| « Back to article | Print this article |

Of the 23 Indian billionaires mentioned in the Bloomberg Billionaires Index, only one saw a reduction in net worth, with the companies owned by most of them outperforming the Nifty 50 index by a big margin.

2017 has been a bumper year for Indian billionaires, with Gautam Adani, Mukesh Ambani, and Sunil Mittal seeing a sharp increase in their wealth despite a slowing economy.

The wealth, or net worth, of Adani, chairman of the Adani Group, grew nearly 120 per cent during this period, the steepest among billionaires.

His group picked up assets in the power transmission sector in India in 2017, but struggled with funding options for its mega coal mine development project in Australia.

Image: Adani is ranked third with his net worth up by $5.66 billion. Photograph: Amit Dave/Reuters

The data is based on the Bloomberg Billionaires Index and takes into account the closing share prices of December 28.

The share prices of the Adani Group companies have risen strongly, with Adani Transmission rising 294 per cent, Adani Enterprises 117 per cent, and Adani Ports 51 per cent.

Adani Power, which is currently in talks to sell its majority stake in loss-making Mundra power project to the Gujarat government, also jumped 36 per cent in 2017.

Adani’s net worth stood at $10.2 billion. In terms of absolute increase in wealth, Adani is ranked third with his net worth up by $5.66 billion, after Mukesh Ambani and Sunil Mittal.

Adani, who started as a diamond trader in Mumbai during the 1980s, has emerged as the most aggressive bidder of stressed assets in India.

Recently, his group bought the integrated power distribution and transmission assets of Reliance Infrastructure’s Mumbai circle.

The deal value of these assets is pegged at Rs 13,251 crore, including regulatory assets (dues recoverable from customers) worth Rs 1,150 crore.

Since 2014, Adani has picked up Lanco’s power plant in Udupi, Karnataka, and the port project of L&T and Tata in Odisha.

The group is also in the race to buy stressed assets of Jaypee Infratech, which is facing insolvency proceedings for defaulting on loans.

Most of the other billionaires, too, have got richer this year.

Image: Not only the telecom business, but Reliance’s core businesses of refining and petrochemicals have also surprised positively. Photograph: Adnan Abidi/Reuters

With the launch of Reliance Jio, which has disrupted the telecom sector, India’s richest man, Mukesh Ambani, added a whopping $17.45 billion, or 77 per cent, to his net worth, which crossed $40 billion.

Most of the gains in the share price of his flagship firm, Reliance Industries (RIL), have come since February 2017 after Reliance Jio announced the commercial roll-out of its operations.

Till then, many on the Street were sceptical of the telecom project in which RIL has invested about Rs 2,00,000 crore.

Not only the telecom business, but Reliance’s core businesses of refining and petrochemicals have also surprised positively.

Refining margins, for instance, touched their record highs of $11 a barrel this year due to favourable tailwinds in the international oil market.

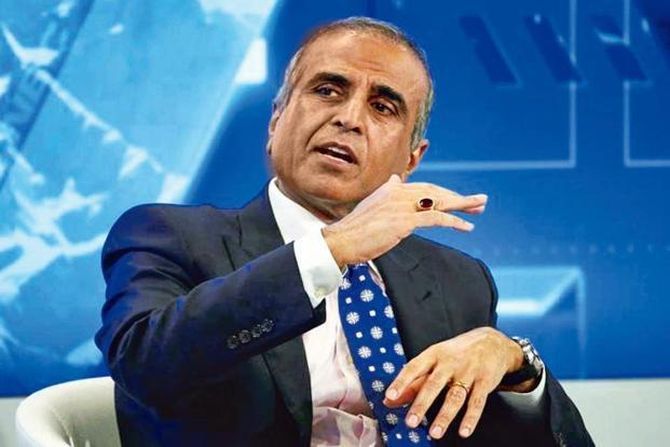

Image: Mittal’s net worth of $15 billion is based on the gain in the share price of Bharti Airtel. Photograph: Ruben Sprich/Reuters

Interestingly, Sunil Mittal, Ambani’s arch-rival in the telecom sector, also became richer by 74 per cent with his net worth touching $15.06 billion.

Mittal’s company has fought back well in the telecom war, which broke out last September when Jio introduced its services to customers for free in the first few quarters.

Mittal’s net worth is based on the gain in the share price of Bharti Airtel, where his family owns a 45.48 per cent stake.

The companies owned by most of these Indian billionaires outperformed the Nifty 50 index by a big margin.

The broader index of the National Stock Exchange is up 29 per cent in 2017.

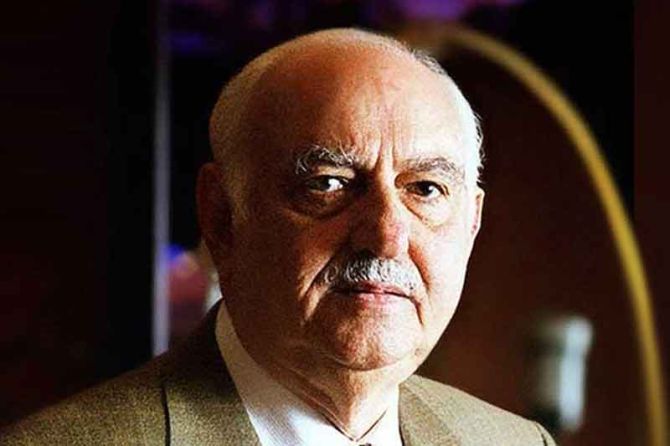

The Pallonji Mistry (above) family, which is fighting a legal battle with the Tatas, also gained 23.7 per cent, with the net worth of the family rising to $17 billion.

The Mistry family derives its wealth from its 18.5 per cent stake in Tata Sons.

During the year, TCS shares gained 11 per cent more, while Titan and Tata Steel shares surged 160 per cent and 87 per cent, respectively, on the bourses.

Image: Lakshmi Mittal would be closely watched in 2018 as he would be in the race to pick up stressed steel assets in India. Photograph: Charles Platiau/Reuters

London-based Lakshmi Mittal was also rewarded by the stock markets, with his wealth up by $5.3 billion to $19.7 billion as the fortunes of ArcelorMittal improved during the year with a revival of the European steel industry.

In 2018, Mittal would be closely watched as he would be in the race to pick up stressed steel assets in India and has already recced Essar Steel’s plant in Gujarat and Bhushan Steel’s assets.

Image: Shanghvi's flagship company grappled with quality issues raised by the US FDA. Photograph: Adeel Halim/Reuters

None of the 23 billionaires on the list lost wealth, except Dilip Shanghvi of Sun Pharmaceutical, whose net worth reduced by 0.5 per cent.

This is mainly because Shanghvi's flagship company grappled with quality issues raised by the US FDA.

Some of the pain was offset by a 68 per cent increase in the share price of another group firm, Sun Pharma Advanced Research Company (SPARC).