| « Back to article | Print this article |

His exit has created a benchmark of sorts for how entrepreneurs and businesses should deal with debt crises.

Unlike many other Indian businessmen, he hasn't fled, tried to hang on to the business by any means or wrangle out of the debt by using his closeness to the current government.

One has to admire him for hanging in there, gritting his teeth, and going through the whole process of losing control over the empire he built and for doing it with dignity.

The ‘so sad’, ‘end of an era’ commentary around Subhash Chandra’s resignation as Zee chairman is misplaced.

What makes the 69-year-old Chandra a good entrepreneur - his restlessness and ability to take risks - is what has led to this situation.

When they worked, these qualities created the Rs 30,000-crore Essel Group from a defunct dal mill.

When they didn't, they landed his group in a debt crisis, with the promoter family pledging its stake in Zee Entertainment.

The debtors called in their money and Chandra lost control of Zee. Big deal.

Look at what he has achieved with his exit.

First, it sets Zee free.

It is so very rare for Indian media businesses to grow out of their founding family's shadow, however, benevolent it may be.

By taking it public in the second year of operation in 1993, Chandra had created a company that has now borne the scrutiny of the market for over 26 years.

It is institutionalised in ways that most owner-led media firms aren't.

This situation will help take it to another level.

The family's holding has gone down from 20 per cent earlier this year to 5 per cent, recently.

The current lot of owners - all financial or institutional investors - will need an exit at some point of the other.

This means Zee will be sold, most probably to a strategic investor.

The reason its shares were pledged was because it is the crown jewel in the Essel portfolio.

The just under Rs 8,000-crore Zee is a cash-spewing market leader in one of the most attractive media markets in the world.

The Zee stock rose by 12 per cent on the news of the promoters losing control.

That is because the market knows what any strategic investor would; that Zee is now free of the shackles of its promoters' debts.

And, the capital an investor puts in now will go to taking the company to its next level in a market that is being redrawn even as we write.

Disney acquired Star last year to become India's largest media company at Rs 12,000 crore in top line.

Google, Netflix, Jio are emerging as the new face of competition.

If Sony acquires Viacom18 as is being reported, it will become at over Rs 10,000 crore larger than Zee.

So, Zee needs to take the battle to the next level.

Chandra's exit leaves Zee free to fly, to become a larger global player.

Second, his exit has created a benchmark of sorts for how entrepreneurs and businesses should deal with debt crises.

Chandra has been upfront about everything from the word go.

Unlike many other Indian businessmen, he hasn't fled, tried to hang on to the business by any means or wrangle out of the debt by using his closeness to the current government.

When his stock crashed late in January he apologised to his bankers and debtors and said he had made some bad calls.

One may not agree with some of his shenanigans in the broadcasting market.

But one has to admire him for hanging in there, gritting his teeth, and going through the whole process of losing control over the empire he built and for doing it with dignity.

It is the sort of thing that helps restore people's faith in big business.

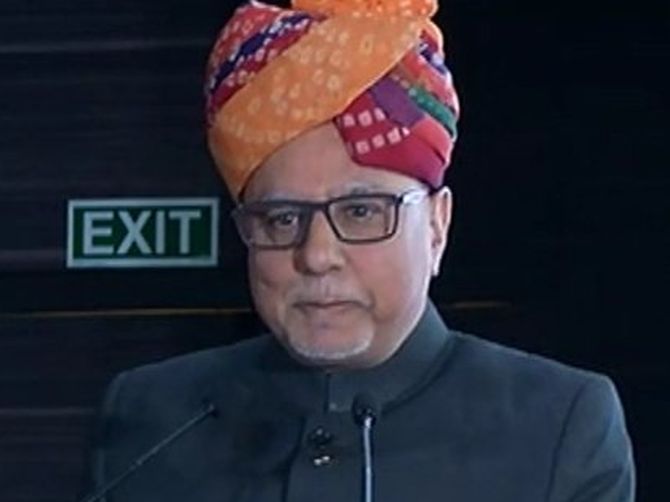

Photograph: Courtesy, Subhash Chandra's Twitter account