| « Back to article | Print this article |

'We all wanted a strong Centre with a decisive mandate from the people, to allow them to take bold decisions.'

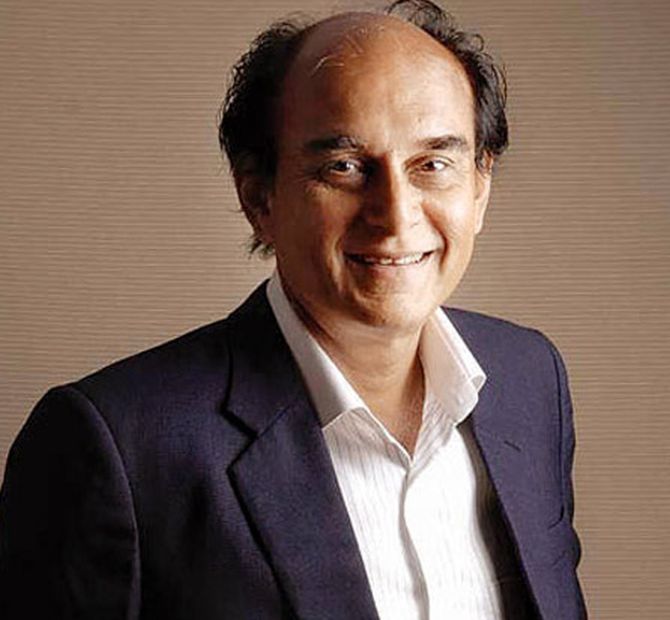

Centre should focus on GDP growth: Adi Godrej, Chairman, Godrej group

I think it is very good that the NDA has come back to power.

It will lead to economic growth, which we badly need right now.

The verdict will give the government a mandate to take action.

That is key. They were earlier in election mode. Now they will get down to business, which is important for the development of the economy.

Above all, GDP growth is what it should concentrate on.

That is because growth will bring jobs, improve income, and spending power.

It will also help address distress, especially in rural areas and bring about some revival in those markets.

The Centre should look at reducing corporate tax rates.

They had announced this earlier, but it was done only for small companies, not the large ones.

We all know that Indian corporate tax rates are the highest in the world.

I think this can be looked into more closely, and also addressed immediately.

As soon as the government takes action on improving GDP growth as well as kicking off further reforms, private sector investment will follow.

I don’t think it will come with a lag if the government is committed to reviving growth.

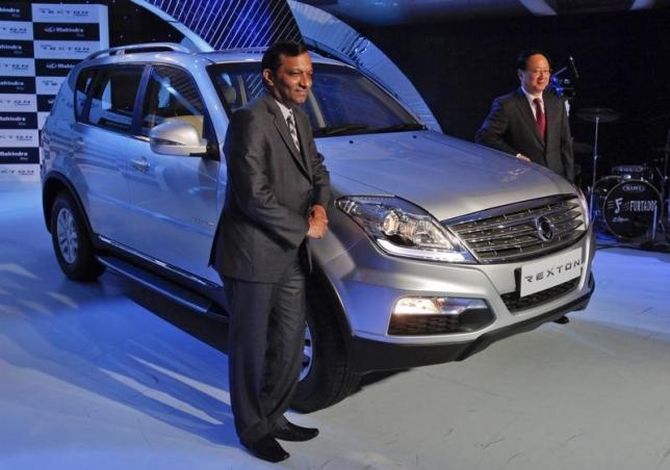

Manufacturing has to be competitive: Pawan Goenka, CEO & MD, Mahindra & Mahindra

The mandate is even more decisive than what the most staunch supporters of BJP+ would have expected.

This augurs well for the country because this is a reconfirmation on the direction the Centre had taken during its first term.

We all wanted a strong Centre with a decisive mandate from the people, to allow them to take bold decisions.

The next five years can be golden provided the government, industry and the civil society work together.

The immediate job for the government has to be getting the consumption cycle going, which has been on a pause mode for a few months, supposedly because of the elections.

Stimulus of government spending will be required and I hope the next Budget will focus on this.

Moving beyond the short term, one of the initiatives that got slightly on the back burner was ‘Make in India’.

If we want a trillion-dollar manufacturing economy, a lot more has to be done for making Indian manufacturing more competitive.

One of the biggest long-term concern has to be job creation and therefore industries that generate jobs must get higher priority.

Majority augurs well for policy: Kaku Nakhate, President and Country Head, Bank of America

Today’s verdict is pro-incumbency and reflects the general satisfaction of voters on the government’s performance.

The electorate rewarded the government for its consistent policies and project execution capabilities, in both social as well as economic spheres.

A clear majority augurs well for policy continuity and supports our house view of fiscal prudence in the years to come.

We think lowering lending rates, bank recapitalisation, and re-couping forex reserves will top the Centre’s agenda.

With a commitment to lowering cost of capital, the government will now focus on injecting liquidity.

Land and labour reforms, and digitisation are also key initiatives the government could focus on.

As global trade conflicts intensify, the government must seize the opportunity to invite multinationals to set up base here, boosting job creation.

The verdict clearly vindicates the government’s stance of driving growth through investments, instead of handouts.

This means road construction, infrastructure development, housing, and projects like ‘Smart Cities’ will dominate the new government’s decision-making process.

Credit, liquidity should top agenda: Vetri Subramaniam, Group president & head (equity), UTI Mutual Fund

For the market and economy, the return of Modi signals continuity in policy.

The outcome has also voided any tail risk related to a potentially unstable coalition government.

Equity markets have moved up recently, signaling comfort with this outcome, but face headwinds from valuations.

The focus shifts from politics to economy and policy.

Bloomberg consensus forecasts for FY20 GDP growth for have started pointing to a dip from September 2018.

High-frequency indicators and company feedback suggest weakness in demand and constrained credit availability.

A post-election seasonal growth uptick is likely, but addressing the credit market pressures and tight liquidity should be top the government’s and RBI’s agenda.

Given the current CPI (consumer price index) inflation, there is room for the monetary policy committee to ease rates, but injecting liquidity is equally crucial.

The market will hope the track record on controlling inflation continues.

Policy needs to target better balance between consumption aspirations and financial savings of the Indian household.

This will enhance macro-economic stability, while creating room for investment revival.

Priorities have to change in 2nd term: Harsh Mariwala, Chairman, Marico Group

The performance of the ruling coalition in the elections has beaten all expectations, including exit polls.

Having said that, we need to have a stronger opposition.

I think, there is need for introspection among opposition parties.

The focus of the new government should shift from welfare to reforms.

The last five years saw greater thrust on welfare rather than on reforms, though there were some key measures such as the Goods and Services Tax, and Insolvency and Bankruptcy Code.

Demonetisation, while not a reform, was needed to reduce dependence on cash.

But now, the focus should be on implementing reforms such as land, labour and agricultural reforms.

The Centre hasn’t moved strongly in these, and I believe priorities have to change during the second term.

The thrust on privatisation also has to grow.

Further, the government has to address the issue of liquidity, increase infrastructure spending, improve credit offtake, and simplify direct tax laws.

All this will create jobs, as well as improve sentiment and spending power.

Private sector will set up plants and increase manufacturing capacity only if consumption grows.