| « Back to article | Print this article |

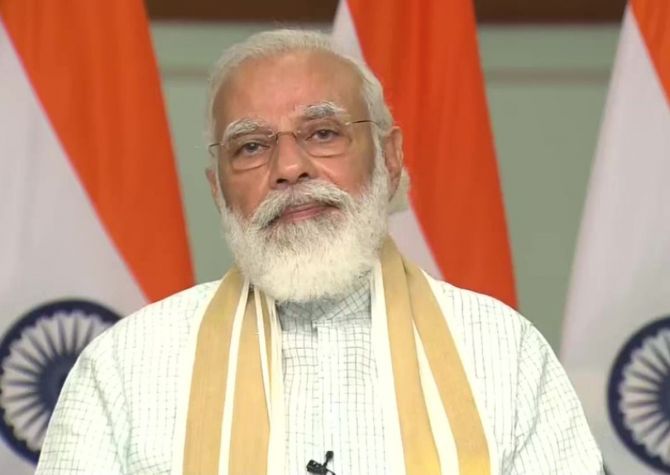

Prime Minister Narendra Modi on Thursday emphasised the role of tax compliance in nation-building and said the government was following a policy-driven governance model.

"The emphasis is on making every rule, law, policy people-centric, and public-friendly. This is the use of the new governance model and the country is getting its results," he said while speaking at the launch of a platform for ‘Transparent Taxation -- Honoring the Honest’.

The prime minister said the new tax system was going to become faceless and this will give a belief of fairness and fearlessness to taxpayers.

"The trend of structural reforms in the country has reached a new stage today. ‘Transparent Taxation -- Honoring the Honest’, this new system of the 21st century tax system, has been launched today," he said.

"The platform has major reforms like faceless assessment, faceless appeal and taxpayer’s charter. Faceless assessment and taxpayer’s charter has come into force from today. The facility of faceless appeal will be available for citizens from September 25 on the birth anniversary of Pt Deen Dayal Upadhaya," he added.

"Now the tax system is going to become faceless but this will give believe to fairness and fearlessness to taxpayers. In the last six years, our focus was banking the unbanked, securing the unsecured, funding the unfunded," said Modi.

"A new journey is beginning today honouring the honest. The country's honest taxpayers play an important role in nation-building. New facilities beginning from today establish our commitment to minimum government and maximum governance," he added.

Meanwhile, Union Finance Minister Nirmala Sitharaman said the initiative is a landmark in the history of tax administration.

"The prime minister's vision is to empower taxpayers, to provide a transparent system and to honour the honest taxpayer. To realise this vision, CBDT has given a framework and put in a place a system in the form of this platform," she said.

"A transparent, efficient and accountable tax administration is what this platform brings it. It uses technology, data analytic and also uses artificial intelligence. It eases compliance burden, brings fair, objective and just system," the Minister added.

According to a release from the Prime Minister's Office, the Central Board of Direct Taxes has carried out several major tax reforms in direct taxes in recent years.

Last year, corporate tax rates were reduced from 30 per cent to 22 per cent and for new manufacturing units, the rates were reduced to 15 per cent. Dividend distribution tax was also abolished.

The focus of tax reforms has been on reduction in tax rates and on simplification of direct tax laws. Several initiatives have been taken by the CBDT for bringing in efficiency and transparency in the functioning of the IT department. This includes bringing more transparency in official communication through the newly introduced Document Identification Number (DIN) wherein every communication of the department would carry a computer generated unique document identification number.

Similarly, to increase the ease of compliance for taxpayers, the IT department has moved forward with the prefilling of income tax returns to make compliance more convenient for individual taxpayers. Compliance norms for startups have also been simplified.

With a view to provide for the resolution of pending tax disputes the IT department also brought out the direct tax ‘Vivad se Vishwas Act, 2020’ under which declarations for settling disputes are being filed currently. To effectively reduce taxpayer grievances/litigation, the monetary thresholds for filing of departmental appeals in various appellate Courts have been raised.