| « Back to article | Print this article |

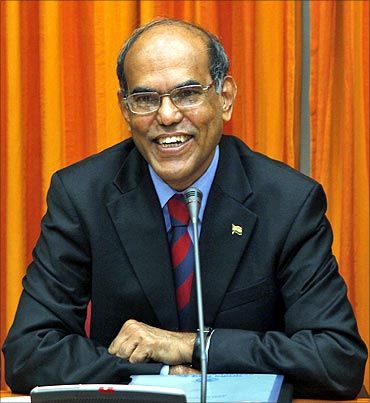

Amidst bankers and industry crying foul over RBI's move to squeeze liquidity, Reserve Bank Governor D Subbarao on Friday met Finance Minister P Chidambaram ahead of first quarter policy review next week.

Amidst bankers and industry crying foul over RBI's move to squeeze liquidity, Reserve Bank Governor D Subbarao on Friday met Finance Minister P Chidambaram ahead of first quarter policy review next week.

The meeting assumes importance in the backdrop of RBI taking a series of measures to tighten liquidity and check import of gold with a view to arrest rupee fall. In its first quarterly review of monetary policy to be unveiled on July 30, RBI will have to take a call on interest rates and improvement of the liquidity situation.

With a view to rescue the Rupee, which fell to an all time low of 61.21 to a dollar on July 8, the central bank has raised the rates at which banks borrow short term funds from RBI and reduced their borrowing limits. Besides, it took steps to discourage gold imports and encourage repatriation of funds by exporters.

Rattled by RBI's initiatives to contain rupee fall, State Bank of India Chairman Pratip Chaudhuri has suggested the central bank should not choke money supply and instead raise interest rate to check volatility in the forex market.

"Whenever the central bank needs to defend the currency or prevent the inflation from going out of hand, please increase the interest rate, don't choke liquidity," he had said.

Prime Minister Manmohan Singh had earlier said the measures taken by RBI were temporary and would be reversed with reduction in volatility in the foreign exchange market.

Ficci President Naina Lal Kidwai has said: "I hope that it stays stable because interest rate going up will be a body blow to industry and industrial growth, which is very important, at a very fragile position right now."

The growth in the current fiscal, according to Prime Minister, is likely to be lower than the projected 6.5 per cent. Last year the growth slumped to a decade low of 5 per cent.