| « Back to article | Print this article |

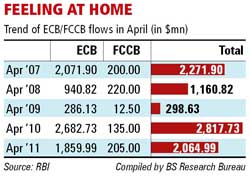

India Inc raised around $2.06 billion abroad in April through external commercial borrowings and foreign currency convertible bonds, compared with $5.63 billion in March, according to data collected by the Reserve Bank of India.

India Inc raised around $2.06 billion abroad in April through external commercial borrowings and foreign currency convertible bonds, compared with $5.63 billion in March, according to data collected by the Reserve Bank of India.

Lower borrowings is partly an outcome of hardening of spreads over the benchmark rates like the London Interbank Offered Rate and the fact that the period was the beginning of the financial year.

Around $1.54 billion was raised by 60 companies through the automatic approval route, which does not require the approval of RBI or the government, while $520 million was raised by the Exim Bank under the approval route, to meet its lending requirements abroad.

State-run Shipping Corporation of India raised $215 million through ECBs for a period of 10