| « Back to article | Print this article |

The RBI on Friday further eased bad loan rules, froze dividend payment by lenders and pushed banks to lend more by cutting the reverse repo rate by 25 basis points, as it unveiled a second set of measures to support the economy hit hard by a coronavirus-led slowdown.

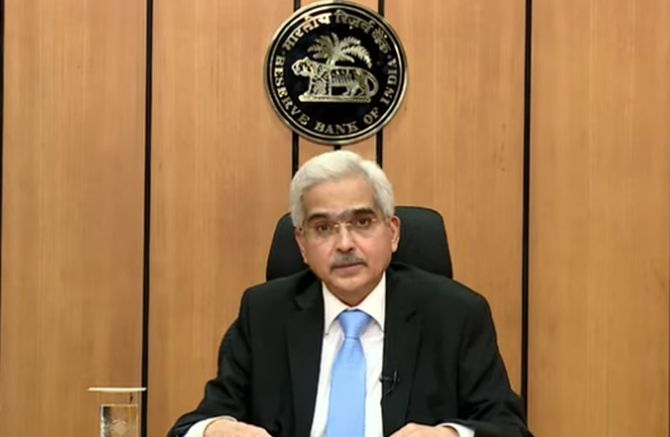

In his second televised address since the nationwide lockdown began from March 25, the Reserve Bank of India (RBI) Governor Shaktikanta Das pledged to boost liquidity and expand bank credit.

In a measure that effectively meant that bad loans or non-performing asset (NPA) classification will now happen after 180 days instead of the current policy of 90 days of payment default, the RBI announced an asset status freeze on loans that have been granted moratorium or deferment on interest/principal payment.

This would cover the borrowers of both banks and NBFCs.

This means that the moratorium period will not lead to a spurt in NPAs in the system and will allow the borrowers across retail, small and medium-sized enterprises (SMEs) and corporates availing the moratorium to access additional funding from banks or non-banking financial companies (NBFCs).

Das, however, said lenders will have to make an additional provision of 10 per cent for those exposures under moratorium.

RBI cut the reverse repurchase rate, a tool to control the money supply, to 3.75 per cent with immediate effect to encourage banks to deploy surplus funds within the system towards lending.

The reverse repo rate cut will discourage banks from parking cash with the RBI and encourage them to lend to the economy.

It kept its benchmark repo rate, which was reduced late last month, unchanged at 4.40 per cent.

The central bank also allowed states to borrow 60 per cent more via ways and means advance facility available and extended the increased limit until September 30.

To preserve capital, RBI asked banks not to pay any further dividends for the fiscal year ended March 31.

"It is imperative that banks conserve capital to retain their support for the economy and absorb losses in an environment of heightened uncertainty," Das said.

The dividend curbs will be reviewed in the quarter ending September 30.

Regulators around the globe have similarly advised lenders to cut or delay dividends so as to ensure that they have enough buffers to weather what the International Monetary Fund (IMF) predicts to be the worst global recession since the 1930s.

RBI will inject Rs 50,000 crore in a new round of targeted long-term repo operations and asked banks to use the funds availed through this facility to benefit NBFCs and micro-finance institutions among others.

The RBI had on March 27 announced a steep 75 basis points cut in the repo rate, slashed cash reserve ratio and permitted a three-month moratorium on all loans, including home loans, extended by commercial banks and lending institutions.

"Since March 27, 2020, when I spoke to you last, the macroeconomic and financial landscape has deteriorated, precipitously in some areas; but light still shines through bravely in some others," Das said.

"India is among the handful of countries that is projected to cling on tenuously to positive growth (at 1.9 per cent). In fact, this is the highest growth rate among the G-20 economies," he said adding the World Trade Organisation sees global merchandise trade contracting by as much as 13-32 per cent in 2020.

For 2021, the IMF projects sizable V-shaped recoveries: close to 9 percentage points for global GDP. "India is expected to post a sharp turnaround and resume its pre-COVID pre-slowdown trajectory by growing at 7.4 per cent in 2021-22."

RBI also announced a Rs 50,000 crore special refinance to pan-India financiers like Sidbi, Nabard and NHB that provide affordable funds to the rural sector and agriculture.

Of this, Rs 10,000 crore will be for National Housing Bank (NHB) which will ease some of the liquidity challenges for housing financing companies to get bank financing.

RBI has also allowed NBFC loans to delayed commercial real estate projects to be extended by a year without restructuring.

In a move that will bring much-needed relief to cash-starved developers, the RBI has further extended the date of commencement of commercial operations (DCCO) of project loans for commercial real estate projects which are delayed for reasons beyond the control of promoters.

It will help in easing out time for maintaining and managing cash flows for these developers.

The Indian economy may be headed for a rare quarterly contraction during April-June as businesses shut down and restrictions on the movement of people and goods imposed through the world's biggest lockdown.

The lockdown which was initially for 21 days, has been extended till May 3.

"The RBI will monitor the evolving situation continuously and use all its instruments to address the daunting challenges posed by the pandemic," he said.

Commenting on the measures, Rumki Majumdar, Economist, Deloitte India, said: "The over-arching goal of the RBI announcements has been to ensure enough liquidity in the market, availability of credit, and sustenance of the MSMEs.

"The recent outbreak of the coronavirus pandemic has hit MSMEs, which account for 45 per cent of total manufacturing output and 40 per cent of exports."

MSMEs are facing a double whammy -- a supply disruption in the one hand, and a fall in sales orders and revenues on the other.

Meanwhile, RBI expects inflation to ease, which gives some headroom to act.