| « Back to article | Print this article |

Parliament’s standing committee might have expressed its reservations on business houses being allowed to start banking operations. But the Reserve Bank of India (RBI) is hardly deterred. It is working overtime to shortlist the names of candidates from among 26 applicants. RBI has deployed additional hands to screen the applications, from a wide range of corporate houses — from conglomerates to micro lenders.

RBI has deployed additional hands to screen the applications, from a wide range of corporate houses — from conglomerates to micro lenders.

After the screening, the shortlisted candidates will be vetted by an external committee, to be headed by former RBI governor, Bimal Jalan. The names of the other members of the committee have yet to be finalised.

Apart from officials from the department of banking operations and development — the RBI wing that has drafted the licence norms and is primarily responsible for shortlisting —20-odd officers are also learnt to be involved in the screening process.

According to sources, these officers have been chosen on the basis of their core competency in areas like corporate finance, accountancy and legal matters, among other things.

Four to five teams, each headed by a general manager, have been created to look into various aspects of the applications. The entire process of screening the applications is being overseen by Anand Sinha, RBI’s deputy governor in charge of banking operations and development portfolio.

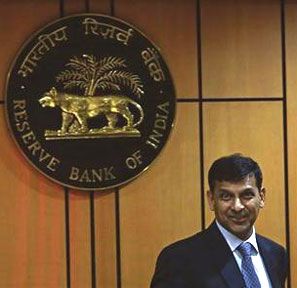

Raghuram Rajan, who took charge as RBI governor on September 4, had said on his first day in office the names would be finalised before or soon after Sinha retires in January 2014.

While the screening team is working on weekends, too, it is not yet clear if the corporate houses would be given licences. It is for the first time that companies are being considered for entry into the banking sector.

The standing committee’s recent suggestions were likely to add complications, central banking sources said.

On Saturday, B Mahapatra, an executive director of RBI who is involved with the banking licence process and reports directly to Sinha, defended the central bank’s decision to allow companies on the ground that business houses had ‘deep pockets’ to carry out capital and technology-intensive financial inclusion projects. Though Mahapatra enumerated the safety nets the central bank had put in place to mitigate conflict of interest and ensure there was no self-dealing, he said RBI’s regulatory and supervisory effectiveness would be tested in preventing new banks, promoted by industrial houses, from self-dealings.

In such a situation, the governor’s view becomes critical. While Rajan’s views since he took charge as governor are not known, he was not in favour of corporate houses’ entry into banking before he joined RBI.

BANKING ON NEW BANKERS

2010

Feb 26 > Former FM (now President) Pranab Mukherjee announces in his Budget speech that corporate and business houses will be allowed to set up banks

Aug 11 > RBI releases discussion paper on entry of new banks in the private sector

Dec 23 > RBI releases gist of comments from the feedback on the discussion paper

2011

Aug 29 > RBI releases draft guidelines for licensing of new banks in the private sector

2012

Jul 10 > RBI releases gist of comments from the feedback on draft guidelines

Dec 18 > Lok Sabha passes Banking Laws (Amendment) Bill, paving the way for RBI to issue final guidelines on new bank licences

2013

Feb 24 > RBI issues final guidelines for new banking licences

Jun 3 > RBI responds to clarifications sought by aspirants on final norms

July 1 > Deadline for filing of application ends

Sep 4 > After taking charge as RBI governor, Raghuram Rajan announces setting up of an external committee under former governor Bimal Jalan to vet applications for new banking licences, likely to be issued around January 2014