Auto and home loan borrowers can expect some relief soon as banks and the RBI are likely to go for a 1 percentage point cut in interest rates in the backdrop of falling inflation.

While bankers and experts expect the lending rate to fall by about one percentage point in the near-term, the Prime Minister's Economic Advisory Council has strongly pitched for rate cut by the RBI in its monetary policy review later in the month.

"There is every possibility of a decline in interest rates. . . unless some major events take place, interest rates should come down by at least 100 basis points," Union Bank of India chairman and managing director M V Nair said in New Delhi.

The base rate of commercial banks, according to RBI data, ranges from 10 to 10.75 per cent.

. . .

Bankers expect interest rates to fall by 1%

The trend for the monetary strategy going forward, according to experts, is expected to be set by the Reserve Bank of India in its third quarterly monetary policy review on January 24.

The RBI, which has increased key rates 13 times since March, 2010, had indicated in its December policy review that it could reverse the tight monetary policy stance in case inflation remains under control.

Food inflation, according to the latest data, fell into the negative zone in the week ended December 24, declining by 3.36 per cent.

With regard to headline inflation, it fell from 9.73 per cent in October to 9.11 per cent in November and is expected to decline further.

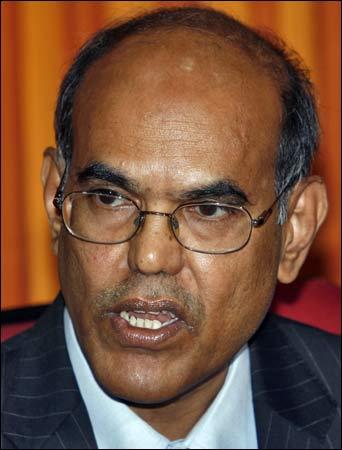

"I expect headline inflation could come down even below 7 per cent by March-end. . . The environment appears to be in favour of the RBI reversing its monetary policy stance," Prime Minister's Economic Advisory Council chairman C Rangarajan said. Earlier this week, RBI Governor D Subbarao said interest rates have peaked and are set to ease from now on.

. . .

Bankers expect interest rates to fall by 1%

"From here on, we could expect reversal of monetary tightening. But it's difficult to say when that will take place and in what shape it will roll out," Subbarao had told the BBC.

India Inc has blamed high interest rates, which have led to an increase in the cost of fresh borrowing, for hindering fresh investment and industrial growth.

Economic growth during the second quarter (July-September) stood at 6.9 per cent, the lowest in over two years.

Industrial production declined by 5.1 per cent in October.

"We expect the repo rate to be reduced in Q2, 2012.

"However, the RBI may cut the cash reserve ratio in the January policy meeting," Standard Chartered Bank economist Anubhuti Sahay said.

article