| « Back to article | Print this article |

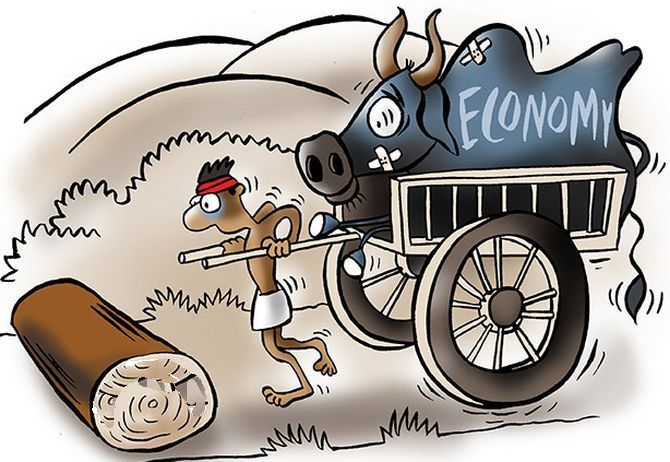

In twin blows to Indian economic revival, higher food prices drove retail inflation to a five-month high of 7.4 per cent while factory output fell for the first time in 18 months.

The second consecutive month of rise in consumer price index (CPI)-based inflation will add to the pressure on the Reserve Bank of India (RBI) to again raise interest rates to tame high prices.

Inflation has been above the targeted zone for the ninth month in a row and as per statute, the RBI will now have to explain to the government in writing why it failed to keep prices below 6 per cent.

Headline CPI inflation surged to 7.4 per cent in September from 7 per cent in the previous month, official data released on Wednesday showed.

Higher inflation was led by food items.

Food inflation surged to a 22-month high of 8.6 per cent while core inflation rose to a 4-month high of 6.3 per cent.

This is the ninth consecutive month where the inflation print has remained above the upper band of 6 per cent and the second successive quarter where the average is higher than 7 per cent.

Irregular rainfall is said to be the primary reason behind higher inflation in vegetable and fruits.

While inflation in cereals has also inched up, the steps taken by the government and a reasonably healthy Kharif output are expected to address the concerns behind the further hike in prices.

Separately, the Index of Industrial Production (IIP) declined 0.8 per cent in August with heavy rains dampening construction activity and electricity demand, and the bleak manufacturing output belying the hope generated by the robust GST e-way bill data.

"The combination of slightly higher inflation and fall in IIP raises concerns," said Nikhil Gupta, chief economist at Motilal Oswal.

"However, next month's data and US Fed's policy will decide whether we see 35 bps or 50 basis point hike by the RBI in December."

Since April 2022, the RBI has increased the interest rate by 190 basis points in a bid to dampen demand.

Official data released by National Statistical Office (NSO) on Wednesday showed that the retail inflation based on Consumer Price Index (CPI) was at 7.41 per cent in September as against 7 per cent in August.

In year ago same month, it was at a comfortable level of 4.35 per cent.

The central government has mandated RBI to ensure that retail inflation remains in the range of 2-6 per cent.

The Reserve Bank of India Act mandates the central bank to show up with a report to the government as to why it failed to contain inflation within the targeted band.

In September, RBI Governor Shaktikanta Das said acute imported inflation pressures felt at the beginning of this fiscal year have eased but it still remains elevated across food and energy items.

"Another rate hike is certain in the December 2022 MPC (Monetary Policy Committee of RBI) review, after the uncomfortable inflation print of 7.4 per cent for September 2022.

"The quantum of the next rate hike will be determined by how much the inflation print recedes in October 2022, as well as the strength of the GDP growth for Q2 FY2023," said Aditi Nayar, Chief Economist at ratings firm ICRA.

IIP contracted by 0.8 per cent in August, mainly due to a decline in output of the manufacturing and mining sectors.

Official data showed that the previous low in industrial output growth was a contraction of 3.2 per cent in February 2021.

Factory output, measured in terms of the Index of Industrial Production (IIP), had expanded by 13 per cent in August 2021.

The IIP grew by 2.2 per cent in July this year.

The manufacturing sector shrank by 0.7 per cent in August 2022 compared to the 11.1 per cent growth recorded in the year-ago period, as per the data released by the Statistics and Programme Implementation Ministry.

The power sector showed a growth of 1.4 per cent against a 16 per cent rise a year ago.

The mining sector witnessed a contraction of 3.9 per cent in August 2022, whereas there was a growth of 23.3 per cent in the year-ago period.

During April-August this year, IIP rose 7.7 per cent against 29 per cent growth in the same period a year ago.

Capital goods output, which is a barometer of investments, rose five per cent in August 2022 compared to 20 per cent growth in the year-ago month.

The consumer durables segment declined 2.5 per cent from 11.1 per cent growth a year ago.

The primary goods segment, which accounts for nearly 34 per cent of the index, expanded 1.7 per cent in August compared to 16.9 per cent growth in the year-ago period.

The ministry said the growth rates over the corresponding period of the previous year are to be interpreted, considering the unusual circumstances on account of the COVID-19 pandemic since March 2020.