| « Back to article | Print this article |

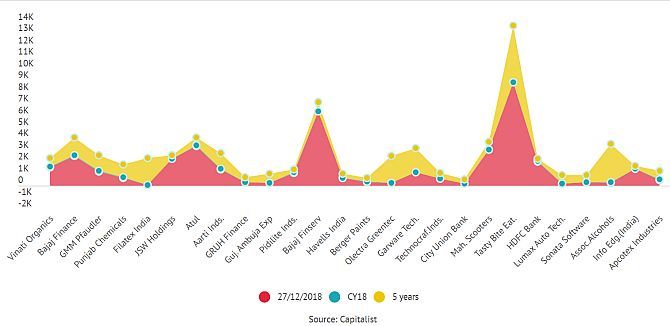

Of these 26, Bajaj Finance, Associated Alcohols and Breweries, Garware Technologies, Filatex India, Tasty Bite Eatables, Aarti Industries and GMM Pfaudler saw an over 10-fold surge in price since 2014.

Deepak Korgaonkar and Puneet Wadhwa report.

Even as the mid and small-cap indices underperformed in calendar year 2018 (CY18) with a fall of 15% and 25% respectively, 136 stocks beat market returns in CY18.

Bajaj Finance, HDFC Bank, Bajaj Finserv and Havells India are among 26 stocks that outperformed the market in the past five consecutive calendar years.

Of these 26, Bajaj Finance, Associated Alcohols and Breweries, Garware Technologies, Filatex India, Tasty Bite Eatables, Aarti Industries and GMM Pfaudler saw an over 10-fold surge in price since 2014.

In comparison, the S&P BSE Sensex and Nifty 50 index gained 69% and 71%, respectively during this period.

Thus far in CY18, the BSE500 index, which accounts for nearly 92% of the country's market capitalisation, has lost 4%.

By comparison, the S&P BSE Sensex and the Nifty50 have rallied around 4% during this period.

L&T Infotech, L&T Technology Services, Bata India, NIIT Technologies, HEG and Vimta Lab are among 19 stocks that rallied over 50% in CY18.

Of these, four stocks -- Responsive Industries, Excel Industries, DIL and IOL Chemicals -- have seen their market price double.

Select financials gain

Sector-wise, six stocks from the financial sector including banks, four from chemicals and two each from textiles, auto and capital goods industry gained ground.

Vinati Organics is the top gainer among the list, gaining 57&% in CY18.

The stock of the pharmaceutical company had rallied 71 per cent in CY17, as compared to 28 per cent rise in Sensex.

Bajaj Finance, too, rallied 46% during CY18, after appreciating 110% in CY17.

In the past five years, the market value of the non-banking finance company has zoomed 16 fold, as compared to 68% surge in the benchmark index.

Analysts remain confident on Bajaj Finance's ability to continue the growth momentum and increase market share as peers tighten their belts, ability to sustain net interest margins and maintain customer acquisition and asset growth.

'Despite the increased volatility and regulatory overhang, it is well placed to weather the liquidity squeeze and risk aversion. Premium valuations and high beta coupled with sector aversion is likely to induce the volatility nevertheless premium valuations are likely to persist,' analysts at Dolat Capital said in result update.

Improving liquidity conditions and a favourable view on the interest rate cycle makes analysts at Kotak Institutional Equities bullish on the financial sector, especially the housing finance companies (HFCs).

'Improvement in the funding environment, rally in bond markets and a likely rate cut will augur well for rate sensitivities in general and HFCs in particular. We reiterate 'add' rating on HDFC with a target price of Rs 2,150,' they said in a recent note.

As regards the overall investment strategy for CY19, experts suggest investors look past any election-fuelled volatility and instead focus on corporate fundamentals.

'Valuations of Indian equities look stretched, but accelerating earnings growth from low double digits in FY 2019 to high-teen rates next year should contain downside,' Jitendra Gohil, head of India equity research at Credit Suisse wealth management, wrote in a recent co-authored report with Premal Kamdar.

'Investors should focus on bottom-up stock picking,' advised Gohil and Kamdar. 'We like select names in energy and utilities, private banks (including corporate lenders), chemicals, construction materials, and IT.'