Take a call to stay put or opt our based on whether you think the company will be able to find a strategic investor, suggests Sanjay Kumar Singh.

Illustration: Uttam Ghosh/Rediff.com

Debt funds, as a category, are hurtling from one crisis to another.

After defaults by the Infrastructure Leasing & Financial Services and delays in payments by the Essel group, recently Dewan Housing Finance Corporation (DHFL) failed to pay interest of Rs 960 crore on its debt.

This failure triggered a downgrade of its debt instruments by rating agencies and thereafter mark-downs of 75% to 100% in the valuations of these papers.

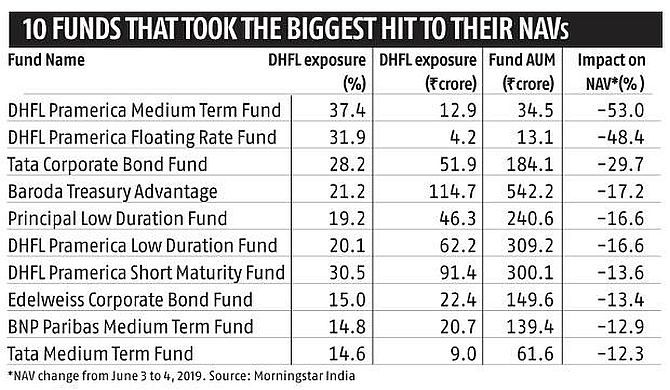

Funds that had high exposure to DHFL debt took big hits on their net asset values, going up to 53% (please see table).

DHFL responded saying that there has only been a delay in payment and that it is allowed a seven-day curing period to pay up.

But its troubles will not end even if it manages to make this payment.

Rating agencies believe its liquidity problems will continue.

The company has large repayment obligations coming up over the next three months, and rating agencies do not have visibility that it possesses the liquidity to meet these obligations.

Refinancing has become difficult, while securitisation of loan book and strategic sales of stakes in group companies have progressed slower than expected.

"Only if DHFL is able to find a large equity partner will it be able to gain the market's trust and be able to refinance its loans," says Arvind Chari, head of fixed income, Quantum Advisors.

High exposure, high losses

That the NAV of a debt fund could plummet by 53% in a single day came as an unpleasant surprise to many retail investors.

According to the Securities and Exchange Board of India guidelines, a fund can take only up to 10% exposure to a single issuer.

Yet, a fund like DHFL Pramerica Medium Term had 37% exposure to DHFL papers.

"When the credit crisis began, these funds were within the stipulated limit. But thereafter they faced redemptions. They could not sell papers like DHFL, so they were forced to sell quality papers. Hence, the proportion of DHFL papers rose past the stipulated limit," says Kaustubh Belapurkar, director-manager research, Morningstar Investment Adviser India.

Stay put or quit?

One criterion you could use to decide is the quantum of loss.

"A majority of debt funds give returns in the range of 7% to 8% annually. If the NAV erosion is in that range, you can expect to recoup your loss within a year. But if the quantum of loss is very high, say 53%, it could take six-seven years to recover your money. Such investors would be better off cutting their losses and exiting," says Nikhil Banerjee, co-founder, Mintwalk.

If despite a big hit you decide to stay put, do so only if you believe that the company will be able to find a strategic partner.

If the loss is in the 10% to 20% range, you may stay put.

"Investors have already taken the hit. DHFL has shown an intent to repay its loan. It is a liquidity and not a solvency issue. The asset quality of its retail loans is healthy. So, the chances of things improving are good," says Belapurkar.

Those who stay put will have to be patient as the pace of rating upgrades and valuation mark-ups could be slow.

Only investors who don't need the money immediately should stay put.

Also decide based on your risk appetite.

"If you will lose sleep worrying about further losses, you may as well quit," says Chari.

If your fund strayed from its mandate by investing in risky papers, exit.

Stay put in case of side-pocketing

Tata Mutual Fund has announced side pocketing in funds hit by DHFL exposure.

More fund houses may do so.

"If you exit a fund where side pocketing has been announced, you will forgo the possibility of gains if any money is recovered from DHFL papers. However, stay put only if the main portfolio is of sound quality," says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors.

Investors who decide to quit must consider the exit load, which can be 1% to 3% and apply for up to three years in categories like credit risk funds.

Also factor in whether you will pay long- or short-term capital gains tax.

Retail investors can do very little in fixed maturity plans (FMPs) with exposure to DHFL papers.

Think about this lack of option when you consider investing in this category next.

Be wary of credit and concentration risk

Sebi's current categorisation of debt funds is based primarily on duration risk (credit risk category is an exception).

It needs to consider classification based on credit risk as well.

"Fund houses need to offer both kinds of funds -- those that take credit risk and those that do not -- so that investors can choose based on their risk appetite," says Chari.

Investors should scrutinise the quality of the portfolio they are investing in.

"A substantial portion of the portfolio should consist of AAA and AA-rated securities," says R Sivakumar, head of fixed income, Axis Mutual Fund.

In future, fund managers will have to be more wary of investing in bonds of companies that have an asset-liability mismatch.

Since India's debt market is not liquid, they will have to control concentration risk better.

Investors, too, need to be cautious.

"Go for debt funds that do not have more than 3% exposure to a single issuer so that the impact of a credit event gets mitigated," adds Sivakumar.

In future, go with fund houses that have their own risk assessment teams.

"They will do a better job of assessing credit risk, compared to those that depend entirely on credit rating agencies," says Banerjee.

Conservative investors may move their debt fund portfolios entirely into liquid funds until the current high credit-risk environment improves.

Finally, recent events show that investors need to seek advice in the selection of debt funds as well, as they tend to do for equity funds.