| « Back to article | Print this article |

The flip side is exporters saying they are not in a position to convert such enquiries into orders, being unable to match the competition's price.

Made-in-India products are costlier by 10-15 per cent as compared to the competition from Bangladesh, Vietnam, Cambodia and others.

At this time of the year, buyers from Western markets travel to China to negotiate with garment exporters for the next season.

Because of the coronavirus spread, most of them have reportedly cancelled the trip and started discussing with exporters from other countries, including India.

T Rajkumar, chairman, Confederation of Indian Textile Industry, says it is possible for export of finished textile goods, clothing and fabric to rise by at least 20-30 per cent this year, due to the Chinese virus issue.

The flip side is exporters saying they are not in a position to convert such enquiries into orders, being unable to match the competition's price.

Made-in-India products are costlier by 10-15 per cent as compared to the competition from Bangladesh, Vietnam, Cambodia and others.

The other major issue for some exporting units is that they are not able to import accessories from China.

With the epidemic in China, many textile factories there have halted operations, disrupting export of both textiles and raw material.

However, add exporters, most of our competing countries are heavily dependent on China for importing raw material for textiles.

So, India can still fill a gap, if the government quickly responds and gives some tax benefits.

On the other hand, the four per cent incentive given under the Merchandise Exports from India Scheme (MEIS) on made-ups and garments was withdrawn recently with retrospective effect from March 7, 2019.

Further, it was stated all incentives under MEIS granted to exporters of made-ups and garments on export till July 31, 2019, would be recovered.

There are also pending claims under the erstwhile ROSL scheme, which was discontinued from March 7, 2019.

"Looking at our current infrastructure and pricing, I am not sure if we would be in a position to take advantage of such inquiries.

"Yes, accessory supply will be impacted, though not in the immediate future," said Rahul Mehta, veteran in the apparel industry and president of the Mumbai-based Clothing Manufacturers Association of India.

Accessories bought by Indian manufacturers from China are stuck.

No deliveries started after the Chinese New year and all units there remain closed.

This will really impact our delivery to customers, says Tirupur Exporters Association general secretary T R Vijayakumar.

"We have to start with local sources but immediately making ready and meeting the quality standards will be tough for us," he added.

Around 10 per cent of fabric and 20 per cent of accessories comes from China to India.

The Association estimates Rs 1,000 crore of accessories (buttons, zips, hangers, needles, etc) are imported by garment units in the country from China, being 40-50 per cent cheaper than sourcing domestically or from other countries.

T Thirukumaran, managing director, Estee Exports, said: "This is the biggest problem we are facing, as many accessories are imported from China and if they don’t open factories fast, we will face huge delays. Twelve items of mine are stuck in Guangzhou since January 21."

With existing stocks, he can run on till March.

When the SARS virus hit China in 2003, later spreading to 17 countries, this did not lead to significant damage for the industry, said a leading apparel exporter.

“This time, it could be a cause for worry if the situation doesn’t come under control and continues for a longer time.”

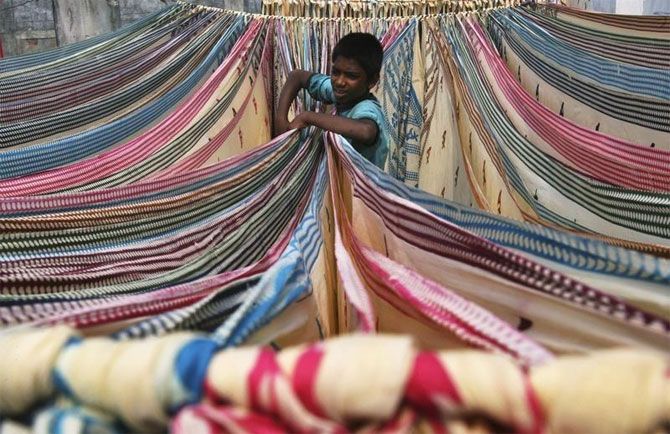

Photograph: Krishnendu Halder/Reuters