| « Back to article | Print this article |

To make possible discretionary spending including capex and that on welfare, the government decided to borrow more than planned in FY21 -- Rs 12.7 trillion.

Abhishek Waghmare reports.

The Union Budget promised an expenditure boost of close to Rs 70 trillion in two years, by budgeting for Rs 34.5 trillion in FY21 and Rs 34.8 trillion in the next financial year (FY22).

In comparison, the government spent Rs 50 trillion in the previous two years (FY19 and FY20).

This way, the FM set the intent for a massive borrowing-led expenditure stimulus.

There is one structural issue that severely limits the spending power of the Centre.

Though the issue is an intrinsic part of public finances everywhere, its imprint on the Union government's finances is such that it would be a mistake to neglect it.

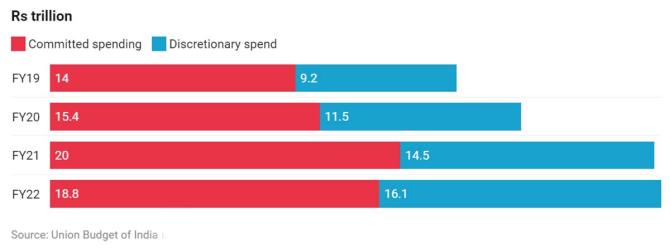

Spending on unproductive and current heads such as salaries and pensions, interest payments and subsidies -- termed as committed expenditure -- will take up an unprecedented Rs 20 trillion in FY21, and Rs 18.8 trillion in FY22.

This would leave only Rs 14.5 trillion in FY21, and Rs 16 trillion in FY22, for discretionary spending by the Centre.

This translates to just 7-8 per cent of GDP.

Funds can only be used from this remainder -- 35-45 per cent of the total -- for capital expenditure (capex), social welfare schemes, and most importantly, spending on health and education.

Further, committed spending may not be limited to these spending heads, and may also include spending on schemes such as the Mahatma Gandhi National Rural Employment Guarantee Scheme and transfers to states.

This analysis thus considers a conservative estimate of committed expenditure.

To look at the lion's share of committed expenditure, and how it particularly makes a bigger impact in a crisis year, let us explore the following numbers.

In FY21, the central government will earn Rs 15.6 trillion as revenue receipts from taxes and non-tax sources.

But its committed expenditure is Rs 20 trillion.

In FY22, its committed spend will be Rs 18.8 trillion against revenue receipts of Rs 17.9 trillion.

This means that the government will use capital receipts from divestment, and borrowings from the market and the National Small Savings Fund, to first service its obligations towards debt, salaries, pensions and subsidies.

And only then will it get the room to spend on capex.

Even then, priority flagship schemes such as MGNREGA and cash income support through PM-KISAN gain precedence, as they are key instruments to the government's rural thrust.

Interest payments are pegged at Rs 6.92 trillion in FY21, and Rs 8.09 trillion in FY22, forming 23 per cent of total spending, and close to 4 per cent of GDP.

Subsidies are pegged at a staggering Rs 6.5 trillion this year, probably the highest ever level to GDP ever, as the government plans to take up the arrears of the Food Corporation of India on its own books.

This compelled the Centre to spend a staggering Rs 4.22 trillion on food subsidy payment, which will be a direct cash outgo from the consolidated fund of India to the Food Corporation of India.

But they are set to fall in FY22, estimated at Rs 3.7 trillion.

"If we set aside the reduction in subsidies, balance revenue expenditure is set to rise by Rs 2 trillion in FY22, more than half of which is driven by higher interest payments," said Aditi Nayar, principal economist at Icra.

To make possible discretionary spending including capex and that on welfare, the government decided to borrow more than planned in FY21 -- Rs 12.7 trillion instead of Rs 12 trillion, and also announced that it would borrow more than the market expectation in FY22.

This sent a strong signal to the markets that the government is willing to spend more even if the fiscal deficit rises to levels unheard of before.

But this borrowing will exert strong pressure on the debt-to-GDP ratio and interest payments in the coming years, especially the next decade, said experts.

"With a higher fiscal deficit expected over the medium term, interest payments are likely to continue to rise, making it challenging to reduce the size of committed items in revenue spending," said Nayar.

Salaries and pension outgo, just for the central government, still remains as much as 2 per cent of GDP.

This inevitable and a big-ticket spending head also contributes to the consumption in the economy, especially towards housing, consumer durable and premium goods.

Adding state government salaries and pensions, the amount under this head would rise way beyond two percentage points, to go over 4 per cent of GDP.

States earmark about 5 per cent of GDP on total committed spending, and just above 2 per cent of GDP on interest payments.

In contrast, the Centre spends four per cent of GDP on just one head -- interest payments.

Feature Presentation: Ashish Narsale/Rediff.com