| « Back to article | Print this article |

'Make In India and the reduction in barriers of trade will potentially create a growth environment.'

‘The higher the GST rate, the higher will be the inflation and worse the compliance,’ Chief Economic Advisor Arvind Subramanian said in an interview to Business Standard, on the demand of states for a rate higher than 18-20 per cent to meet their developmental requirements.

‘The higher the GST rate, the higher will be the inflation and worse the compliance,’ Chief Economic Advisor Arvind Subramanian said in an interview to Business Standard, on the demand of states for a rate higher than 18-20 per cent to meet their developmental requirements.

Subramanian told Dilasha Seth and Arup Roychoudhury that the states have not done serious calculations and are understandably nervous about the unknown.

He added the manufacturing states also have urban consumption centres, giving them a natural cushion and lowering compensation requirement.

Edited excerpts:

What will be the impact of inflation once goods and services tax (GST) is rolled out?

Remember that if something by definition is revenue neutral, the incidence of tax on valuation will drop.

The poor will largely be protected. As the finance minister read out, 53-54 per cent of Consumer Price Index basket is GST-exempt, 30-35 per cent is taxed at the lower rate and only 12-13 per cent is taxed at the normal rate.

So, of course, lower the standard rate, less will be the inflation. In our report, we have said that at 18-20 per cent GST rate, inflation will be zero.

But states have sought a rate higher than 18-20 per cent. What will be the incidence of inflation then? Will it impact the overall GST structure?

But states have sought a rate higher than 18-20 per cent. What will be the incidence of inflation then? Will it impact the overall GST structure?

The higher the rate, the higher will be the inflation.

What the states are saying now is not the last word. One, they have not really done serious calculations.

Two, they are also understandably nervous about the unknown.

Services taxation, in particular, is going to be completely new to them.

Therefore, it is not surprising that they feel apprehensive and want high rates.

But we know that higher the rates, the worse the compliance and it can backfire.

But if we do a good job of assuring them compensation, then hopefully, they should be open to set rates rationally.

States are quite unhappy with the 18 per cent standard rate suggestion and argue that the combined tax at the moment is around 27-30 per cent. Hence, GST rate should also be higher...

That combined tax of 27-30 per cent is just on manufacturing.

That is not how the calculation goes. It has to be the average of manufacturing and services that are going to be buoyant over time.

So, you can’t just look at one component and say 27 per cent.

Will the assurance of full compensation to the states for five years dent the fiscal calculations of the Centre? You have, in your report, recommended giving fiscal headroom to implement GST.

I don’t know what the compensation is going to be. If it is not big, then it will not have a large impact.

My instinct suggests that losing states are also the big urban consumption centres.

Maharashtra has Mumbai, Karnataka has Bengaluru and Tamil Nadu has Chennai.

So, since the manufacturing states have big urban consumption centres, there seems to be a natural cushion there.

But what if there is still a large compensation requirement?

If you still have compensation requirements, you have two-three choices.

Either you raise the GST rate, or you cut expenditure or let the deficit adjust that.

In the report, we have argued that while the compensation is temporary, the structure of rate is permanent. So, don’t burden what is permanent.

In case the April 1, 2017 deadline is not complied with, will it be feasible to roll out the tax reform mid-year?

The government is committed to meeting the April 1 deadline.

In case the April 1, 2017 deadline is not complied with, will it be feasible to roll out the tax reform mid-year?

I don’t want to think about that. Let’s think about April. The government is committed to meeting the April 1 deadline.

The argument goes that as states lose the power of deciding the tax rate they will no longer have the competitive tool of offering tax sops for manufacturing? Is there some weight in that?

It is a fair point to an extent. It is the freedom or the ability of not raising rates than the ability to raise taxes that states wanted.

But to some extent you could argue that for a country like India you do not want this undesirable race to the bottom.

You want states to compete on offering better manufacturing infrastructure and services.

Does keeping items including alcohol, real estate and initially petroleum out of GST result in a flawed taxation structure?

If you look at across the world there is no perfect system.

It begins somewhat imperfect and evolves over time. That’s what happened with state VAT as well.

We should not let the best become the enemy of the good. Over time, it becomes better.

By getting 29 states and two union territories on board who fear that their autonomy will get lost, we have come up with a design that is actually very good.

It will be about learning by making mistakes and that’s how things happen in complicated political systems like India.

GST was the biggest economic reform international investors were keenly watching. What impact do you see in investment inflows hereon?

Part of reasons why investors said that they also thought that given the govt has a mandate it needs to translate that into some big policy reform and that’s what has happened.

It is as much a signal about using the mandate as it is about the content of the reforms.

What impact do you see of GST on the gross domestic product growth?

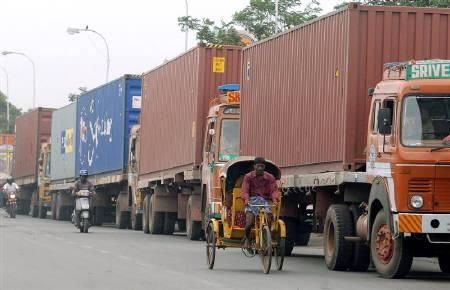

I have done no such calculation. What we do know is that there will be a very big impact on goods movement within India.

Lots of compliance benefits will also come across.

Make In India and the reduction in barriers of trade will potentially create a growth environment.