Photographs: Savita Kirloskar/Reuters Namrata Acharya in Kolkata

Once bitten, but hardly twice shy.

After having burnt their fingers in the microfinance sector, you might expect investors there to show restraint.

On the contrary, private equity and venture capital (PE and VC) companies are exploring newer, more risky terrain, such as the Rs 35,000-crore (Rs 350-billion) chit fund sector.

These earlier stakeholders in the MFI sector are now turning to this one.

Shriram Chits, with an annual turnover close to Rs 4,200 crore (Rs 42 billion) and one of the biggest in the country, has seen queries from a number of PE funds for investment in its business.

. . .

After MFI turmoil, chit funds the next big draw

"We have (also) seen interest from our existing investors in the Shriram Group to invest in our chit fund business," said Y S Chakravarti, chief operating officer, Shriram City Union Finance, who is also on the board of Shriram Chits.

Enquiries, it seems, are pouring in from all quarters.

For instance, Lok Capital, a VC firm founded by IDFC's Rajiv Lall and PE veteran and former Actis head in India, Donald Peck, that was focusing on the microfinance sector, is now actively exploring options to invest in chit fund companies.

"We are clearly looking at investment opportunities that will expand financial inclusion, and chit funds is one.

"The chit fund model is unique and it has a lot of advantages, with elements of savings.

They operate on the same model as MFIs, and their commission is also capped," said Venky Natarajan, managing director of Lok Advisory Services.

. . .

After MFI turmoil, chit funds the next big draw

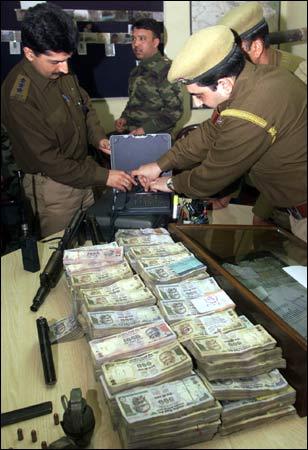

Image: Indian police officers examine seized currency notes in Srinagar.Photographs: Fayaz Kabli/Reuters

To begin, Lok Capital might invest up to Rs 5 crore (Rs 50 million) in a chit fund company.

"After the crisis in the MFI sector, investment opportunities in NBFCs (non-banking finance companies) has shrunk.

"Investors are looking at alternative investment options, and chit funds is one," said Shashi Shrivastava, senior vice-president, Grameen Capital, a financial advisory firm focused on the MFI sector.

However, with the commission of chit fund companies now capped at five per cent of chit value, the returns may not be as alluring as the MFI sector.

Recently, the All India Chit Fund Association gave a charter of demands to the Union finance ministry, including allowing members to undertake sensitisation deals, issues on rating and waiver of service tax.

. . .

After MFI turmoil, chit funds the next big draw

Image: Employees at a wholesale shop count money in Allahabad.Photographs: Jitendra Prakash/Reuters

The estimated size of the industry is Rs 35,000 crore (Rs 350 billion), with the unregistered part estimated to be at least 100 times the registered one, according to association data.

There are about 30,000 registered chit fund firms.

For this sector, the MFI crisis was a blessing in disguise. The southern states of Kerala, Andhra Pradesh and Tamil Nadu, where the MFI crisis got precipitated, account for a third of the chit fund industry in India.

"Not only have we seen a rise in business but also enquiries by VC firms for investment in the sector," said T S Sivaramakrishnan, proprietor of Balussery Chit Fund, and secretary of the All India Chit Fund Association.

. . .

After MFI turmoil, chit funds the next big draw

Image: A bank employee checks a Rs 500 note at a counter of Yes Bank's microfinance division in Mumbai.Photographs: Punit Paranjpe/Reuters

Last year, the industry grew around 20 per cent, against a usual growth of 10-15 per cent, he said.

A chit fund is a saving-cum-borrowing instrument, with a scheme operating under a predominant value and denomination.

Each scheme admits a particular number of members, who contribute a certain sum every month to a 'pot', which is auctioned each month.

The highest bidder wins the pot.

The bid amount is also called a discount and the prized subscriber wins the sum equal to the chit value, less the discount.

. . .

After MFI turmoil, chit funds the next big draw

The discount money is then distributed among the rest of the members.

Typically, these companies cater to middle-income group clients, due to the high cost of operations and cap on revenue.

However, with the crisis in the micro finance sector, chit fund companies are now eager to tap lower income group households.

Thus, over the past year, chit funds of lower denomination, with a higher number of participants, fuelled the growth of the industry in the southern states, said Sivaramakrishnan.

article