| « Back to article | Print this article |

Markets ended marginally lower on Monday, snapping four day winning streak, weighed down by pharma shares on worries that the new price control will sharply reduce drug prices thereby impacting growth and profitability.

Markets ended marginally lower on Monday, snapping four day winning streak, weighed down by pharma shares on worries that the new price control will sharply reduce drug prices thereby impacting growth and profitability.

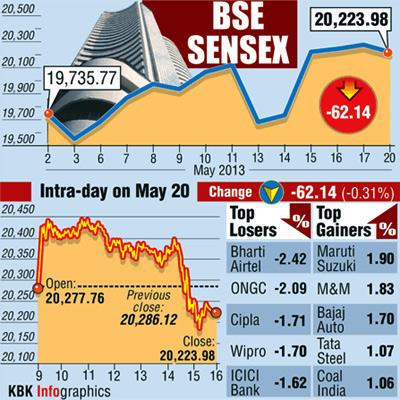

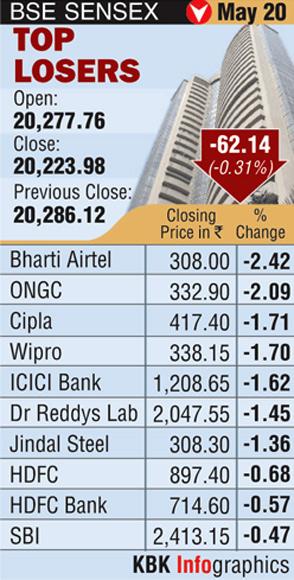

The 30-share Sensex ended at 20,224 down 62 points or 0.31% and the 50-share Nifty ended at 6,157down by 30 points or 0.49%.

On the international front, rising optimism about global growth pushed world shares to a near five-year high on Monday, while comments from Japan's economy minister that consumers could suffer if the yen falls further lifted it off a 4-1/2 year low.

Data last week that showed US consumer sentiment at its strongest in nearly six years continued to support equity markets. MSCI's world index is at its highest since June 2008 as top European shares started the week up 0.2%.

The Nikkei share average surged to a fresh 5-1/2 year high on Monday, buoyed by further weakness in the yen and optimism over the growth outlook after the Japanese government raised its assessment of the economy for the first time in two months.

Signs of an improving US economy and Wall Street's record closing high on Friday cemented the positive mood in markets.

The Nikkei climbed 1.5% to 15,360.81, the highest closing mark since December 2007.

During the day, the index rose as high as 15,381.74, the highest level for the same period.

Meanwhile, Gold prices today fell by Rs 399, or 1.54%, to Rs 25,556 per 10 grams in futures trade in line with weak overseas trends.

Analysts said sustained weakness in the overseas markets, where gold dipped to one-month low, put pressure on the precious metal prices at futures trade.

On the sectoral front, BSE Healthcare index slumped by nearly 2% followed by counters like Consumer Durable, Banks, Oil & Gas and PSU shares, all falling down by 1% each.

However, BSE Auto and IT indices gained by nearly 1% each.

Shares of pharmaceutical companies were under pressure, declining up to 6% on Bombay Stock Exchange.

Ranbaxy Laboratories, Lupin, GlaxoSmithkline Consumer Healthcare, Venus Remedies and Elder Pharma were down in the range of 5-6%

On the gaining side, auto stocks were in demand with M&M, Maruti Suzuki, Hero Moto Bajaj Auto and Tata Motors spurting between 1-2% as reports suggest encouraging sales growth during the current month.

On the gaining side, auto stocks were in demand with M&M, Maruti Suzuki, Hero Moto Bajaj Auto and Tata Motors spurting between 1-2% as reports suggest encouraging sales growth during the current month.