| « Back to article | Print this article |

The government's priority should be to bring stability in the banking sector by capital infusion or enabling large-scale mergers and acquisitions, says Jigar Shah.

With the Assembly elections behind it, the market is preparing for the results season.

Jigar Shah, chief executive officer, Maybank Kim Eng Securities, in an interview to Puneet Wadhwa, says he expects the earnings for 2016-17 to rise by 3 to 5 per cent, and for 2017-18 by about 9 to 10 per cent:

Are the markets underestimating the global and domestic risks?

The global and domestic risks in the past few months have eased a bit.

India continues to remain a hot favourite among foreign investors, despite demonetisation and the US Federal Reserve’s decision to raise rates. The resilience in the US market has kept many other emerging markets on an up move this year.

Liquidity is good in India and externally -- fuelling a rally in the market even as a price-to-earnings ratio of 17x one-year forward and weak earnings growth challenge the margin of safety.

The unexpectedly favourable result in the recent elections for the Bharatiya Janata Party has removed even the slightest of doubts for 2019. Hence, the anticipation that 'never before' reform measures will be undertaken is palpable among investors and citizens.

After the recent assembly poll outcome, what more would you like to see from the government in policy action over the next two years?

The government's priority should be to bring stability in the banking sector by capital infusion or enabling large-scale mergers and acquisitions.

It should increase privatisation by selling non-core and non-strategic government units, releasing funds which can be channeled into infrastructure.

It should implement an industry-friendly structure in the goods and services tax, resulting in overall savings in the tax outgo.

Which sectors are you overweight and underweight on ? Any contrarian bets?

We like private banks, software, media and entertainment, renewables, four-wheelers.

Software is a contrarian bet, as we feel sector-related headwinds are in the price.

You had been bullish on the banking space. What’s your call now?

The time for private banks and financiers is still good, even as they trade at increased valuations.

The shift of market share from State-owned banks to the private sector is accelerating and that benefit will reflect for the next few years.

The time to exit will be only after a few years when the base for these private banks/financiers becomes big and growth slows down.

Telecom has been in the news in recent months. Is it a good time to invest?

Telecom is yet in transition. The data business will now take centrestage and that will force each of the major telcos to invest in new networks and capabilities.

Consolidation in the sector over time should result in removal of discounted prices but in the near term, the stress will remain. The time to invest should be during reasonable market corrections.

We like telcos which provide data bandwidth and related solutions, as well as those supplying fibre optic, cables, networks.

Capital goods and consumer goods stocks have done well recently. Is the tide turning?

It is more of a relief rally then a fundamental evidence in favour of consumer or capital goods.

There is sporadic evidence of a pick-up in some segments of capital goods, such as construction and irrigation equipment, but that is not a full-blown recovery in the sector.

In the case of consumer, there has been a mild improvement in cafe chain same-store sales growth and in some categories in urban areas. The rural market situation is not clear. We need some more data points with consistency to say the tide is turning.

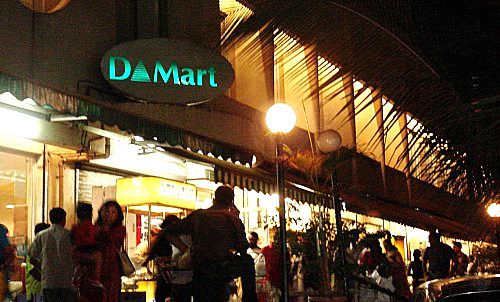

Image: "D-Mart has just listed and it would be fair to assess its performance only after a few quarters. It has its unique success story," says Jigar Shah, CEO, Maybank Kim Eng Securities. Photograph: Kind Courtesy Dmart/Facebook.

When do you see a pick-up in the capex cycle?

It might take long time, due to China's sheer capex. Most of the commodity products are available in advance. A pick-up can come only if India manages to start some mega projects in power, metals and transport.

We believe earnings for 2016-17 should rise by 3 to 5 per cent, and for 2017-18 by 9 to 10 per cent.

Can the D-Mart listing trigger a re-rating of the Indian retailing sector?

D-Mart has just listed and it would be fair to assess its performance only after a few quarters. It has its unique success story.

Its listing gains are mainly attributable to its model and management quality and are unlikely to drive re-rating of other companies in the same sector.