| « Back to article | Print this article |

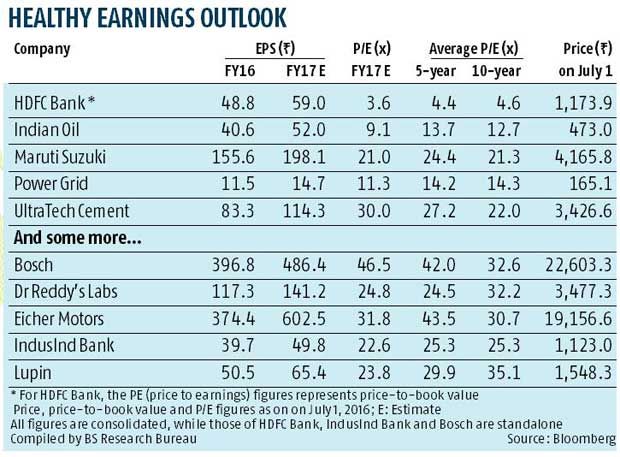

These are companies with a strong track record and good prospects on earnings.

In only four months, the S&P BSE Sensex has rallied 18 per cent; the MidCap and SmallCap indices are up 22-24 per cent.

This is despite adverse global developments such as slowing Chinese economy, weakness in the US and, more recently, the referendum by Britons favouring an exit from the European Union (EU).

Financial markets the world over seem to have ignored the risks arising from Brexit, having recouped the losses that followed the event.

However, many experts believe that in the medium term, this event has the potential to pull down global growth rates, besides creating significant tension among EU countries. Markets are susceptible to such risks.

The other issue is that the current valuation of the Indian market is not cheap and earnings growth is far from exciting.

In such an environment, it is better to stick to tested names, where earnings growth visibility is strong.

Here are five large companies, with a market value of over Rs 50,000 crore (Rs 500 billion), fitting the bill.

HDFC Bank's impeccable record of consistently high earnings growth, outstanding asset quality and a strong brand has led to fantastic stock returns.

Even during bear phases, the stock has stood out. Since listing in May 1995, the share price has grown at a compounded annual rate of 27 per cent; the past five-year return was 18.7 per cent a year.

The bank's focus on the more profitable retail and working capital (of corporate) segments has been a key growth driver.

With banking penetration still low in India, HDFC Bank is best placed to gain. It is estimated to clock 21 per cent earnings growth in FY17 and 23 per cent in FY18.

With banking penetration still low in India, HDFC Bank is best placed to gain. It is estimated to clock 21 per cent earnings growth in FY17 and 23 per cent in FY18.

Indian Oil (IOC) could see further re-rating on improving prospects, better financials and stable policies.

Its net debt to equity ratio has already fallen sharply from one in FY14 (gross debt of Rs 89,000 crore) to 0.4 in FY16, as oil prices are down and IOC no longer has to share the cost of selling fuel at below-cost price, consequent to a policy shift to market-linked prices for fuels (except cooking gas and kerosene).

Notably, the FY17 outlook for its core businesses remains good, with refining margins above Singapore benchmark; petrochemicals' performance, though, might be slightly flattish.

Unlike FY16, the absence of huge inventory losses due to a fall in oil prices means strong earnings growth in FY17. New capacities (Paradip refinery) will also add to volumes.

Maruti is India's largest car maker for a reason. It has consistently met customer needs.

First, by selling fuel-efficient and quality cars at competitive prices, backed by an unmatched service network. And, of late, by meeting rising aspirations through more expensive/premium cars across categories, like the Ciaz, Vitarra Brezza, Baleno etc.

This has boosted its image from a small carmaker to one that also makes premium cars, while broadening its portfolio and helping it sustain leadership, a trend analysts see continuing.

And although it is seeing intense competition in the entry level segment (Alto, Wagon R), analysts say that relaunches going ahead should help.

Maruti is also expected to launch one-two new vehicles every year and with a far better success-rate expect the company to stay ahead. Maruti's volume strategy and steps to move up the value-chain have worked well so far.

So, even in the current environment of intense competition Maruti has clocked good margins led by economies of scale and increasing share of higher priced vehicles.

Maruti's financial record is enviable, with net profit up 180 per cent in the past four years. Though one-offs impacted June output, last month's report by Motilal Oswal Securities pegs Maruti's FY17 volume growth at 13.7 per cent.

Power Grid, despite slowdown in the power sector, has been the least impacted, having successfully captured the untapped opportunity in the transmission segment.

This is also visible from the more than doubling of its revenue and net profit in the past five years. The company continues to invest and commission new transmission capacities.

In FY16, it commissioned new capacity worth Rs 32,000 crore (Rs 320 billion), almost 50 per cent higher than the year-ago figure, and the FY17 figure is also pegged at similar levels.

Analysts, thus, are confident of its earnings growing by an average of 20 per cent annually in the next couple of years. Benign valuations increase the stock's attractiveness.

UltraTech Cement, having overtaken Holcim group companies (ACC and Ambuja Cements) in capacity and revenue, has scored well on profitability, too.

It has among the best in operating earnings per tonne - Rs 936 for FY16, says Edelweiss.

Led by volume growth of eight to 10 per cent and margin gains on operating earnings in FY17, its earnings are estimated to grow by a little over 30 per cent in FY17. Similar growth is seen in FY18.

That's also why the UltraTech stock trades at a premium. A company that generated nearly Rs 4,500 crore (Rs 45 billion) in cash flow from operations in FY16, debt of Rs 10,000 crore (debt to equity ratio of 0.48) is manageable, even if it goes for big acquisitions.

If UltraTech's acquisition of Jaypee group's cement assets goes well, it will boost its annual capacity to about 100 million tonnes.

Photograph: Reuters