| « Back to article | Print this article |

Koo has so far raised $4.1 mn in Series A funding from existing investors Accel, Kalaari Capital, Blume Ventures and 3one4 Capital.

Giving an exit to its sole Chinese investor Shunwei Capital, Bombinate Technologies, the parent company of Vokal and homegrown microblogging platform Koo, has onboarded investors such as BookMyShow founder Ashish Hemrajani, Udaan co-founder Sujeet Kumar, Flipkart CEO Kalyan Krishnamurthy, Zerodha founder Nikhil Kamat and former Indian cricketer Javagal Srinath, who bought the VC’s stake in the company.

Without giving any financial details of the transaction, the company said that Shunwei Capital had held a bit more than 9 per cent in Bombinate Technologies.

The company said it is a part of its commitment to build an 'Atmanirbhar' app for India and the world.

“We are a response to the top global products out there.

"In order to help with the emotion of being Atmanirbhar, it was important that Shunwei Capital exited the company,” Aprameya Radhakrishna, CEO and co-founder, Koo and Vokal, told Business Standard.

“We had been in discussion with Shunwei Capital to enable a smooth exit after it invested in our company 2.5 years ago while we were raising funds for Vokal and has now fully exited the parent company Bombinate Technologies,” he added.

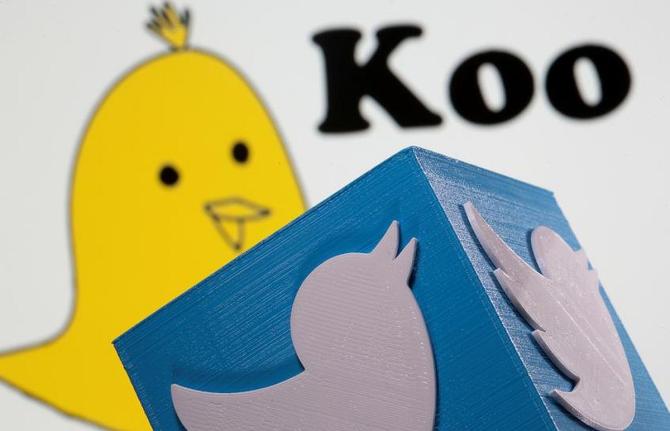

Koo shot to fame last month after microblogging giant Twitter faced a standoff with the government on the farmer protests after which the desi app was pitched by several ministers, including Cabinet ministers Piyush Goyal and Ravi Shankar Prasad.

Koo then witnessed a traction in its userbase with over 5 million downloads so far.

When questions were raised on its ties with Shunwei Capital, Radhakrishna had tweeted that Koo is an India registered company with Indian founders and Shunwei, which had invested in his Vokal journey, will be exiting fully.

Koo has so far raised $4.1 million in Series A funding from existing investors Accel, Kalaari Capital, Blume Ventures and 3one4 Capital.

Photograph: Dado Ruvic/Reuters