| « Back to article | Print this article |

Start saving for it as early as possible and review your portfolio every 5 years

Mumbai-based Shubro Sen has been putting aside Rs 40,000 per month towards his retirement corpus since the past three years.

He is 40 years old and wants a corpus of Rs 5.8 crore (Rs 58 million) by the time he retires at age 60.

Unfortunately, his current rate of saving will not allow him to save so much.

At best, his corpus will be Rs 2 crore -- a shortfall of Rs 3.8 crore.

He has a wife and four-year old son. Now, he has charted a plan to increase the corpus with the help of a financial planner.

This includes increasing his monthly allocation.

Interestingly, if he had started at age 35, only two years before he actually did, he would have reached his corpus comfortably.

At age 30, retirement is not on the radar for most of us.

All savings are towards goals like repaying the home loan, children’s education, parents’ health care expenses, etc.

“Whatever your expenses and goals at age 30, one should always put aside a certain amount for retirement.

"Do not touch this corpus for any other need, however critical,” says Deepali Sen, founder and partner, Srujan Financial Advisers.

The whole idea is to have a balance between long-term and short-term goals and allocate your funds accordingly, says Anil Rego, chief executive officer (CEO), Right Horizons.

“Make an assessment of all your needs, including retirement, and see if you can make a fair contribution towards that.

If it is not possible, you might need to reduce some other needs to accommodate it.

"In fact, certain lifestyle expenses might be wants not needs,” he explains.

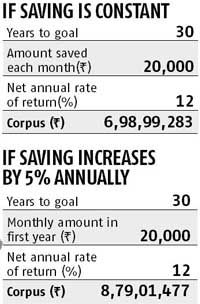

It is also important to review your retirement corpus regularly, preferably every five years. For instance, assume one starts saving Rs 20,000 at age 30 and plans to retire at age 60.

Let us assume annual return of 12 per cent and the saving remains constant throughout.

The corpus at the end of 30 years will be approximately Rs 6.98 crore.

But, assuming you increase the saving by five per cent every year, the corpus at the end of 30 years will be Rs 8.8 crore.

“Post retirement, while some expenses increase, some could actually decrease.

"For instance, your lifestyle expenses like eating out and entertaining might reduce.

"Or instead of a fulltime driver you might decide to make do with a part-time driver, since you don’t need to travel daily. The biggest mistake most people commit is that they withdraw money from their own retirement corpus to meet other expenses,” says Sen.

Expenses to allocate for age 30 At the age of 30, saving on your children’s higher education or wedding or for the downpayment for your house take priority over retirement.

“Long-term goals might not be clear at this stage, as you might not have children. The goals could be saving for children’s education or retirement.

"As long as you are putting money in long-term assets, it is good,” says Rego.

At age 30, investable surpluses are usually low, as one might be spending on setting up a house, paying an equated monthly instalment, setting aside money for a child’s education, etc which doesn’t leave much room for retirement savings, says Gaurav Roy, co-founder and chief operating officer of BigDecisions.com.

However, if you don’t start early, you need to save much more later, as you don’t give your savings the benefit of additional time to compound. Age 45-50

Paying off a home loan is another big expense most people would achieve by the age of 45-50 years.

With this crossed off your list, you can increase your retirement saving to that extent.

With this crossed off your list, you can increase your retirement saving to that extent.

For instance, if you plan to travel extensively after retirement, that is something you need to start saving for.

Or if you want to pursue a hobby, you need to save money to pay for the classes.

After 50

By this time, your income increases and your loan is usually paid up, your children are in college and possibly your parents are no more.

Running a smaller household leaves you with surpluses, which ideally should go towards your retirement corpus.

A common mistake most people do is to dramatically up the lifestyle because they feel flush with money.

“This is the time when you must increase your retirement savings, as there will be no further opportunity to do so,” says Roy.

Medical expenses for self and spouse are something you have to budget for.

Now is a good time to make an additional allocation towards it.

Even if you have health insurance, that will only cover hospitalisation expenses and not daily medicines or day care procedures.

“Typically, after 60 years, expenses towards medicines can be as high as Rs 3,000-5,000 per month. That in itself is Rs 5-6 lakh over 10 years and not covered by insurance. Hospitalisation expenses might not be this much,” Rego points out.

After 60

If you want to leave something for your grandchild, that is something you have to budget for, separately from your consumption, Sen points out. That is why she advises saving a certain amount in equity even after 60 years.

How to plan expenses after retirement

Sen recommends having a balanced portfolio between equity and debt after retirement.

For the first 10-15 years after retirement, you can keep utilising from the debt portfolio, both returns and principal.

During this time the equity will grow. So, after 10-15 years, you can start utilising the equity portfolio.

However, this is for your routine monthly expenses and assuming you have a contingency fund for emergencies.

However, this is for your routine monthly expenses and assuming you have a contingency fund for emergencies.

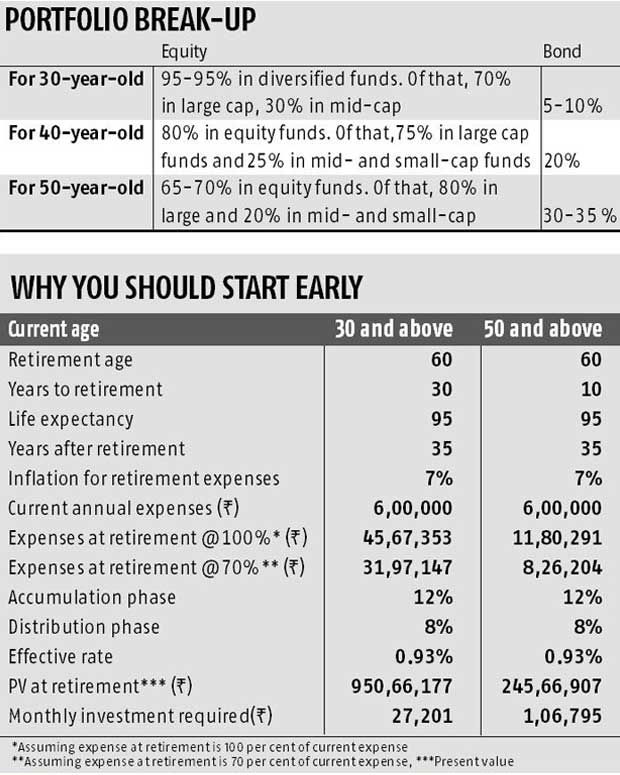

“Ideally, one should assume expense post-retirement will be 70-80 per cent of current monthly expenses, taking into account inflation.

While a review of the portfolio should be done every six months, one need not take action unless there is a need.” Sen says.

According to Rego, equity can be 25 per cent of the portfolio, as long as fixed income is able to beat inflation. If you invest in good balanced mutual funds, there is no need to change your portfolio unless the funds’ performance dips too much.

Other than this, if you, your spouse or some other family member is diagnosed with a chronic ailment, that might require regular medication.

Then, you could need to increase the allocation towards medical expenses as part of the retirement corpus.

| Shubro Sen Works in financial services sector

“It would have been a better situation if I had started retirement planning earlier. To make up the deficit in corpus, we have made lifestyle changes like reduced eating out, stopped watching movies in multiplexes and shopping only whenever required” |