| « Back to article | Print this article |

How election results will impact India's growth, stock markets

The election results will have a positive or negative impact on the economy depending on which party will win the elections.

Take a look at how each May 16 scenario is likely to turn the fortune of the economy…

How election results will impact India's growth, stock markets

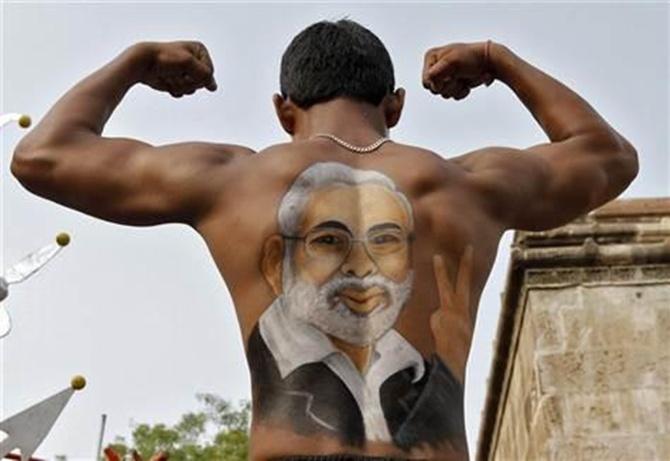

Scenario 1

Single party gets majority/coalition with a few partners

Inflation

Sharp deceleration in CPI inflation in FY16 led by improvement in productivity dynamics

CAD

Wider CAD as capex picks up, FY15E: -2% to -2.5% of GDP, FY16E: -2.5%

Stock Market

Beta rally continues (assuming supportive global cues) for 2-3 of months, till market participants realise govt’s inability to drive rapid changes and FY15 first-quarter results temper optimism.

Click NEXT to read more...

How election results will impact India's growth, stock markets

Scenario 2

Coalition with many partners

GDP growth

Moderate recovery in growth. FY15E: 5.5-6%; FY16E: 6.25-6.75%

Inflation

Meaningful deceleration in CPI inflation in FY16, led by improvement in productivity dynamics

CAD

Wider CAD, moderate pick-up in capex. FY15E: -1.75% to - 2.25%of GDP, FY16E:-2.5%

Stock Market

A temporary lull in the market (flows-wise) till a post-poll alliance gets stitched; Given Modi at the helm, sentiment to remain positive; dash for quality within cyclical stocks

Click NEXT to read more...

How election results will impact India's growth, stock markets

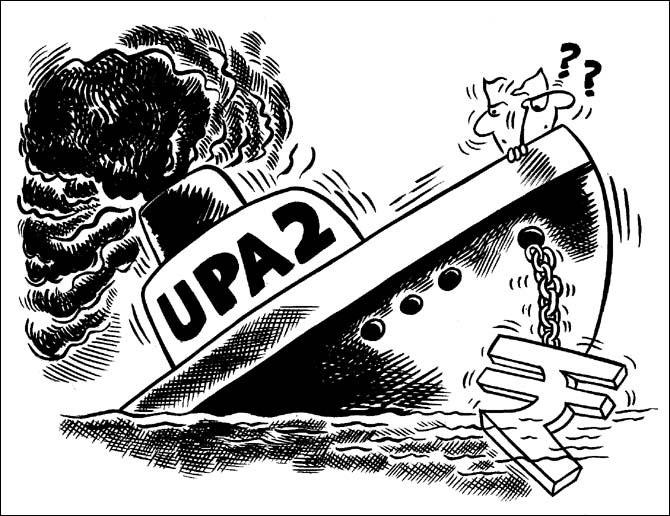

Scenario 3

Fragmented coalition, with lead party getting around 180 seats

GDP growth

Slow recovery in growth. FY15E: 5.0- 5.5%; FY16E:6.0-6.5%

Inflation

Gradual deceleration in CPI inflation in FY16, led by improvement in productivity dynamic

CAD

Low CAD as slow pick-up in capex. FY15E: -1.5% of GDP, FY16E: -1.4%

Stock Market

Markets to react negatively to “No Modi” at the Centre and a potentially unstable government; some sector rotation towards defensive bets might be seen as cyclicals give up their gains

Click NEXT to read more...

How election results will impact India's growth, stock markets

Scenario 4

Government with lead party in supporting role

GDP growth

Weak growth outlook. FY15E: 4.75-5%; FY16E:5.0-5.5%

Inflation

CPI inflation and inflation expectation likely to remain unanchored, leading to monetary tightening by RBI

CAD

Declining CAD as capex slips further. FY15E:-1.5% to -2.5%of GDP, FY16E: -1.5%

Stock Market

Unwinding of the beta rally as apprehension of a rating downgrade emerges; reallocation to defensives and exporters; Broad market to stay resilient as, historically, election results have never altered market trends