| « Back to article | Print this article |

Strangely, a few days after filing the charges, the CBI teams arrived in Hyderabad and Mumbai to raid GVK's offices and found incriminating evidence, a reversal of the normal course of events.

Anjuli Bhargava reports.

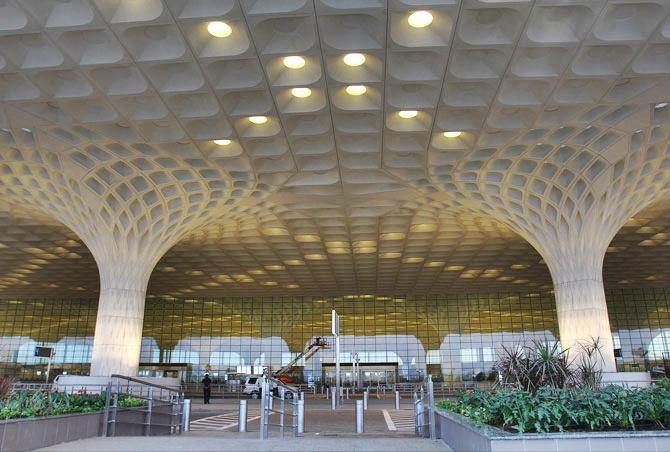

On June 27, a first information report was filed by the Central Bureau of Investigation, alleging money laundering by the promoters of GVK Airport Holdings, the group that holds the majority stake in Mumbai International Airport Limited, the entity that runs and operates Mumbai airport.

Strangely, a few days after filing the charges, the CBI teams arrived in Hyderabad and Mumbai to raid GVK's offices and found incriminating evidence, a reversal of the normal course of events.

What was found remains to be seen, but this is the latest controversy that is threatening to derail the country's most awaited infrastructure project: The Navi Mumbai International Airport (NMIA).

In November 2015, then Maharashtra chief minister Devendra Fadnavis's motley crew of officers who were manning what they had dramatically termed the 'war room' had told this correspondent that the first flight from NMIA would take off by the winter of 2019.

That schedule has come and gone and, as of now, construction at the site is yet to begin.

To call an airport 'jinxed' is not a happy description, but there is virtually no other word to describe the fate of this project that was first proposed in 1997 and approved in 2007.

It was in February 2017 that MIAL won the final bid for the project, but it took the City and Industrial Development Corporation (CIDCO), the state-run agency responsible for the project, eight months to send the letter of award to the concessionaire.

The concession agreement was signed between the two parties in January 2018.

According to GVK, the financial closure for the project was achieved by July 2018, with YES Bank (MIAL paid upfront fees of Rs 150 crore to the bank) as the lead banker.

But GVK had refused to start construction until it received the full land parcel for the project unencumbered, which CIDCO failed to provide.

However, CIDCO, the ministry of civil aviation (MoCA) and state government sources say GVK had been 'dragging its feet' even before the pandemic.

They argue that GVK's own problems -- an overstretched balance sheet and high debt -- have caused MIAL not to accelerate the construction of NMIA.

"Had NMIA gone to another concessionaire -- one who did not handle the existing Mumbai airport -- I think we would have seen much more urgency. As things stand, GVK is already earning a substantial revenue from MIAL," says a senior MoCA official.

After YES Bank got tangled in its own problems, MIAL asked State Bank of India to give an underwriting commitment for the NMIA project, which the bank has agreed to, provided the land for the airport is completely unencumbered -- a matter that is not yet fully resolved at the CIDCO end.

The commitment is for Rs 8,500 crore (Rs 85 billion) for the first two phases of the airport with a traffic volume of 20 million.

The equity component of Rs 2,000 crore (Rs 20 billion) was paid by MIAL a year ago.

Anyone familiar with the airport privatisation process that began around 2004 is aware that the agreements were far from kosher.

At the time when the agreements between GVK, GMR and the government were signed, many points of disagreement arose, including allegations that land parcels being handed over to GVK and GMR were far in excess of what was needed for the airport.

Many experts raised questions over the revenue share of the Airports Authority of India over non-aero revenue generated by the private airports.

In general, almost everyone who observed the process and terms felt that they were tilted in favour of the two private players.

Today, however, the revenues that the airports have generated including AAI's share are far higher than what the state airport developer would have managed, and the public would have had to contend with pathetic airports for a far longer time.

In the first year of the concession agreement, Rs 228 crore (Rs 2.28 billion) was paid to AAI (2006-2007), 38.7 per cent of the gross revenue.

This has gone up 13.53 per cent on a compounded basis and in 2019-2020, it was Rs 1,348 crore (Rs 13.48 billion).

In other words, the total revenue earned by MIAL in 2019-2020 was Rs 3,483 crore (Rs 34.83 billion).

But observers, and even those involved directly in the exercise, say that the costs of the project -- as is often done in Indian infrastructure projects -- may well have been inflated, as the CBI is alleging against GVK.

"No matter whose books are examined, some dirt is likely to be found," points out a former aviation secretary.

He says that to rake up these issues now seems futile since the horse has bolted from the stable.

Interestingly, CBI's investigations take place against the background of an arbitration proceeding that GVK has brought against its South African partner, Bidvest, to restrain the latter from selling its 13.5 per cent equity to a third party.

GVK had exercised its right of first refusal and asked Bidvest for time to raise money to buy out its stake.

In doing so, GVK was fending off a counter-bid by the Adani group, which had offered Bidvest Rs 1,200 crore (Rs 12 billion) for its stake.

In January this year, GVK won a reprieve from the arbitration tribunal, which restrained Bidvest from selling its stake to a third party.

The Adani group has major plans in the airport sector after it won bids to operate six airports in 2019, outbidding rivals aggressively.

More recently, though, it sought to delay the handover of at least three of them (due to the pandemic) and lost the Jewar airport to the Zurich airport-led consortium.

The latest case against GVK may change the complexion of the transaction as many banks and stakeholders become wary of dealing with an entity charged by the CBI.

But perhaps what is worse is that this new case and the niggling problems between GVK, MIAL, CIDCO and other stakeholders may lead to yet another delay in a project that has been in the making for over two decades -- a delay India can ill afford.

Feature Presentation: Aslam Hunani/Rediff.com

This report was filed before it was revealed on Monday, August 24, 2020 that Gautam Adani's Adani group is in talks to buy out GVK and some of its partners in Mumbai airport.