Among the bank groups, under the baseline scenario, public sector banks’ gross NPA ratios may increase to 13.2 per cent by September 2020 from 12.7 per cent in September 2019.

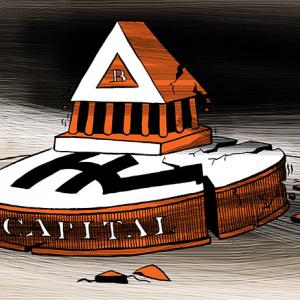

Public sector banks (PSBs) need to improve performance and work to build buffers against disproportionate operational risk losses, according to the Financial Stability Report (FSR).

State-owned banks have been grappling with stressed loans and limited capacity to absorb further rise in slippages expected due to prolonged economic slowdown.

In fact, the Reserve Bank of India’s (RBI’s) stress tests have projected a rise in gross non-performing assets of banks to 9.9 per cent by September 2020 from 9.3 per cent in September 2019.

According to the FSR, the regulator conducted macro stress tests for credit risks to assess the banking system’s resilience to macroeconomic shocks under baseline conditions.

It assumed continuation of the current economic situation in the future.

Among the bank groups, under the baseline scenario, public sector banks’ gross non-performing asset (NPA) ratios may increase to 13.2 per cent by September 2020 from 12.7 per cent in September 2019.

Bad loans of private banks may rise to 4.2 per cent from 3.9 per cent.

In case of foreign banks operating in India, gross NPAs may increase to 3.1 per cent from 2.9 per cent in September 2019, the FSR said.

The pace of economic growth decelerated to 4.5 per cent in the second quarter ended September 30, 2019.

In the monetary policy review early December, the RBI revised its real GDP growth estimates for 2019-20 to 5.1 per cent from 6.1 per cent in the October policy.

The economy is expected to grow at 5.9-6.3 per cent during the April-September 2020 period.

PSBs’ profitability ratios were muted due to weak credit growth as well as slow resolution of NPAs.

The profitability ratios of private banks also declined whereas foreign banks showed better profitability.

PSBs’ weak return on equity (RoE) and return on asset (RoA) numbers compared to their private sector counterparts continue to come in the way of their ability to raise equity capital from the market at a decent rate.

Regarding buffers against anticipated risks, private banks’ provision grew at a faster rate as compared to those of PSBs, the report said.

Net NPA ratio declined to 3.7 per cent in September 2019 from just below four per cent in March 2019, reflecting increased provisioning.

The provision coverage ratio (PCR) of all scheduled commercial banks or SCBs rose to 61.5 per cent in September 2019 from 60.5 per cent in March 2019, implying increased resilience of the banking sector.

Referring to the review of various sectors, it said the asset quality of agriculture and services sectors, as measured by their gross NPA ratios, deteriorated in September 2019 as compared to March 2019.

For various sectors, slippages during the period declined.

Among the sub-sectors, slippage ratios of ‘textiles’, ‘rubber’ and ‘construction’ industries increased during the period.