Photographs: Reuters

August was a month of agony for investors as they lost more than Rs 1 crore (Rs 10 million) in every second of trade, on an average, taking the total losses for the market to over Rs 5.5 lakh crore (Rs 5 trillion).

It was also the worst month for investors since January 2011, when the average loss per second of trade was about Rs 1.5 crore (Rs 15 million).

The benchmark index lost over 1,500 points in the entire month, while the investor wealth plummeted by Rs 555,650 crore (Rs 5,556.50 billion) -- the biggest monthly loss since January 2011 when the market had lost little over Rs 700,000 crore (Rs 7,000 billion).

Click on NEXT for more...

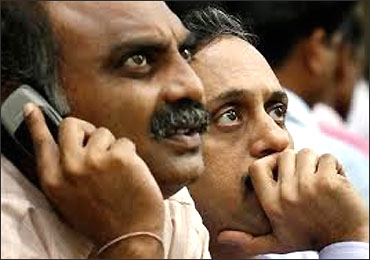

August agony cost investors Rs 1.13 cr every second

Image: Worried investors check stock prices.There were 21 trading days during August, with each day having 23,400 seconds of trade. This puts the average loss for every second at Rs 1.13 crore (Rs 11 million) for the month.

The losses would have been much higher, but for a sharp rebound in the last two days of trading, when the market rose by over 5 per cent with an over 800-point rise in the Sensex and about Rs 3 lakh crore (Rs 3 trillion) gain in investor wealth.

Click on NEXT for more...

August agony cost investors Rs 1.13 cr every second

Image: A man stands in front of a bull statue outside the BSE.Photographs: Arko Datta/Reuters

The average loss for one day was about Rs 26,500 crore (Rs 265 billion).

This includes losses for all the investor classes - promoters as well as public shareholders of over 4,000 actively traded companies in the stock market.

This is based on decline in the value of all listed stocks, which fell to Rs 60,61,625 crore (Rs 60616.25 billion) at the end of August.

Adding to the investors' agony, August proved to be the fourth consecutive month of monthly losses.

Click on NEXT for more...

August agony cost investors Rs 1.13 cr every second

Image: A broker monitoring the stock prices.Photographs: Reuters

The markets also recorded losses in July (Rs 113,673 crore (Rs 1,136.73 billion)), June (Rs 921 crore (Rs 9.21 billion) and May (Rs 176,220 crore (Rs 1,762.20 billion) -- taking the total four-month loss to Rs 850,000 crore (Rs 8,500 billion).

Prior to this, investors had gained about Rs 550,000 crore (Rs 5,500 billion) in two months (March and April), but lost Rs 950,000 crore (Rs 9,500 billion) in the year's first two months, January and February.

Click on NEXT for more...

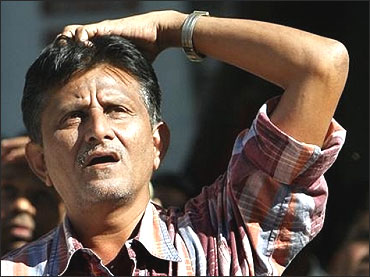

August agony cost investors Rs 1.13 cr every second

Image: An investor reacts to the falling stock prices.Photographs: Reuters

The losses in recent months have been mainly due to heavy fund outflows in the wake of global economic uncertainties.

The total losses this year so far stand at about Rs 12,50,000 crore (Rs 12,500 billion).

Interestingly, the stock market had recorded a total gain of about Rs 12,00,000 crore (Rs 12,000 billion) during entire 2010.

So far, the highest-ever monthly loss has been recorded in January 2008, when investors lost about Rs 13,74,000 crore (Rs 13,740 billion) after the markets started falling from its all-time high of Sensex at 21,206.77 points.

Click on NEXT for more...

August agony cost investors Rs 1.13 cr every second

Image: A stock brokers engages in trading at a firm in Mumbai.Photographs: Arko Datta/Reuters

The losses exceeded Rs 10 lakh crore in October and June months of 2008 as well, while March and September that year had seen losses of about Rs 7.5 lakh crore (Rs 7.5 trillion) and Rs 6 lakh crore (Rs 6 trillion), respectively.

This makes August, 2011 the seventh biggest monthly loss so far.

In the total loss of about Rs 5.55 lakh crore (Rs 5.5 trillion) in August, the promoters' share is estimated at about 60 per cent, while the remaining includes all other investor classes such as retail investors, HNIs, mutual funds, FIIs, insurers, etc.

article