| « Back to article | Print this article |

SBI's product has some interesting things to offer to the potential borrower, points out Joydeep Ghosh.

With the Reserve Bank of India (RBI) making it mandatory for banks to introduce products linked to external benchmarks -- the repo rate, three-month Treasury bill, six-month Treasury bill or any rate published by the Financial Benchmark India (FBIL) -- from October 1, the country's largest bank, State Bank of India (SBI), has already introduced the first repo rate-linked home loan product.

While other banks have to launch their products by October 1, and there are reports that even non-banking financial companies will offer products linked to external benchmarks, SBI's product has some interesting things to offer to the potential borrower.

Principal to be equally divided over the tenure

This is a big move and will have many implications.

A borrower who takes a Rs 30 lakh loan over 20 years will have to pay Rs 1.5 lakh of principal every year.

Also, at the rate of 8.05 per cent, the interest component in the first year will be Rs 2,35,965.

And the total outgo in the first year: Rs 3,85,965.

In comparison, for a conventional, equated monthly instalment product that is available currently, the numbers look something like this: For a Rs 30-lakh loan for 20 years at 8.05 per cent, the total outgo in the first year through 12 equated monthly instalments (EMI) is Rs 3,02,239.

Of this, the interest outgo is Rs 2,39,208, whereas the principal outgo is only Rs 63,032.

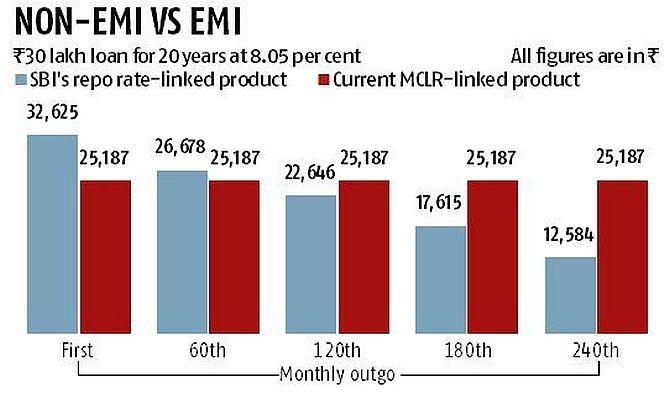

However, due to the high principal amount, the first month's outgo in SBI's product will be Rs 32,625 compared to an EMI of Rs 25,187 in the conventional product.

This is the first non-EMI home loan product in which the monthly instalment will come down over the years.

In fact, in the final year, the monthly outgo will be as low as Rs 12,000.

Since the principal payout is front-loaded, the interest outgo over 20 years will also be lower by around Rs 8 lakh.

Is it good for a retail borrower?

From an interest rate perspective, definitely.

From the perspective of a higher monthly payout initially, perhaps not.

But if you can afford to pay a higher amount in the initial years, this product is definitely a good one simply because the principal will come down at a faster pace, thereby making foreclosure cheaper.

In addition, the tax benefit that can be availed of will be much higher.

Currently, Section 80C allows home loan principal deduction up to Rs 1.5 lakh.

In addition, under Section 24 a deduction is available on interest payout up to Rs 2 lakh.

In addition, for affordable housing, the government has extended an additional benefit of Rs 1.5 lakh under Section EEA for individual borrowers.

Existing borrowers

The limiting factor, or entry barriers, of this product will be the higher monthly payout in the early part of the tenure.

Also, the eligibility criteria have been made tighter -- from around 60 per cent to 40 per cent of the take-home salary.

So, to get a loan of Rs 30 lakh for 20 years, the potential homebuyer's take-home salary will have to be around Rs 80,000 a month -- a significant amount.

But if someone takes a joint loan, it will be easier.

Harsh Roongta, a financial planner registered with the Securities and Exchange Board of India (Sebi), has this advice for existing borrowers: "If existing borrowers can afford to pay a higher amount initially, even they should move to this kind of product.

"Over time competition from other lenders will decide if this product stays the way it is."

There will be a one-time shifting charge, but experts say that unless the cost is prohibitive, one should use the opportunity.

Since the loan is linked to the repo rate, and currently, it is southward-bound, rates would come down further in the immediate future.

Many feel that the rate cut season may not be too prolonged.

But over a 20-year period, the interest rate cycle will go both ways.

Since one cannot predict the direction in the long run, it does not make sense to worry too much about it.

However, the best part of the product is its transparency.

Whenever there is a rate hike or fall, the change will happen within three months.

With October 1 and the festival season approaching, potential homebuyers can look at such products to buy properties.

There could be other product variants from banks and non-banking financial companies.

A word of caution: Buy only ready-to-move-in properties.