| « Back to article | Print this article |

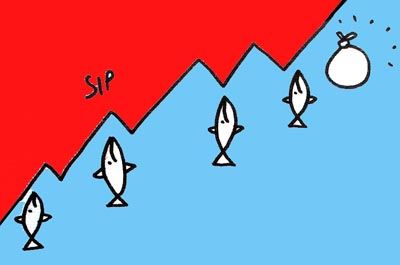

To make money, invest in both good and bad times; otherwise the entire exercise is futile, experts tell Joydeep Ghosh & Sanjay Singh.

Illustration: Dominic Xavier/Rediff.com

In past rallies, Vishal Upadhyay, an entrepreneur, used to wait for the markets to fall to start a systematic investment plan (SIP). This is how he made reasonable money in the past.

The basic SIP logic of garnering more mutual fund (MF) units for the same investment amount when markets are low worked wonders for him. This time, after waiting for quite a while for a proper entry point (read sharp correction), he started three SIPs, one in a large-cap fund and other two in mid-cap schemes.

And, Upadhyay is not alone in starting SIPs. They seem to have become the flavour of the season.

In August, the MF industry had almost 16 million SIP accounts, contributing as much as Rs 5,200 crore, up 49 per cent from August last year, according to data from the Association of Mutual Funds in India (Amfi).

"Investments through SIPs have been adopted by quite a few investors, given its simplified approach and the fact that investors need not worry about timing the market," says Sundeep Sikka, chief executive officer (CEO) and executive director, Reliance Nippon Life Asset Management.

This rise in SIPs has coincided with the rise in the markets. Of course, there is no denying that investors have been enthused more because the Nifty 50 is trading close to 10,000 points, and has risen 12.4 per cent in the past year.

The good news

Investors who have entered in the past couple of years would have made money.

In the past year, some of the large-cap schemes have given spectacular returns. IDFC Focussed Equity Fund (regular) has returned 33.73 per cent and JM Multi-Strategy Fund has 27.22 per cent and a whole host of other funds have returned over 20 per cent.

Many investors, especially the first-time ones, would have had a good experience investing in stock markets. And, it becomes critical because the other options aren't doing so well.

Rates of small savings schemes, including savings deposit rates, are going down, gold hasn't been a spectacular performer and there is too much of uncertainty about the direction real estate will take, after implementation of the Real Estate Regulatory Act, and the goods and services tax (GST).

Investors are currently entering the markets when valuations are high. Any correction in the market over the next year or so could cause their SIP returns to turn negative.

That is when they will need to stick to their SIPs.

"Link your SIP to a long-term goal and continue with it for the entire tenure. Any fall in the markets in the interim should not lead you to stop your SIP," says Nikhil Banerjee, co-founder, Mintwalk.

Investors need to continue with their SIPs even through bear market phases for their investments to do well. If they exit then, they could well end up with negative returns.

Another worry is that many investors are choosing the SIP route to get into sector funds and small-cap funds.

"At present, people are doing a lot of SIPs in small-cap funds and in sector funds, such as banking. There are high risks when you invest in such funds, which an SIP cannot take care of entirely. You are better off investing in diversified funds and being diversified across market caps," says Kunal Bajaj, founder and chief executive officer, Clearfunds.com.

SIPs in good as well as bad

By definition, an SIP is the practice of investing a consistent rupee amount in the same scheme at regular intervals (say, each month) over the course of a set period of time.

By doing so, the investor purchases more units of a scheme when the price is low and fewer units when the price is high, thereby getting a good average price.

This helps him earn an attractive rate of return over the long term. And, that is why the long-term approach is the most important aspect for SIP investors.

Sikka says that before investing in an MF scheme through SIP, it's important to see the performance of the scheme and asset management company through different market cycles, rather than looking just at near-term performance.

Since SIPs are long-term instruments, it's very important to choose the right fund house. There are many schemes which provide excellent returns when the markets are doing well.

But, when markets fall, these schemes tend to fall steeply.

"One should continue investing in the market through SIP, irrespective of market movements to achieve long-term financial goals," adds Sikka.

Long-term data show SIPs done for short durations can result in loss of money. Mintwalk ran the numbers from January 1, 1995, until December 31, 2016.

Suppose you started an SIP in the Nifty index on any date during this period. If your SIP was for one year, you would have a 28 per cent probability of losing money during this period. But, if you increased the tenure of your SIP to three years, your probability of making a negative return would decline to five per cent.

Over a 10-year period, irrespective of the day you invested on, you would make a profit.

"The probability of making a positive return increases with the duration of the SIP," says Nikhil Banerjee, co-founder, Mintwalk.

Then, there is lump sum

There is a constant debate on this point. Would an investor have made more money investing through the lump sum or SIP route?

"In a consistently rising market, SIP returns lag lump sum investments. If the markets go up in a straight line, as they have this year, you are better off investing a lump sum amount at the start of that period," adds Bajaj.

But, if the market were to correct, by say 10 per cent, suddenly a lump sum investor will find that the year-to-date gain (21.7 per cent) has shrunk. One may use the lump sum investment route, especially if one receives a bonus or any other windfall, but only when valuations are attractive and the investment horizon is for more than five years.

SIPs, typically, are meant for investors who want to save for the long-term: for, say, a child's education, to buy a house, or for retirement. So, it does require discipline, a lot of patience and consistent investment even during bad times.

Otherwise, starting an SIP now, when the markets are high, will prove a wasted effort.