| « Back to article | Print this article |

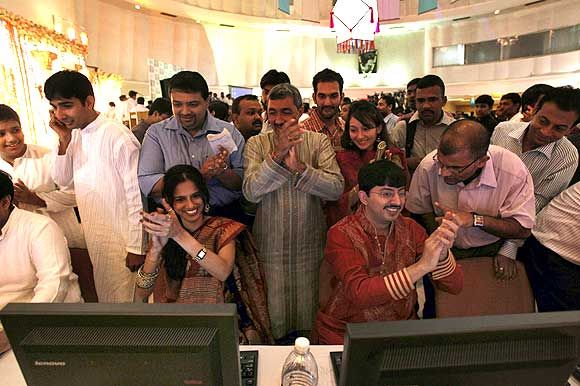

Dalal Street has ignored the Greek crisis, but it could be a case of irrational exuberance.

Dalal Street has ignored the Greek crisis, but it could be a case of irrational exuberance.

The current Sensex valuation is approaching its previous high despite the March quarter seeing one the sharpest falls in corporate earnings.

The Sensex is now trading at 22.7 times its underlying earnings over the last 12 months, similar to the ratio in the months before the global equity meltdown after investment bank Lehman Brothers collapsed in September 2008.

The difference now is in the underlying corporate earnings. In February 2008, the earnings per share of the Sensex was up 21.9 per cent from a year ago.

In contrast, the Sensex EPS now is down 14.3 per cent from a year ago.

Most brokerages reckon earnings will decline for Sensex companies in the June quarter as well.

“The market has become progressively expensive and valuation ratios of benchmark indices are nearing previous highs.

This has increased the urgency for a recovery in corporate earnings,” said Anoop Bhaskar, head of equity at UTI Mutual Fund.

The analysis is based on the Sensex’s closing value and its price-to-earnings multiple in the middle of February and August each year since 2001.

The index of underlying earnings per share is derived by inverting its reported P/E multiple. The earnings trend, however, suggests things will get worse before they gets better.

The index of underlying earnings per share is derived by inverting its reported P/E multiple. The earnings trend, however, suggests things will get worse before they gets better.

“We expect top line and bottom line contraction of 2.7 per cent and 2.4 per cent, respectively, year on year for Sensex companies,” Prateek Parekh of Edelweiss Securities wrote in a recent report on the first-quarter earnings.

The consensus estimate is a 4.9 per cent year on year decline in the Sensex companies’ combined net profit in the June quarter, the third consecutive quarter of sub-zero growth.

This has created a wedge between the Sensex valuation ratio and underlying earnings. While earnings worsened every quarter of the last financial year, the market became progressively expensive.

In February 2014, the Sensex was trading at 16.7 times the index underlying earnings, lower than the 15-year average PE multiple of 18.1x.

The P/E multiple expanded to 18.3x in August 2014 and further to 20.4x in February this year. Bulls, however, discount the weak earnings.

“That earnings would be bad in the June quarter was widely expected. Right now, the market is rallying due to a fall in crude oil prices and expectations of further economic reforms in the monsoon session of Parliament,” said Devang Mehta, senior vice-president and head of equity sales at Anand Rathi Financial Services.

“It also helps that India’s current account deficit has fallen to a record low and foreign exchange reserves are at an all-time high. This makes India fairly immune to the global contagion, if any, from the Greece crisis,” he added.

High valuations are, however, making it increasingly difficult for fund managers to generate sufficient returns.

“The holding period for equity investors is lengthening. If earlier they needed to stay invested for three years to make sufficient returns, now it could be as high as five years,” said Bhaskar.

A longer holding period means investors should be willing to accept more volatility. It could even mean accepting losses in the near to mid-term due to sharp changes in the external environment.

Now its a moot questions whether domestic retail investors who are flocking the street right now are aware of this.