| « Back to article | Print this article |

With the small-cap indices on the National Stock Exchange (NSE) -- the Nifty Smallcap 50 and Nifty Smallcap 250 -- skidding nearly 31 per cent and 25 per cent, respectively, in the past one year (since August 20 last year), it is best to remain prudent, writes Puneet Wadhwa.

An absence of a fiscal stimulus from the government and surcharge-related issues with foreign portfolio investors (FPIs), amid other global developments, have dented market sentiment since the Union Budget on July 5.

The S&P BSE Sensex and the Nifty 50 have slipped around 5 per cent and 6 per cent, respectively, since then.

Pain in the mid and small-cap segments has been more pronounced with both the indices slipping nearly 8 per cent and 11 per cent, respectively, during this period.

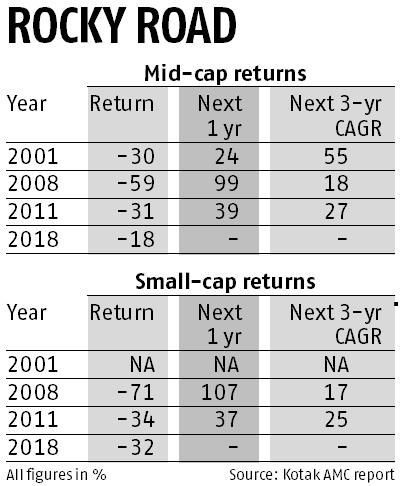

Casting the net wider reveals a worrisome picture with the small-cap indices on the National Stock Exchange (NSE) -- the Nifty Smallcap 50 and Nifty Smallcap 250 -- skidding nearly 31 per cent and 25 per cent, respectively, in the past one year (since August 20 last year) and are trading in bear terrain.

On the other hand, the midcap indices on the NSE -- Nifty Midcap 50, Nifty Midcap 100, and Nifty Midcap 150 -- are approaching this phase with a fall of 17 per cent, 19 per cent, and 16 per cent, respectively, over the past one year, the ACE Equity data show.

In comparison, the Nifty 50 has slipped around 4 per cent during this period.

Typically, bear markets are associated with declines in an overall market or an index.

Individual stocks can be considered to be in a bear market if they see a fall of 20 per cent or more over a period of time.

Among the mid and small-cap segments, the markets have severely punished the counters where there have been governance-related or operational issues over the past year.

Reliance Communications (RCom) tops this list with a fall of nearly 94 per cent in the past one year.

All the other Anil Dhirubhai Ambani Group (ADAG) companies such as Reliance Capital, Reliance Power, and Reliance Infrastructure (RInfra) have lost around 89 per cent each.

Jet Airways, Dewan Housing Finance Corporation (DHFL), and Bombay Dyeing have slipped 71-92 per cent during this period.

"There have been governance-related or operational issues with some companies in the small-cap segment, which has dented sentiment.

"In the process, some quality names also got battered at the bourses," says G Chokkalingam, founder and managing director, Equinomics Research.

Analysts see more pain for these two segments till the time there is a pick-up in market sentiment and there is a visible improvement in corporate earnings.

That said, they suggest investors who have an appetite for risk and can stay invested for the next 12-24 months look for opportunities within the small and mid-cap segments.

"Valuation headroom for the Nifty is limited in an environment of continued earnings downside risks.

"Mid-caps now trade at a discount to large-caps and offer relatively good risk-reward.

"However, market sentiment and a potential liquidity improvement in the economy are key pre-requisites for mid-caps to perform," says Gautam Duggad, head (research), Motilal Oswal Financial Services.

Chokkalingam is also bullish on the small-cap segment and says it is a good time to buy from a 12 to 24-month perspective.

"The only risk is that there should be no further deterioration in the economy, which, in turn, can impact corporate earnings and dent sentiment further," he says.