| « Back to article | Print this article |

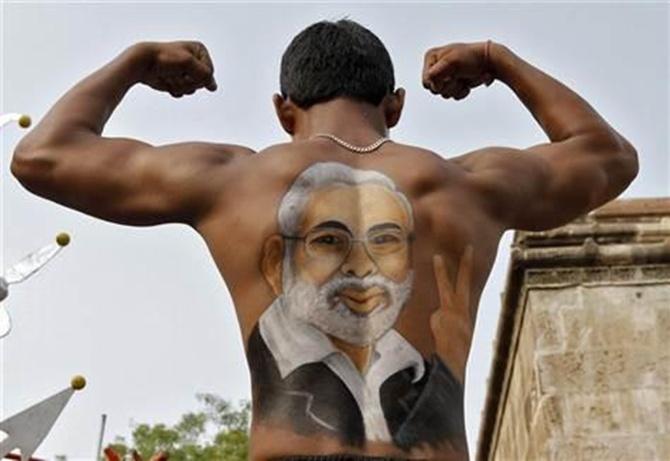

Prime Minister Narendra Modi is increasing his focus on economic reforms including raising the cap on foreign investment in the insurance sector and changes to tax and labour rules that could accelerate recovery, but he faces stiff opposition.

Prime Minister Narendra Modi is increasing his focus on economic reforms including raising the cap on foreign investment in the insurance sector and changes to tax and labour rules that could accelerate recovery, but he faces stiff opposition.

Following is the status of key pending reforms:

FDI in insurance

- Government needs approval during a parliamentary session starting on Nov. 24 to allow overseas investors to hold a 49 percent stake in insurance companies, up from the current 26 percent cap. The law would also raise the cap for the pension industry. Opposition have not yet promised support needed to pass the law in upper house.

- The industry expects that raising the cap would result in $2 billion of inflows into insurance.

Land purchase rules

- The government wants to make it easier to buy land for infrastructure and industrial projects, possibly by exempting public-private partnerships from an act passed last year. Opposition partes are expected to resist. Modi could seek to change the law in a joint session of both houses of parliament or by decree early next year.

- Road projects alone worth $10 billion face delays over land disputes and other clearances.

Labour reforms

- Modi has promised to amend archaic labour laws, reducing regulatory interference while coaxing employees' with more benefits. Initial softball measures are awaiting parliamentary approval. The government will have to overcome union resistance to move forward on relaxing restrictions on hiring and firing.

Goods and service tax

- The government wants to pass a constitutional amendment in the parliamentary session, then win the consent of state assemblies to implement India's first nationwide service tax union by April 2016. If successful, economists say the measure could add 2 percentage points to GDP growth.

- Most state governments are on board, but the main opposition Congress has still not given its backing.

- Consensus still missing on the final GST tax rates – recommendations vary from 16 per cent to 27 per cent.

Asset sales

- The government plans to raise nearly $9.5 billion by selling stakes in state-run and private companies including oil explorer ONGC and Coal India by March.

- Analysts doubt whether the target will be achieved. Market valuations are high and Modi seems determined to overcome labour union opposition to the Coal India sale, but the government has started the sell off late in the financial year.

Subsidy reforms

- Government plans to cut wasteful subsidies on fuel, fertiliser and food, estimated at over 21 percent of total estimated revenue receipts in 2014/15.

- The government has ended diesel subsidies and is waiting for a panel's report to announce next steps, possibly in the annual budget in February.

Coal

- Coal fields will be auctioned by February, and will be followed by plans to allow commercial coal mining for the first time, and invite in foreign miners. The government used an executive decree to bring about the changes. Now it needs parliamentary support.

Mobile, Radio Spectrum

- The government is planning the sale of mobile telephone and FM radio spectrum in early 2015.