| « Back to article | Print this article |

The sale of Essar Oil was India’s biggest deleveraging exercise undertaken by any debt-heavy group

The sale of Essar Oil and related infrastructure to Rosneft and other partners has created many records. The transaction is India’s biggest FDI inflow, apart from being India’s biggest deleveraging exercise undertaken by any debt-heavy group.

In 2016, the sale of assets by Indian corporate sector spiked as economy slowed down and banks became more aggressive in getting their funds back. The global commodity crash also led to many projects becoming unviable.

Be it the Tatas, Ruias, or the Jaypee group, India Inc sold more assets than buying new ones. Here is the list of top transactions undertaken by Indian companies to reduce their debt.

| Month

| Seller

| Buyer

| Size(in RS cr)

|

|---|---|---|---|

| Nov 14 | Avantha (Korba) | Adani Power | 4,200 |

| Oct 16 | Essar Global | Rosneft, Trafigura, UCP | 85,000 |

| Jan 11 | Essar Global (Vodafone stake) | Vodafone Plc | 24,000 |

| Aug 15 | Gammon | Brookfield | 6,750 |

| Dec 13 | GMR | Malaysia Airports | 1,334 |

| Mar 16 | GVKPIL | Fairfax | 2,149 |

| Oct 16 | Hiranandani | Brookfields | 6,800 |

| Oct 16 | Jaypee | Orient Cement | 1,950 |

| Feb 16 | Jaypee | Ultratech | 16,370 |

| Aug 14 | Jaypee | Shree Cement | 360 |

| Mar 14 | Jaypee | Dalmia Bharat | 1,200 |

| Sep 13 | Jaypee | Ultratech | 3,800 |

| Nov 14 | Jaypee (hydro) | JSW Energy | 9,700 |

| May 14 | L&T (Dhamra) | Adani Ports | 5,500 |

| Nov 14 | L&T (Karrupalli port) | Adani Ports | 2,000 |

| Aug 14 | Lanco (Udupi power) | Adani | 6,300 |

| Oct 16 | R-Com (51% in tower) | Brookfields | 11,000 |

| May 16 | Rel Infra (11 road projects) | GIC, Isquared, Macquarie | 8,800 |

| Feb 16 | Reliance Cement | Birla Corp | 4,800 |

| Jan 14 | Tata Power | Bakrie | 3,100 |

| Apr 16 | Tata Steel | Greybull Capital | Nominal value |

| Jan 14 | Videocon(Mozambique stake) | ONGC | 16,200 |

| Jun 16 | Welspun | Tata Power | 9,249 |

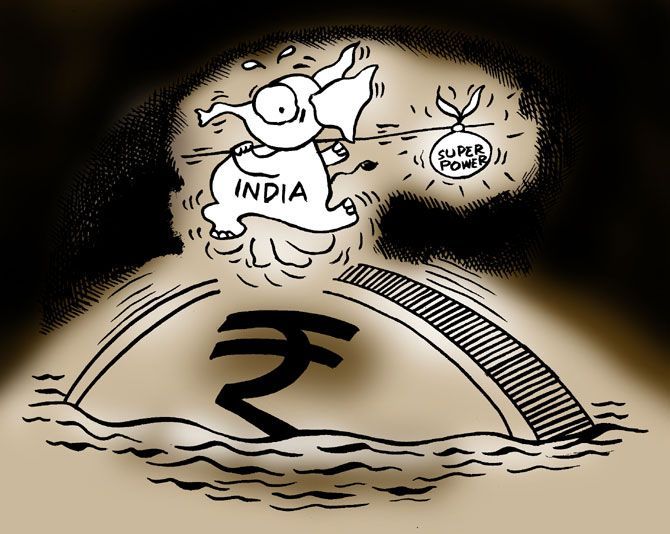

Illustration: Uttam Ghosh/Rediff.com