| « Back to article | Print this article |

From inheriting legacy textile and oil businesses to stepping into retail, telecom and digital, RIL is a company for New India.

Viveat Susan Pinto & Sundar Sethuraman report.

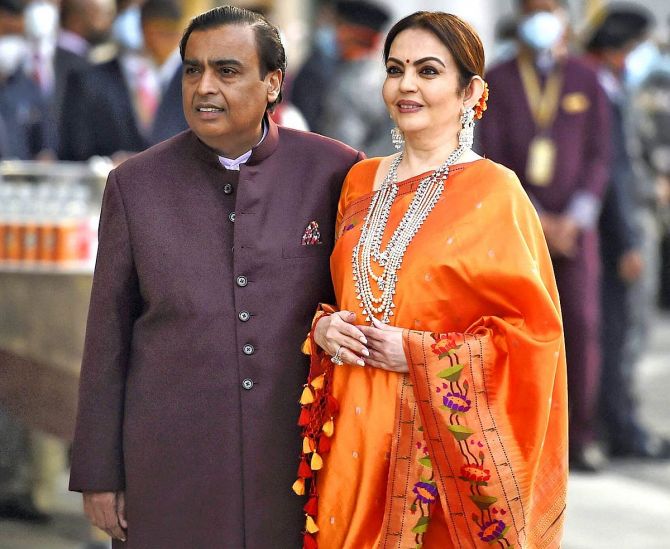

At the 45th Annual General Meeting of Reliance Industries (RIL) in August, chairman and managing director (CMD) Mukesh Ambani described the company as an “unputdownable book” with never-ending chapters of success.

“Reliance grew from strength to strength because we internalised the founder’s mindset of purpose, philosophy and passion,” he said.

Wednesday marked the 90th birth anniversary of RIL founder Dhirubhai Ambani.

Mukesh Ambani, 65, also the world’s eighth richest person according to Forbes, took over as CMD in July 2002 following the demise of his father.

From inheriting legacy textile and oil and gas businesses to stepping into areas such as retail, telecom and digital services and green energy, RIL today is a company for New India, says Arvind Singhal, chairman of consultancy Technopak.

“Mukesh Ambani quite simply redefined scale and business growth.

"In the last two decades, he has positioned RIL as a global major, an Indian MNC,” he says.

“Whichever category he entered, whether retail, telecom or even green energy and FMCG now, his ability to think big, execute large and complex projects, and take on incumbents including domestic and international rivals have been the hallmarks of his two-decade journey,” Singhal adds.

Ambani has brought together a team that can deliver on his dreams, points out U R Bhat, co-founder, Alphaniti Fintech.

“Internationally, most of the wealth is created through consumer-facing businesses.

"Ambani has done that here with Reliance.

"From an industrial to a consumer-facing business, the journey is difficult.

"Only a few have made that change successfully. Reliance is one of them.”

To put things in perspective, Reliance’s revenue grew 15.1 per cent on an annualised basis to touch nearly Rs 7 trillion in FY22 from Rs 42,129 crore in FY02.

Ebitda and net profit have grown at 14.1 per cent and 15.7 per cent to touch Rs 1.28 trillion and Rs 60,705 crore, respectively.

And RIL’s market capitalisation has risen at an annualised rate of 22.3 per cent, from Rs 31,687 crore in FY02 to Rs 17.81 trillion in FY22.

It was 3.36 per cent lower at Rs 17.21 trillion at Wednesday’s closing price.

In categories such as retail and telecom, which accounted for 34 per cent of revenue and nearly 45 per cent of Ebitda in FY22, RIL has been a trailblazer, says Harish H V, managing partner at Ecube Investment Advisors.

“Mukesh Ambani is a disruptor.

"His entry into telecom in 2016 forced a consolidation in the market, bringing Vodafone and Idea together and giving strong competition to players such as Airtel,” he says, adding: “In retail, Reliance is not only the largest in India, but also ranks among the top globally.”

Deloitte’s Global Powers of Retailing Report 2022 ranked Reliance Retail, which was launched in 2006, the second-fastest growing retailer, adding it was the only Indian company to be featured on the list for the fifth time in a row.

According to Motilal Oswal’s 27th annual wealth creation study, released earlier this month, Reliance emerged as the largest wealth creator for the fourth time in a row.

The group created wealth to the tune of nearly Rs 13 trillion during 2017-22 and broke its own previous record of Rs 10 trillion created in the 2016-21 cycle, Raamdeo Agrawal, chairman and co-founder of Motilal Oswal Financial Services, says.

As G Chokkalingam, founder and managing director of Equinomics Research, says, Ambani’s journey has been about “clever pivots”.

“He was quick enough to identify business opportunities and dive into it with an ambitious target in mind.

"He is clear that he wants to be the leader in every segment and believes in thinking big,” he says.

From a single refinery in 2002, Jamnagar is now the world’s largest single-location refining complex, according to company executives.

Reliance has also added some of the world’s largest downstream units at Jamnagar over the last two decades.

It has set up the world’s largest refinery off-gas cracker plant at Jamnagar, the largest petcoke gasification unit, and first-ever virtual pipeline to import ethane from the US to diversify feedstock.

After the launch of Jio in 2016, the cost of data per gigabyte (GB) fell from Rs 500 to Rs 12, according to sector experts.

India’s ranking in broadband data consumption moved from 150 in 2016 to number one in 2018, due to Jio.

And thanks to Reliance Retail, residents of tier-II and III towns in India have access to shopping experiences similar to their counterparts in metro cities.

“Undoubtedly, Reliance has played a crucial role in India’s economic growth.

"With its size and base, it will end up creating value for both stakeholders and consumers.

"For any investor who has a view from a 5-10-year perspective, RIL is a good place to invest.

"In my view, the next two decades will be far more exciting than the last 20,” says market expert Madhusudan Kela.

There have been a few misses, however.

Reliance exited the upstream oil and shale gas business in the US in 2021 and also called off a $15-billion deal with Saudi Aramco last year to buy a stake in the oil-to-chemical (O2C) business.

The company has, however, announced that it will invest Rs 75,000 crore in O2C at this year’s AGM, after a similar commitment last year to invest in green energy.

The green energy business plan will entail a Rs 60,000-crore investment in four giga factories that will manufacture and fully integrate all the critical components, and a Rs 15,000-crore investment in building value chain, partnerships and future technologies.

The sky is clearly the limit for Reliance.