbury demanding Rs 252 crore (Rs 2.52 billion) for duty evaded between May 2010 and January 2013.

Notices were also issued to the Himachal Pradesh Deputy Director for Factories and Deputy Director for Industries.

In response to a query from Business Standard, Cadbury says: "We do not agree with the allegations and will be challenging the same through the process provided under the excise law. The company firmly believes that the decision to claim excise benefit in respect of our plant in Baddi is valid and we will strongly defend this position through the courts."

Click NEXT for Shell case...

Shell: Prized shares

Shell

Tax demand: Rs 5,000 crore

As Shell's was a case of transfer pricing, it did not involve the kind of investigations that were conducted in the cases involving Cadbury and Nokia.

Officials say shares transferred by Shell to a group company were underpriced and this came to their notice during a routine assessment.

Shell India issued 87 million shares to Shell Gas in March 2009 at Rs 10 apiece. The Income-tax Department contested this figure and said the shares should have been priced at Rs 183.

Officials claim the underpricing not only led to a loss of over Rs 15,000 crore (Rs 150 billion) to the nation in the form of foreign flows but was also tantamount to evasion of capital gains tax.

Last month, the Income-tax Department issued a draft order pegging Shell's liability at about Rs 5,000 crore (Rs 50 billion).

If Shell accepts the order, the department will send a final order along with the demand notice. If the company rebuts the order, it will get 90 days to appeal to the Dispute Resolution Panel.

Shell has described the order as "absurd". Yasmine Hilton, the India head of Royal Dutch Shell, said this amounted to taxation on FDI and that in order to settle this tax liability the company will need another equity infusion which may again be taxed.