| « Back to article | Print this article |

'If you miss the deadline, you can still file a belated tax return till March 31, 2021, with a fee under Section 234F, which could be up to Rs 10,000, in addition to an interest under Section 234A and 234B of the Act.'

Bindisha Sarang reports.

There is good news for last-minute income-tax return (ITR) filers, who have yet to file their returns for fiscal year 2019-2020 (assessment year 2020-2021).

The I-T department has introduced Jhatpat processing for quick processing of tax returns.

It has launched the Central Processing Centre (CPC) 2.0 -- its technologically upgraded platform for faster processing.

"CPC 2.0 will offer pre-filled ITR forms to taxpayers. It will also enable faster processing of ITRs and tax refunds," says Naveen Wadhwa, deputy general manager, Taxmann.

Who can opt for it:

Several forms are available for different types of assessees to file their tax returns -- from ITR-1 to ITR-7.

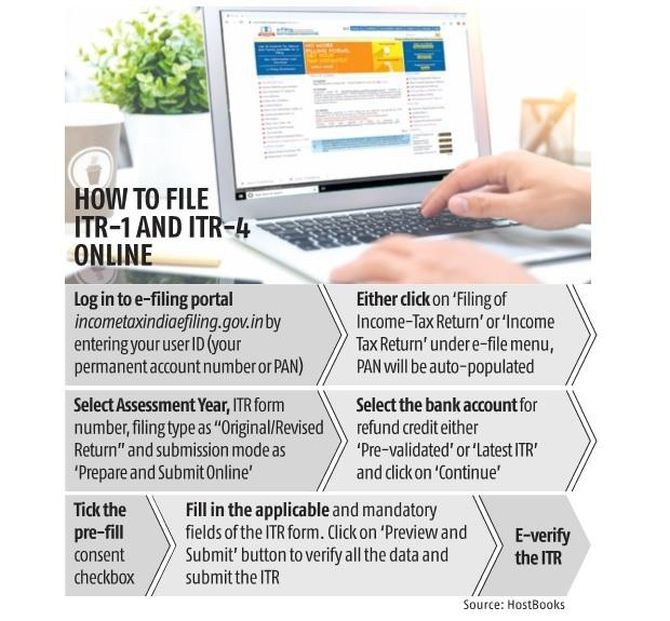

"Currently, Jhatpat processing is available for taxpayers eligible to file their returns via ITR-1 and ITR-4," says Kapil Rana, founder and chairman, HostBooks.

Resident individuals having total income less than Rs 50 lakh from salary, one house property (single ownership), and income from other sources are allowed to file their returns in ITR-1.

Similarly, resident individuals/Hindu Undivided Family/partnership firm having total income less than Rs 50 lakh from salary, one house property (single ownership), income from other sources and income from business or profession computed on presumptive basis under Section 44AD or 44ADA of the Act are allowed to file their tax return in ITR-4.

A few conditions apply.

"This scheme is available only when your bank account is pre-validated, you have no tax arrears, no income discrepancy, no tax deducted at source or challan mismatch, and the return is verified," says Suresh Surana, founder, RSM India.

Turnaround time:

To file via this scheme, visit the I-T department's Web site and select the appropriate ITR form. Then fill it out, submit, and verify it.

"There is no major overhaul in the return filing system under Jhatpat processing. But changes have been made to make it more efficient," adds Surana.

Though it has been claimed that processing of return will be immediate, no time limit has been specified by the government.

"Certain types of returns are being processed under this initiative within two-three days. Intimation of return processing is also being shared in a user-friendly manner," adds Wadhwa.

Don't miss the deadline!

Though the usual deadline for filing ITR is July 31 of the assessment year, due to the ongoing COVID-19 pandemic, the government has allowed taxpayers not requiring an audit to file their ITR by January 10, and those requiring an audit to file it by January 31, 2021.

Missing these deadlines will lead to a penalty.

"If you miss the deadline, you can still file a belated tax return till March 31, 2021, with a fee under Section 234F, which could be up to Rs 10,000, in addition to an interest under Section 234A and 234B of the Act. However, note that you will not be allowed to carry forward losses, except income from house property, if the return of income is not filed by December 31," says Gopal Bohra, partner, NA Shah Associates LLP.

What should you do

Jhatpat processing is a good alternative for taxpayers who are eligible and haven't filed their returns yet.

"Taxpayers should use the proper form, provide all relevant information, verify its correctness, match with Form 26AS, and file with e-verification, so that the return can be processed in time and refund, if any, can be released at the earliest," adds Bohra.

Feature Presentation: Aslam Hunani/Rediff.com