Read the numbers carefully because no one can offer a credit card at zero cost or give a loan at a simple interest of 9%.

Retail investors and consumers are easy preys to smart marketers.

Retail investors and consumers are easy preys to smart marketers.

There are numerous examples of financial products being sold to them through promises which say something in a big font size but when one looks at the fine print, things may be completely different.

Many people take advertisements or marketing programmes at their face value, only to regret the decision later.

Here are a few examples of marketing pitches and how you should read them:

Earn an annualised returns of 13.7%

Such inflated figures are usually advertised during offering of non-convertible debentures (NCDs) or bonds. Debt instruments are offered at a fixed annualised interest rate, which are also known as coupon rate.

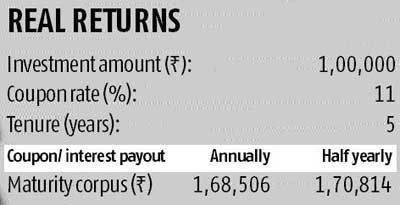

However, there is a difference between yield and coupon rate, with the former also includes the compounding factor and the latter being the pure interest payout. Look at the table (Real Returns) to understand it.

In the table below, the interest rate offered is 11 per cent, if an investor chooses to take an annual compounding option the effective yield would be 11 per cent, But if the money is compounded on a quarterly basis, then the effective yield would be 13.7 per cent. The periodicity of compounding interest can make a significant difference.

Credit card at zero cost

You must have not only seen advertisements but also received personal emails, SMS which would have tempted you to apply for one. However it is important to understand why a finance company would sell a credit card at zero cost.

There has to be a catch and you will get to know it once you read the fine print, that is, term and conditions. It can mean that card fee in the first year is completely waived off, and the person will need to start paying from the next year.

Usually, the fee waiver is granted only if the customer makes purchase beyond a certain limit in a year. For example, if the entire spends on the card crosses Rs 1 lakh in a year, the issuer will not charge any fee. But if cardholder does not exceeds this threshold, the fee would be applicable.

Invest Rs 5,000 a month for 20 years and get Rs 1.5 crore

Such lucrative offers are common and are tempting for those looking to build a long term wealth.

However it is quite important to understand the way numbers are used to reach the figures. The companies assume annual average returns of 20-25 per cent when calculating the final figure.

This especially happens when equity markets are bullish. But stock markets go through phases and the average returns, in reality, will be much lower.

If the average return over 20 years is 12 per cent, the person would actually get close to Rs 50 lakh on investing Rs 5,000 a month. Also the returns shown in advertisements do not include various charges. Post-charges, the net returns would be lower.

Personal loan at simple interest of 9%

Lucrative enough to make you apply. However current interest rates offered on personal loan varies from 13 per cent to 18 per cent.

Then, how can it be possible that a banker will lend at a rate which is substantially lower than those prevailing in the market?

If you see advertisement of a personal loan at 9 per cent, it means the interest calculated is on the original loan amount and not as per the reducing balance method. Thus the net interest rate which one ends up paying by the end of the loan tenure is more than 16 per cent. The lower number showed was just a trick to attract the borrowers.

Bonus payout at 10%

Whether bonus or a windfall gain, any such advertisement sounds sweet and therefore it is normal to fall for such offers from insurance companies selling traditional plans. However one must understand that bonus is calculated on sum assured and not on premiums.

The sum assured in traditional policies is usually low and thus the net return earned is around six per cent.

Down payment 20%, EMI on possession

Developers usually come out with such schemes wherein the buyer has to pay only the downpayment. The equated monthly instalment (EMI) will start after the date of possession.

However, until then, the buyer needs to service the interest in the loan, also any delay in the project completion will further pinch the buyer.

One must make sure to check the credentials of the builder/developer, as in case of default or delay the entire loan would have to be serviced by the buyer.

Also, such offers are for limited term, say up to three years. If the project is not completed within the stipulated time frame, the buyer needs to pay the EMI thereafter.

NUMBERS GAME

- Financial products usually don’t come at zero cost

- Read the offer document and terms and conditions before buying/investing

- Don’t believe the numbers, understand the detailed calculation

- Consider the real, rather than nominal, returns

The writer is CEO & founder of Right Horizons.