| « Back to article | Print this article |

RIL's December quarter performance is likely to be muted, says Amritha Pillay.

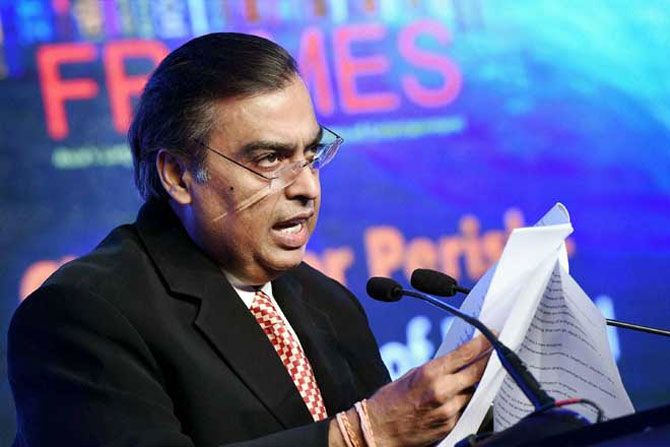

The Mukesh Ambani-led Reliance Industries Ltd is expected to report a sequentially flat performance for its December 2016 ended quarter due to weaker profitability in the company's petrochemical business, according to analysts.

Reliance Industries will announce its financial results for the October-December 2016 period on Monday.

The Street will look forward to company guidance on its telecom business and the commissioning schedule for the calendar year.

In a Bloomberg poll, 11 analysts estimated a standalone net profit of Rs 7,842 crore (Rs 78.42 billion) and standalone revenue of Rs 65,753.6 crore (Rs 657.536 billion).

Most analysts said Reliance Industries' gross refining margins (GRMs) would be in the range of $10.7 to $10.9 per barrel in the December quarter, sequentially higher from $10.1 per barrel reported for the September 2016 ended quarter.

Satish Mishra and Deepak Kolhe, analysts with HDFC Securities, expected higher GRMs at $11.5 a barrel.

'Refining earnings before interest and tax (Ebit) is expected to be up 10%/2% QoQ/YoY. GRM can rise from $10.1 a bbl in September quarter to around $10.9 per bbl, on stronger product cracks and modest inventory gain,' analysts Sanjay Mookim and Anand Kumar from DSP Merrill Lynch wrote in a report.

The company's better performance in the refining segment is expected to offset the lower profitability expected for its petrochemicals business.

'Maintenance shutdown and lower petchem earnings to offset strong refining quarter. Despite, a sharp improvement in Singapore complex GRM in the quarter to $6.7/bbl from $5.1/bbl in the September quarter, we expect Reliance's earnings to be largely flattish versus September quarter,' said Arya Sen and Ranjeet Jaiswal, analysts with Jefferies.

There could be a likely impact of the demonetisation drive in the country.

'We expect petchem earnings to be muted led by lower spreads in both polymer and polyester chains and lower sales offtake due to demonetisation impacting the offtake by customers,' Amit Rustagi and Probal Sen wrote in an IDFC Securities report.

Rustagi and Sen expect GRMs for the company to touch $11.1/barrel for the December 2016 ended quarter.

The company's exploration segment is likely to continue to remain a drag.

'Reliance Industries is likely to report small losses on domestic exploration and production business. US shale will also continue to remain loss-making. Crude oil prices are higher year on year but and domestic gas prices are lower. KG D6 production is expected to be down 24% year on year,' the DSP Merrill Lynch analysts noted in their report.

Reliance Industries' telecom venture Jio extended free services last month up to March this year. Management guidance on plans for Jio services beyond March will be one of the key announcements to look for on Monday.