| « Back to article | Print this article |

Over 85 per cent of SIP AUM, or Rs 5.8 trillion, is in equity schemes, compared to just Rs 6,100 crore in debt.

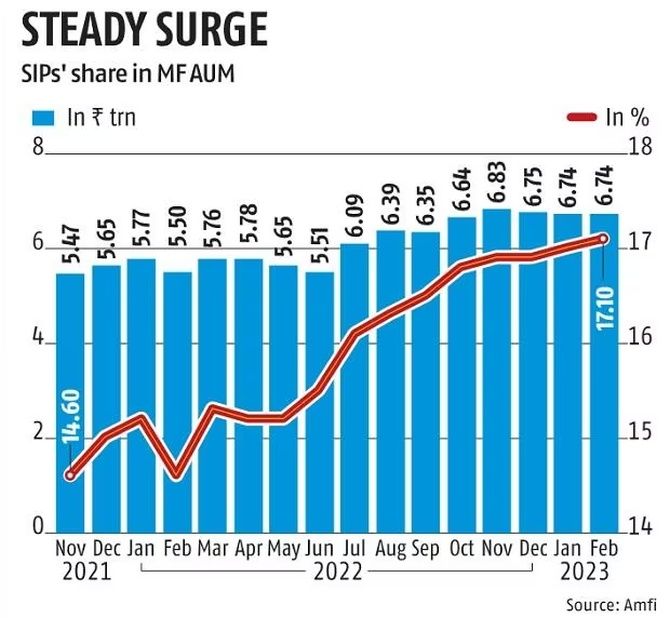

The steady inflows from systematic investment plans (SIPs) into mutual funds (MFs), coupled with outflows from debt schemes, has propelled the share of SIPs in the total assets being managed by the industry to a new high of 17.1 per cent in February.

SIPs are used predominantly by retail investors. Nearly seven of every 10 SIP accounts are in equity-oriented active MF schemes.

Debt schemes receive a fraction of SIP inflows and a majority of its assets under management (AUM) belong to institutional investors.

Data from the Association of Mutual Funds in India (Amfi) pegs the end-February SIP AUM at Rs 6.74 trillion and the industry's total AUM at Rs 39.46 trillion.

In the past year, SIP AUM has risen 23 per cent, while total AUM has gone up only 5 per cent.

Strong SIP inflows are a result of its growing investor base.

In the current financial year (2022-23, or FY23), net SIP account additions from beyond the top 30 (B30) cities have outpaced growth in the top 30 (T30) cities, probably for the first time.

Until end-February, the industry recorded 5.4 million net SIP account additions from B30 cities, compared to 4.6 million from T30.

Overall, there are 32 million active SIP accounts from T30 locations and 31 million from B30.

The number of active SIP accounts was 63 million at the end of February, rising 19 per cent in FY23.

The surge in overall SIP accounts has ensured a steady flow of new money into MFs through SIP accounts.

SIP investors allocated over Rs 11,000 crore every month to MFs in the past 12 months.

The industry's overall AUM suffered due to outflows from debt schemes. Debt AUM declined 10 per cent year-on-year in February to Rs 13 trillion.

Fund houses and MF distributors have popularised SIPs in recent years, projecting the monthly investment model as the best way to benefit from volatility in the equity market.

“The whole MF ecosystem, including asset management companies (AMCs) and distributors, have done a lot to promote SIPs. Investors now understand that investing through SIPs will allow them to benefit through the rupee cost averaging,” says Akhil Chaturvedi, chief business officer, Motilal Oswal AMC.

Rupee cost averaging is said to occur when investment is made at regular intervals.

The system allows investors to buy more MF units at the same price when the market is low and less when the market is high, bringing down the average cost per unit.

However, the rising traction of SIPs has not diminished the share of one-time investments in equity AUM in the past year.

Data shows that equity SIP AUM's share in total equity MF AUM has remained stable at around 37 per cent, even as monthly SIP inflows have remained robust.

At the end of January, equity SIP AUM was Rs 5.8 trillion, while the overall equity fund AUM was at Rs 15 trillion, reveals Amfi data.

Equity-oriented schemes enjoy the lion's share in total SIP AUM.

Over 85 per cent of SIP AUM, or Rs 5.8 trillion, is in equity schemes, compared to just Rs 6,100 crore in debt.

Hybrid schemes are the second most preferred option among MF investors, with SIP AUM of Rs 53,400 crore.

Solution-oriented schemes, index funds, and exchange-traded funds have SIP AUM of around Rs 10,000 crore each.

Overall, retail AUM in equity, hybrid, and solution-oriented schemes came in at Rs 20.28 trillion at the end of February. This figure stood at Rs 18 trillion at the end of 2021.

Feature Presentation: Rajesh Alva/Rediff.com