| « Back to article | Print this article |

Even investors with sums as low as Rs 1,000 per month can start their investment journey, suggests Sarbajeet K Sen.

Gone are the days when stock market trading meant going to the floor of the stock exchange and shout, either buy and sell orders.

With the advent of the National Stock Exchange's electronic trading platform to the application or app-based trading, investing in the stock market has never been simpler.

As we move from paper-based investing to digital platforms that enable transacting, tracking, reviewing and rebalancing with the click of a button, life should be easier for the investor.

But is it the case?

Easy to use...

Besides saving time and costs, app-based investing allows investors to access a sea of information, which otherwise may be difficult.

It also helps the investor track his portfolio on a real-time basis.

Apps also offer online advice through tools such as asset allocation planner and portfolio composition analyser.

These help investors build an ideal asset allocation and compare the actual with an ideal situation, respectively.

Such 'gap analysis' can help the investor reach his financial goals if he exercises discipline while investing.

App-based investing also helps the investor to benefit from 'investing-on the go'.

This involves picking up short-term mispriced bets, which otherwise may not be available.

"Investing platforms are recognising the preference for app-based investing and going to great lengths to streamline the user flow, keeping the UI/UX (User interface/User experience) delightful, and reducing friction in onboarding.

Apps are constantly upgraded.

New features deployed get reflected instantly and are suited for all operating systems.

Things that seemed difficult to do on a mobile, like KYC, are also now easily facilitated by apps without a glitch," says Harsh Jain, co-founder and COO, Groww, a mutual fund investment platform offering app-based investing.

Also, given the low costs associated with app-based investing, even small investors with sums as low as Rs 1,000 per month can start their investment journey.

This may not be possible in the off-line world, given the costs.

...but limited horizon:

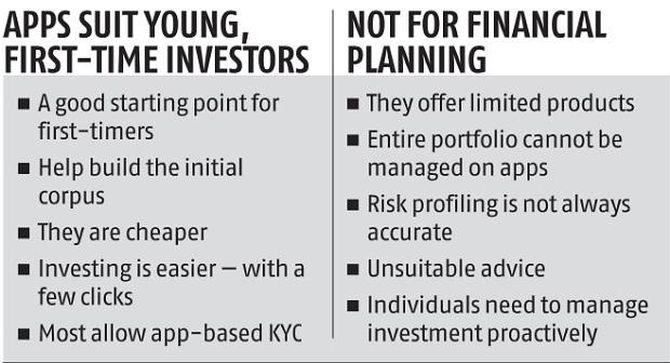

But these apps have limitations as well.

For one, many investing apps limit investment choice by offering just one option, such as a mutual fund or insurance.

They often create an environment that would induce investors to opt for the manufacturer's products and do not offer information about other product categories.

Sometimes app owners may provide solutions in line with their views, which may not work for all investors.

For example, one may come across an app that gives a particular mutual fund portfolio, which is mid-cap heavy and may not consider other low-risk profiles at all.

Investment advisors feel many apps may be limiting.

"Most mobile apps offer very few asset classes, and hence, investments would be highly concentrated towards a single asset. For example, a mutual fund investing app would keep the investor in the dark about other products like direct equity, gold ETFs, life insurance, health insurance and Public Provident Fund. This leads to focus on single product-based approach," says S Sridharan, head, financial planning, Ladder Investment Advisors.

Choose the right app and mix:

A mobile app can be a facilitator in executing investments in a hassle-free manner.

However, it may not always be able to replace a financial advisor or your own judgment since individual investment needs are different.

"Don't jump into a product without knowing the objective. It is advisable to seek help from a financial advisor or go for a platform that provides both advice and execution," says Sridharan.

Jain advises going for an app that has all the features to help one manage one's investments easily instead of one that bombards the investor with unnecessary features and information.

"The app should offer superior UI/UX.

It should be clean, jargon-free, with very clear user flow. The app must also be fast and bug-free. See if the app offers you all information in a simple and concise manner like easy discoverability of funds, access to educational/help resources etc," says Jain.

A good app must also allow flexible payment options like UPI, net banking and NEFT.

The app must also be transparent in its pricing policy and should not have hidden charges.

"You can shortlist a few apps which are rated above 4.5 on the playstore, take a look at the user reviews, try them out and see how seamless on-boarding and navigation are," says Jain.