| « Back to article | Print this article |

Among the 30-share basket, 27 stocks led by Bajaj Auto and Bharti Airtel ended with losses.

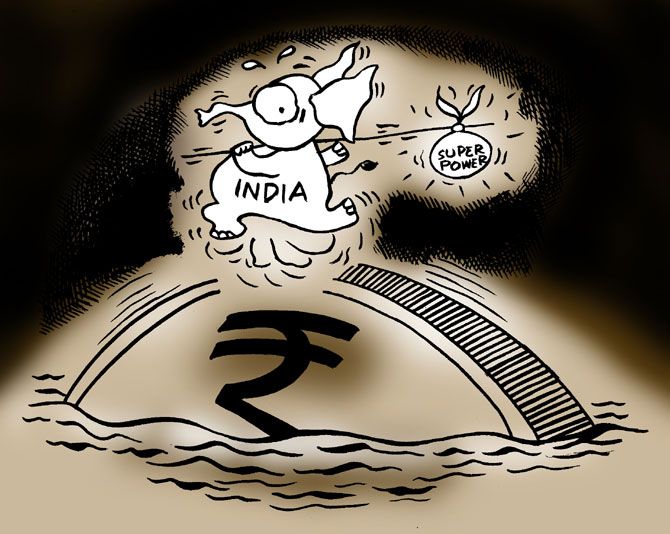

Illustration: Uttam Ghosh/Rediff.com

Investor wealth eroded by Rs 4.6 lakh crore on Friday amid massive selling in the stock market where the BSE benchmark index plummeted 840 points.

The 30-share Sensex crashed 839.91 points, or 2.34 per cent, to end the day at 35,066.75.

Following the sharp decline in stocks, the market capitalisation of BSE-listed companies tumbled by Rs 458,581.38 crore to Rs 148,54,452 crore.

This is the biggest single day fall of the index since August 24, 2015, when it had fallen by 1,624.51 points.

This is the biggest single day fall of the index since August 24, 2015, when it had fallen by 1,624.51 points.

The Budget for 2018-19 imposed long-term capital gains tax of 10 per cent on equities.

"The major part of today's correction can be attributed to the budget announcement of imposition of long term capital gains tax on equity, introduction of tax on distributed income by equity oriented mutual funds and fiscal slippage.

“The move surprised the Street as most participants were factoring in a change in definition of Long Term to two or three years from a year," said Devang Mehta, head - equity advisory, Centrum Wealth Management.

Among the 30-share basket, 27 stocks ended with losses led by Bajaj Auto and Bharti Airtel.

All the sectoral indices on BSE ended in the red led by realty and infrastructure.

On the BSE, 2,527 stocks declined, while 310 advanced and 124 remained unchanged.

"Sensex and Nifty saw heavy selling post budget day. Investors were disappointed with LTCG coming in over and above STT.

“However, budget is aimed at spurring demand from rural India and masses going forward to take care of India growth story.

“Execution and implementation will be the key ahead," said Anita Gandhi, whole time director, Arihant Capital Markets.