| « Back to article | Print this article |

The threat may be a decade away, but it has brick-and-mortar sellers rethinking their strategies and banking on the govt to regulate online companies.

On its Big Billion Day, Flipkart logged $100 million worth of sales in just 10 hours. Amazon announced a $2-billion investment for its India operations.

Many serious dollar fundings have been raised by e-commerce companies in the past few months. Is the end for physical retail in the country in sight?

Businesses running brick-and-mortar stores as well as manufacturers (mostly in consumer durables and electronics) are nervously asking the government to intervene. They are seeking the creation of a regulator to stop online retailers from undercutting prices.

The complaints of deep discounts have reached the doorstep of Commerce and Industry Minister Nirmala Sitharaman, and officials of the Competition Commission of India (CCI) are busy reading up on online retail, so far an unexplored subject for them. They are assessing if the flash sales online constitute predatory pricing.

However, while physical retailers continue to feel threatened by the marketing blitz of their online counterparts, big companies are getting smarter with their strategies to guard their turf.

However, while physical retailers continue to feel threatened by the marketing blitz of their online counterparts, big companies are getting smarter with their strategies to guard their turf.

Not only are the likes of the Future group, Tatas and Reliance foraying into e-commerce, but they are also entering alliances with online players to expand their reach. Kumar Mangalam Birla and his Aditya Birla group also plan to enter the Indian online market.

In the midst of so much action, a silver lining for India's retail trade, totalling around $600 billion, is the insignificance of the e-commerce market estimated at around $4 billion.

Arvind Singhal, chairman and founder of Technopak, a leading retail consultancy, argues that the notion of online businesses destroying offline ones arises from the fear of the unknown.

Singhal says it will take another decade at least for online retail in India to adversely impact physical chains in a substantial manner.

By then, smartphone users would have formed an influential mass and the quality of data and logistics would have got better.

“The fear that physical retail currently harbour about online retail is similar to what the kirana, or neighbourhood stores, had some years ago about modern trade. Things didn't turn out as feared, but "who likes competition? Life will be much simpler without it,'' says Singhal.

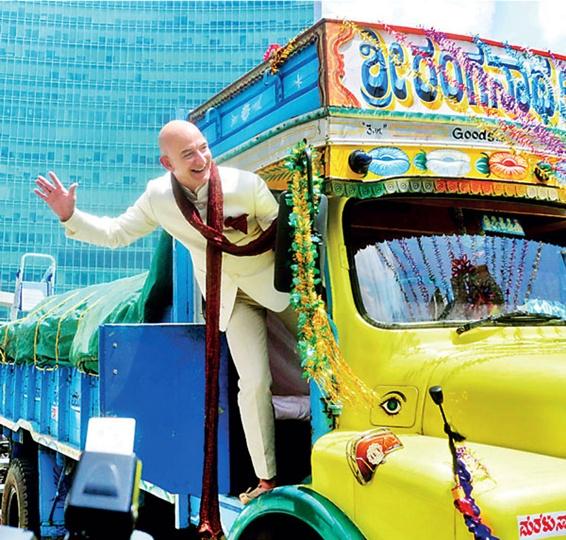

But the e-commerce players are preparing for the long haul. "We are looking at a 25-year horizon for the business,'' says Snapdeal co-founder and CEO Kunal Bahl. On his recent visit to India, Amazon's Jeff Bezos too spoke about long-term thinking.

Experts suggest that even with $100 million in sales in half a day, Indian e-commerce players are yet to emerge as a real threat. A significant comparison would be Chinese e-tailer Alibaba.

In its Singles' Day sale earlier this week, Alibaba totted over $9 billion. Latif Nathani, country managing director of eBay, the top American online marketplace player, pointed out to Business Standard that the e-commerce market in China is about to touch $340 billion, while India lags at just $4 billion.

Brokers and investment group CLSA Asia Pacific Markets estimates online sales in India will jump to $22 billion by 2018.

Regulating the tides

Sources in the government indicate that a policy to allow foreign investment in the e-commerce sector will have to wait as the business is still nascent. Till recently, the government was believed to have been working on opening up the sector to foreign direct investment (FDI).

Even though FDI is not permitted in e-commerce, all prominent companies operating in this space have foreign funds, as they either have a marketplace model (which is not barred from foreign investment) or they have a complex corporate structure to beat the norms.

The anti-FDI lobby for the e-commerce sector is rather strong. Apart from many of the large industry houses with interest in retail, even some prominent online players are against FDI in their business.

Once FDI is permitted in e-commerce, American major Amazon is expected to shift to the inventory-based model, something that is part of its DNA. Competition in India will not like that to happen any time soon, say sources, because Amazon is well-placed to overtake the Indian players with the inventory-based format.

In the inventory model, the company has full control over the products and delivery, while the marketplace format allows vendors selling on an e-commerce player's platform a critical play.

Even so, the worry over online retail refuses to die down. Future group Chairman Kishore Biyani recently tried to allay the fear by saying that online competition will dominate for only 6-18 months. But having said that, his group tied up with Amazon to jointly sell goods over the Internet.

Even so, the worry over online retail refuses to die down. Future group Chairman Kishore Biyani recently tried to allay the fear by saying that online competition will dominate for only 6-18 months. But having said that, his group tied up with Amazon to jointly sell goods over the Internet.

In fact, leading e-commerce players are going all out to woo physical retailers to their platforms. Snapdeal's Bahl, soon after signing a deal with Japanese investor Softbank, went to meet the honcho of a physical retail company for a potential tie-up.

Bezos ensured that Amazon's venture with Future was put in place quickly. Snapdeal already has Ratan Tata on its side as an investor, and Akhil Gupta, vice-chairman of Bharti Enterprise (which runs Easy Day retail chain besides other businesses), as a board member.

Consumer electronics companies like LG, Samsung, Videocon, Sony and Panasonic, which were up in arms against online retail's deep discounts, are now instructing their trade partners that products sold through online marketplaces without their knowledge during flash sales would not get the benefit of after-sale service and warranties.

These companies are also talking to e-commerce players, persuading them to be fair in pricing and not to go for discounts unfair to physical stores.

Looking into the future

Looking into the future

A global study by Nielsen Research shows that this year, for the first time, the Asia-Pacific e-commerce purchases will outstrip those in North America.

In the global e-commerce market that is estimated to touch $1.5 trillion this year, the top online categories are clothing and accessories. It is almost the same in India.

In India, Flipkart and Myntra, which was acquired by Flipkart a few months ago, have a combined fashion business of around Rs 3,500 crore (Rs 35 billion). Analysts estimate that the fashion business of the two companies together could touch Rs 20,000 crore (Rs 200 billion) in three years.

They together account for around 50 per cent of the Indian e-commerce market and, as an industry source put it, are aiming at 70-80 per cent in the next four to five years.

"An Indian Alibaba is inevitable in a few years,'' Mukesh Bansal, CEO of Myntra and part of the top team at Flipkart, had said recently.

It is this possibility that worries the physical retailers. It could well prove inevitable if they don't plan their counter moves right away.