MotherCare, the baby and maternity clothes retailer that annually sourced garments worth Rs 100 crore from a single exporter in Tirupur, filed for bankruptcy in the UK and will close all its 79 shops in that country.

It was the latest world-famous brand to pull down Tirupur’s fortunes.

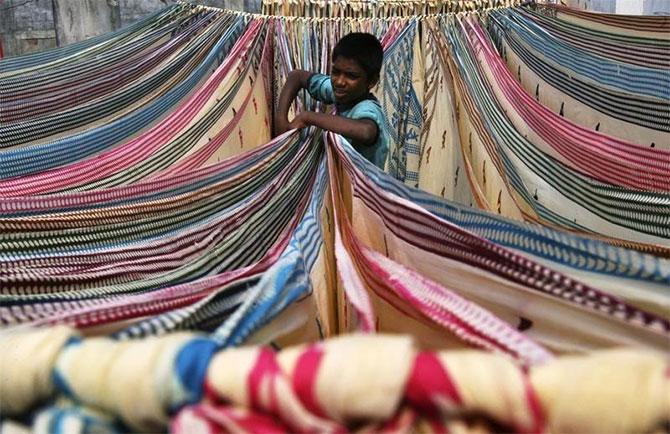

Tirupur, the garment hub that makes exports worth Rs 26,000 crore annually, had a forgettable year in 2019.

At least four world famous brands that sourced their products from the Tamil Nadu city either filed for bankruptcy in the US and Europe as demand slowed down due to competition from online channels and costs going up.

MotherCare, the baby and maternity clothes retailer that annually sourced garments worth Rs 100 crore from a single exporter in Tirupur, filed for bankruptcy in the UK and will close all its 79 shops in that country.

It was the latest world-famous brand to pull down Tirupur’s fortunes.

Media reports quoting Coresight Research said that as of November 1, nearly 9,000 textile retail stores were closed in major markets across the US and Europe.

The closures were 55 per cent higher than last year's.

As many as 10 major brands, including Forever 21, Payless and Barney's, filed for bankruptcy between January and October, estimated CB Insights, which tracks private company financing and angel investments.

Textile Magazine, in its latest issue, counted JCPenney, GAP, Sears and Victoria's Secret among major companies that have downsized.

It said Zalando, the European e-commerce brand, is winding up sourcing from India after closing its private-label segment zLabels.

The company once sourced garments worth nearly Euro 20 million annually from India—mainly from Bengaluru and Tirupur - but has decided to end that.

Mothercare had slumped to £36.9m loss in the financial year ending March 2019, struggling amid a period of turmoil for high street retailers.

It followed the likes of Bonmarche, Jack Wills and Karen Millen, which have gone bust in recent months, according to UK’s Daily Mail tabloid.

One of the key reasons for these brands to shutdown is changing consumer trends and competition from e-commerce players.

R Raj Kumar, managing director of BEST Corporation Ltd that supplies garments to various brands, said his company used to get around Rs 100 crore worth of business from MotherCare alone but orders reduced by 50 per cent after UK brands scaled down.

Kumar, who believes that the brand will come to its glory dates after the current consolidation phase will get over.

Till the time, he decided to look for new customers and new geography.

To be cost competitive, his company already set up a facility at Ethiopia, which enjoys duty free status from major markets, and exploring other countries.

Another exporter recalled his association with an American brand, which filed for Chapter 11 bankruptcy protection in the US recently.

He said some big retailers have opted for Chapter 11 because they wanted to get out of leasing contracts.

Most of these retailers have set up shops in locations which are taken for lease for long years.

In the current market conditions they can't afford to pay such a hefty rent and can't cancel the lease, which will call for heavy compensation.

Chapter 11 gives cushion for retailers to come out from this problem for the retailers.

"What we are seeing is a temporary phase, most of these brands will come back in a franchisee model or through a different route.

"We are confident of getting back the orders.

"Our only challenge is to be cost competitive, for which we need Government's support," said the exporter on condition of anonymity.

Photograph: Krishnendu Halder/Reuters