| « Back to article | Print this article |

Fall in oil prices, adequate forex reserves and domestic institutional buying help Indian markets buck the trend

Fall in oil prices, adequate forex reserves and domestic institutional buying help Indian markets buck the trend

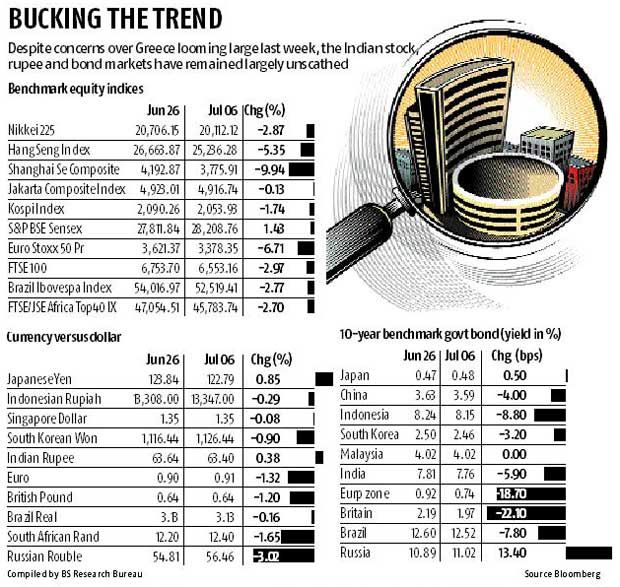

The development in Greece over the past week has roiled global stocks, bonds and currencies but India’s financial markets have managed to hold their own.

While most developed and emerging markets have declined an average of two per cent in the past week, India’s benchmark indices have managed to outperform by nearly 400 basis points.

Similarly, the rupee has appreciated against the dollar, even as most other emerging market currencies have conceded some ground in the past six trading sessions, as the deepening of the Greek crisis triggered a flight to safe-haven assets.

Analysts attribute this to the country’s improving macro situation, the fall in global crude oil prices and buying support from domestic investors.

“The Indian equity market remained steady even as key Asian peers China, Indonesia and Taiwan declined sharply by four to seven per cent.

Indian equities were largely insulated from developments in Greece and recovered over five per cent intra-month as monsoon rainfall surpassed government forecasts and concerns over an aggressive Fed liftoff moderated,” said Abhay Laijawala, head of research at Deutsche Equities India.

“The rupee also outperformed most emerging market currencies, underscoring our long-held view that improved external balances & higher forex reserves will help it withstand outflow pressures emanating from (US Fed developments).”

“In the wake of the Greek vote, crude oil prices have plunged, with Brent trading below $60 a barrel.

"With nearly 80 per cent of its crude requirements being imported, India would be a massive beneficiary of falling crude prices, with narrowing of its trade deficit, current account and fiscal deficit,” said Ajay Bodke, chief portfolio manager at Prabhudas Lilladher.

Brent crude prices fell to $57 a barrel on Monday from $62 a barrel at the end of last month. Experts say every $1 decline in oil prices results in nearly $1 billion (Rs 6,400 crore) of forex savings for the country.

Sachchidanand Shukla, senior vice-president at Axis Capital, had in a note last week said: “India’s macro is in a much better shape as compared to 2012-13. . . Some of other key parameters that made Southeast Asian economies more vulnerable like pegged exchange rates, overheating, higher credit and huge external debts are not that big a vulnerability right now for most emerging markets, including India.”

Sachchidanand Shukla, senior vice-president at Axis Capital, had in a note last week said: “India’s macro is in a much better shape as compared to 2012-13. . . Some of other key parameters that made Southeast Asian economies more vulnerable like pegged exchange rates, overheating, higher credit and huge external debts are not that big a vulnerability right now for most emerging markets, including India.”

Market experts also highlight the buying support provided by India’s domestic investors during the foreign institutional investor selloff. For instance, foreign investors had pulled out nearly Rs 1,200 crore (Rs 12 billion) from Indian stocks during the start of last week, when the Greek situation first escalated.

However, domestic investors pumped in nearly Rs 2,000 crore (Rs 20 billion) during the same time, helping stocks withstand the global risk aversion without much damage.

Interestingly, after the initial knee-jerk reaction, flows from foreign investors also turned positive in the past few sessions, underscoring their faith in the Indian market.

Image: Indian equities were largely insulated from developments in Greece; Photograph: Reuters