| « Back to article | Print this article |

Reserve Bank of India (RBI) Governor Raghuram Rajan’s move to increase the repo rate 25 basis points may not translate into an increase in deposit rates across the board by banks, owing to a comfortable liquidity position and little compulsion to raise resources by offering higher rates..jpg?w=670&h=900) “The decision to raise or reduce rates depends on the demand and supply conditions, not a mere rise or fall in repo rates,” said K R Kamath, chairman and managing director, Punjab National Bank, and chairman of the Indian Banks’ Association.

“The decision to raise or reduce rates depends on the demand and supply conditions, not a mere rise or fall in repo rates,” said K R Kamath, chairman and managing director, Punjab National Bank, and chairman of the Indian Banks’ Association.

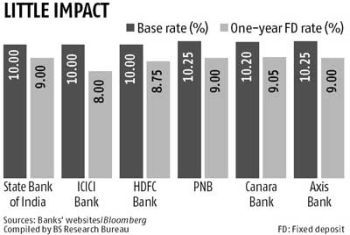

Similarly, lending rates, too, may not see an across-the-board rise, though a few riskier segments could see an increase in lending rates.

“While there is a need to retain deposit rates at these levels due to the high inflation, banks also need to see if the increase can be passed on to borrowers. But credit demand has not started picking up. So, if banks raise deposit rates, the cost will have to be absorbed. Each bank’s asset-liability management committee will meet and take a decision on whether to raise rates or not,” Kamath said.

Chanda Kochhar, managing director and chief executive officer, ICICI Bank, said lending rates weren’t directly linked to repo rates, but were dependent on banks’ cost of funds.

“For many quarters, deposit rates have not changed. The reason is deposit rates are linked to the rate of inflation. You should give positive returns to your depositors. You should watch the trends in inflation and deposits, which impact the cost of funds and lending rates,” she said.

Though returns to depositors were negative because of the high inflation, banks were unlikely to raise deposit rates, as that would impact their margins, said Rakesh Shinde, research analyst (institutional equities), Bonanza Portfolio.

“In December, the RBI governor had raised the issue that though the central bank had increased repo rates, banks were not passing it on to depositors. It was only after this that a few banks raised deposit rates in some time-buckets,” he said.

This time, banks are comfortable on the liquidity front and most have already made provisions to address asset quality issues.

As there is no immediate requirement for funds, it is unlikely they will raise deposit rates immediately.

For retail investors, the current deposit rates were very tempting, especially short-term ones, said Jyotheesh Kumar, executive vice-president and business head, HDFC Securities.

“At an average of nine-9.5 per cent for one-year bank fixed deposits, for retail investors, this is a good chance to lock into fixed deposits or tax-free bonds that are offering about nine per cent,” he said.

M Narendra, chairman and managing director, Indian Overseas Bank, said it was unlikely there would be an upward revision in base rates or an across-the-board rise in lending rates.

But banks could raise lending rates in some segments, depending on the credit rating of the client and the relative cost to the bank, he added.

While pricing loans, banks would factor in credit cost, said Arundhati Bhattacharya, chairman, State Bank of India. For instance, since credit costs are lower in segments such as home loans, which are secured loans, it may be possible to lower the rates in that segment.

For instance, since credit costs are lower in segments such as home loans, which are secured loans, it may be possible to lower the rates in that segment.

Re-pricing in loan rates might be seen in segments such as personal loans, which were riskier than home loans, said Kumar of HDFC Securities.

The fact that most banks were consciously going slow on credit growth, owing asset quality concerns, was another reason why a rise in lending rates was unlikely at this point, said Shinde of Bonanza Portfolio.