| « Back to article | Print this article |

NSE’s recent move to rebrand its indices with the prefix Nifty will help boost recall among investors

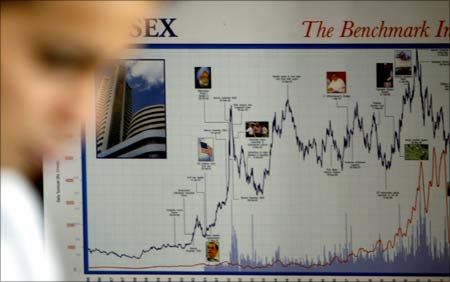

When the Bombay Stock Exchange’s Sensitive Index surged seven times between 1990 and 1992 from 650 points to 4,467 points, it heralded the first major bull run for Indian equities.

While the spectacular run-up came to be associated with the infamous Harshad Mehta scam, it also entrenched the Sensex as a barometer of the Indian capital market.

Indeed, since it was first compiled in 1986, the Sensex has come to be known as the market bellwether.

Subsequent rallies -- be it the 1998-2000 technology boom or the 2003-07 run-up triggered by global liquidity -- were also best captured and chronicled via the Sensex.

Though the National Stock Exchange’s Nifty index has been in existence since 1995, the media and a bulk of the retail investing community have preferred the Sensex to understand and communicate market direction.

However, Nifty has a virtual monopoly in the index derivatives segment, accounting for over 90 per cent of the total value, while Sensex accounts for under 10 per cent.

Thus, for traders and analysts, the Nifty is the index of choice. NSE says the Nifty 50 options are the largest traded contract globally in the equity index options category.

Two weeks ago, the NSE announced the rebranding of all its existing indices including CNX Nifty, CNX 100, CNX 200, CNX 500, CNX Midcap and CNX Smallcap. India Index Services & Products, an NSE group company, will include ‘Nifty’ as a prefix and replace the current prefix ‘CNX’ effective November 9, 2015.

NSE’s flagship CNX Nifty index, for instance, will be rebranded as Nifty 50.

Says Chitra Ramkrishna, managing director and CEO, NSE, “The inclusion of Nifty in the name of IISL’s (India Index Services & Products Ltd, a subsidiary of NSE Strategic Investment Corp) indices will enhance the acceptability of products linked to the Nifty family worldwide.”

According to NSE, Nifty has become a strong brand name among investors tracking the capital market and the brand extension exercise will lead to standardisation of indices coming from the NSE.

“There’s a strong quality association with Nifty and the idea was to take our strongest brand and use it across indices,” said Ravi Varanasi, chief, business development, NSE.

Will the rebranding help? Kamlesh Rao, CEO, Kotak Securities, believes that retail investors still associate the market with the Sensex but Nifty is far more popular among traders.

“The including the prefix ‘Nifty’ among indices is a good move since it will lead to a better recall value among investors, especially for online transactions,” he says.

“When you have a strong brand identity like Nifty it doesn’t make sense to have different entities (like CNX). Besides, Nifty is more well-known among general investors,” said Jagdeep Kapoor, chairman and managing director, Samsika Marketing Consultants.

According to Kapoor, indices do two things: lend credibility and give direction and assurance.

In this case, Kapoor believes, Nifty can serve as the mother brand and give the required halo effect to other indices, or sub-brands, raising the trust factor and respectability associated with the latter.

“Sub-brands need the support of the mother brand. For instance, Alto and Wagon R won’t be as successful if they go it alone as when they are used alongside the mother brand Maruti Suzuki.

"Similarly, Nifty will lend support to other indices and help complete the brand family,” he said.

“On paper this seems like a good move as it will help dislodge inertia to some extent. Will it work or not for NSE is a function of time. Nifty gaining mind share over Sensex cannot happen overnight,” adds Santosh Desai, MD & CEO, Future Brands.

Interestingly, NSE’s rebranding of its indices comes at a time when its rival BSE is becoming aggressive.

For instance, BSE has surpassed its rival NSE in terms of building a robust SME platform, with more than 100 companies listed so far, compared with less than 10 for the latter.

BSE’s high speed BOLT Plus system is now the fastest trading platform in the world with a response time of six micro seconds for trades executed on it.

Notably, BSE currently uses the prefix S&P for all its indices including Sensex. Till February 2013, NSE had a licence agreement to use the S&P prefix from Standard & Poor’s.

Is rebranding a good strategy to take on competition? According to brand experts, NSE should focus on the customer and not the competition. “The aim should not be to replace or displace some other brand.

The exchange has to focus on the ball, the investor; rather than the bowler, the competition. Focusing on the bowler will get you bowled,” cautions Kapoor.

He observes that there have been numerous instances in the past of a new entrant or a relatively newer brand dislodging an older, more established brand by making the right strategic moves, catering to customer needs and focusing on growth.

BSE did not respond to an email asking it to elaborate on its strategy to boost brand Sensex.

Desai feels that dislodging the Sensex will not be easy, especially since it has long been used as a yardstick or a benchmark that has become embedded in the consciousness of people.

“Sensex is like a default setting in the heads of retail investors.

"They associate it with numbers of a certain magnitude and trying to change it would be akin to changing one’s currency or measurement system, areas where the inertia is strong,” he says.

Some brokers are also sceptical about NSE’s latest rebranding move.

“There’s no point in changing the name of the restaurant, if you don’t address the food issues,” says a senior broker, on condition of anonymity.

“Instead of resorting to such gimmicks, the exchange should work on bringing down transaction costs and enabling wider participation. As participation and volumes improve, the brand will automatically get a boost.”