| « Back to article | Print this article |

Most NBFCs will have to slow down their loan growth.

Some of the most leveraged will have to sell a part of their assets (or loan book) to banks to raise incremental capital.

Others may have to knock on the door of their deep-pocketed parents.

Krishna Kant reports.

As liquidity squeeze tightens and fundraising becomes expensive, retail non-bank lenders will have to raise incremental equity capital to maintain their pace of growth.

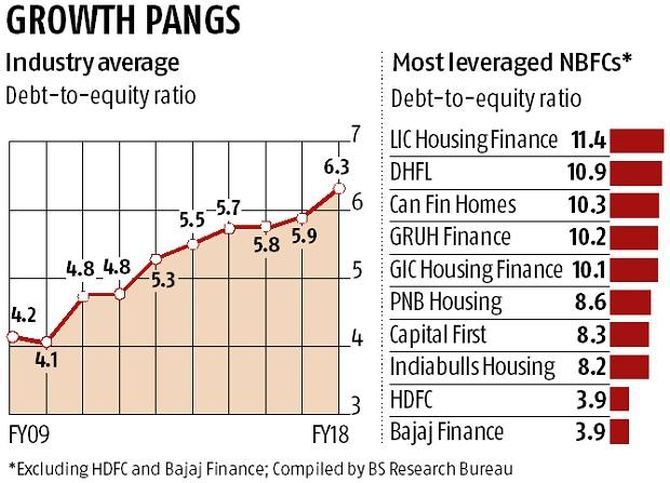

The industry's average balance sheet leverage ratio jumped to a 10-year high of 6.3x during FY18, up from 5.9x a year ago and 4.1x in FY10.

In comparison, HDFC -- the industry leader and the lender least affected by the recent turmoil in the industry -- had debt to equity ratio of only 3.9x last fiscal (Please see the chart).

In all, five non-bank retail lenders reported debt to equity ratio of 10 or more last fiscal year and another three had leverage ratio of between 8 and 10.

This, the analysts say, make them vulnerable to any volatility in the bond and commercial paper market.

The numbers exclude HDFC and Bajaj Finance, the two largest non-bank lenders in the industry.

Both companies reported debt to equity ratio of 3.9x on average during FY18.

Including their numbers, industry leverage ratio declines to a respectable 4.9x last fiscal year, lowest in eight years.

HDFC raised around Rs 125 billion in fresh equity last fiscal year while Bajaj Finance raised around Rs 45 billion, making them greatly immune to current turmoil in the bond market.

The analysis is based on the historical financials of 23 listed retail non-banking finance companies (NBFCs) that are part of BSE 500 index.

Some of the prominent NBFCs in the sample include HDFC, Bajaj Finance, LIC Housing Finance, GIC Housing, Indiabulls Housing, PNB Housing, and Can Fin Homes.

"Liquidity situation was quite benign till a few months back and there was a good appetite for retail NBFC paper, especially from mutual funds. Given this, lenders had no qualm about stretching their balance sheet, and continue to grow faster," says Dhananjay Sinha, head research at Emkay Global Financial Services.

Analysts also say that equity raising entails equity dilution, which is frowned upon by existing equity investors as its dilutes the companies' future earnings per share and dividend per share (if any).

For example, incremental equity capital, including retained earnings, accounted for only 10 per cent of the industry's incremental assets growth in the last three years (between FY15 and FY18).

In contrast, incremental borrowings, including deposits, accounted for nearly three-fourths of the industry's incremental loan growth.

Experts are raising doubt about the industry ability to maintain their pace of growth through reliance on the debt market.

"Wholesale funding is now an issue for NBFCs due to tighter liquidity and steady rise in interest rates. Non-bank lenders will now have to either take a hit on loan book growth or raise fresh equity to continue grow their business," says Karthik Srinivasan, head of financial sector ratings ICRA.

According to him, the funding requirement is the biggest for housing finance companies (HFCs) that have some of the highest debt to equity ratio in the industry.

"Regulation allows HFCs to leverage their equity by up to 16 times, but higher leverage means greater dependence on money and bond market that has become risky in current environment," says Srinivasan.

NBFCs are facing repricing where fresh funding is coming at a much higher interest rates.

"This is squeezing the margins for NBFCs and the impact is greatest for those with lower capitalisation," says Sinha.

Capitalisation is the share of equity or net worth in a lender's total assets.

The ratio was 12.1 per cent for our sample on average last fiscal year, lowest in a decade.

Analysts also say it won't be easy for companies to raise fresh equity capital given the recent sell-off in the sector.

"Retail NBFCs were sought after by equity investors till few months back due to high double digit growth reported by them. The cycle has now reversed and NBFCs are going through derating (cut in earnings multiple) and will require lot of convincing for companies to raise fresh capital in the current environment," says Sinha.

ICRA says either way most NBFCs will have to slow down their loan growth and some of the most leveraged such as Dewan Housing will have to sell a part of their assets (or loan book) to banks to raise incremental capital.

Others may have to knock on the door of their deep-pocketed parents such as Life Insurance Corporation, GIC or HDFC for fresh capital.

Illustration: Uttam Ghosh/Rediff.com